Chinese language marketplaces have formally arrived in Canada.

In response to Omnisend’s newest survey, 60% of Canadians have shopped on a Chinese language market like Temu, Shein, or AliExpress in 2025. That’s up from 55% final 12 months. And whereas most aren’t doing it each day, the frequency is rising quick: 10.3% now store there a minimum of as soon as every week, and over a 3rd say they’ve used a couple of of those platforms.

Temu is main the cost, however Shein and AliExpress are using the identical wave. The info factors to a transparent shift: these platforms have gotten a part of on a regular basis on-line procuring in Canada.

Fast-glance findings

Right here’s what stood out from the August 2025 survey:

- 60% of Canadians now store at Chinese language marketplaces — up from 55% in 2024

- 10.3% achieve this weekly

- Temu leads at 51.95% (up from 39.26% in 2024)

- Shein follows at 37.84% (up from 34.64%)

- AliExpress sits at 30.28% (barely down from 32.19%)

- Temu is now the second most visited procuring web site in Canada, behind solely Amazon

- Shein ranks second amongst Canadian trend and attire websites, simply behind The Hole

Temu pulls forward

Temu has quickly develop into Canada’s go-to market, with greater than half of Canadians (51.95%) saying they’ve shopped there prior to now 12 months. Its progress from 39% final 12 months makes it one of many fastest-climbing platforms within the nation.

As Marty Bauer, Ecommerce Skilled at Omnisend, explains: “These marketplaces are now not fringe gamers. Temu is now the second most visited procuring web site in Canada, simply behind Amazon, and over 52% of Canadians say they’ve shopped there prior to now 12 months. Its fast progress has additionally raised the visibility of different Chinese language marketplaces, placing stress on each native retailers and world giants.”

Shein makes trend good points

Shein continues to achieve floor as a trend go-to. In 2025, 37.84% of Canadians say they’ve shopped on Shein, up from 34.64% in 2024.

It’s now the second most visited trend and attire web site in Canada, simply behind The Hole.

Weekly and month-to-month utilization are additionally climbing:

- 7.49% store Shein weekly

- 18.77% store month-to-month

- 1.36% are each day consumers

These numbers might not match Temu’s scale, however they sign that Shein is now not a distinct segment trend model — it’s mainstream.

Market habits are shifting

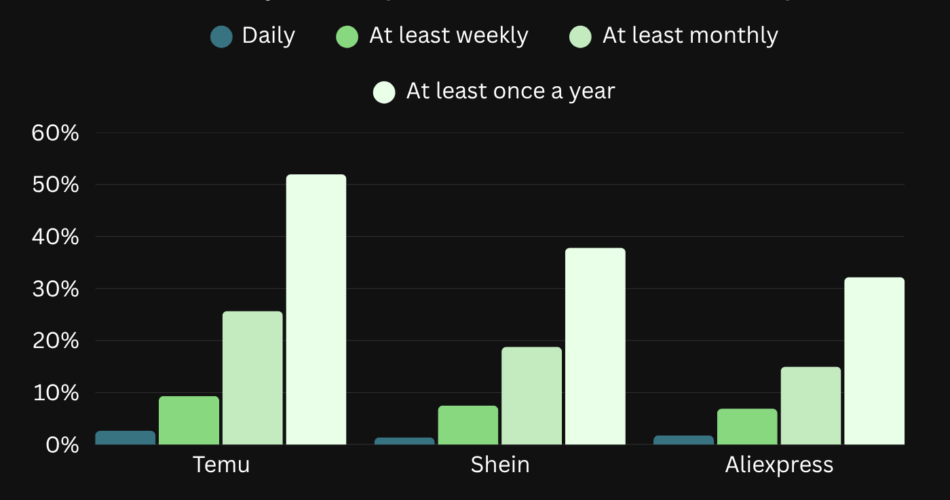

The survey additionally highlights altering frequency of use:

| Market | Day by day | At the very least weekly | At the very least month-to-month | At the very least yearly |

|---|---|---|---|---|

| Temu | 2.63% | 9.34% | 25.68% | 51.95% |

| Shein | 1.36% | 7.49% | 18.77% | 37.84% |

| AliExpress | 1.75% | 6.90% | 14.97% | 32.19% |

As Bauer notes: “Whereas each day utilization stays comparatively low, the true progress is occurring in month-to-month and weekly procuring patterns. This isn’t a passing development — these platforms have gotten a daily a part of customers’ procuring routines.”

What this implies for Canadian retailers

The rise of Temu, Shein, and AliExpress places new stress on Canadian retailers — notably smaller ecommerce manufacturers.

“Chinese language marketplaces are elevating the bar on pricing and comfort, which makes competing more durable for smaller ecommerce manufacturers,” says Marty. “However native companies have a possibility to win on pace, service, and model belief.”

Marty additionally factors to the significance of sensible advertising: “Platforms like Omnisend assist manufacturers automate and personalize their electronic mail, SMS, push notifications, critiques, and extra — saving time and bettering buyer engagement with out huge advertising groups.”

Closing takeaway

Temu, Shein, and AliExpress are now not the disruptors, however part of the panorama. With 6 in 10 Canadians procuring on a minimum of one Chinese language market, and weekly use rising, the expectations for comfort and worth are shifting in actual time.

Canadian manufacturers might not be capable to out-discount world platforms, however they’ll nonetheless stand out. Buyers are forming new habits, however loyalty hasn’t been locked in but. So by leaning into pace, service, model connection, and smarter advertising, Canadian companies can nonetheless maintain floor in opposition to the ultra-low-cost competitors.

Source link