This August, Future Horizon brings you fresh insights into the semiconductor industry. Dive into the most recent market tendencies and outlook beneath.

Government Abstract

Annualised development charges retreated once more barely in June, with Whole Semiconductors rising 18.0 %, down from final month’s 18.2 % and April’s 22.9 % and, while nonetheless in respectably excessive double-digit development terrain, was nonetheless sizeably down from August 2024’s 28.5 % cyclical peak.

All three sectors carried out properly in June, with Whole ICs persevering with their lead because the prime business development driver at a wholesome 19.8 %, albeit down from 21.2 % in Could and 25.2 % in April, with Opto at 6.8 % and Discretes at 6.2 %, vs. final month’s minus 6.6 % and plus 5.2 % respectively.

While the general semiconductor market nonetheless confirmed a powerful double-digit development, the general pattern is flat, at across the 20 % stage, various from August 2024’s 36.2 % peak to January 2025’s 14.8 % low.

These peaks don’t final without end, nor do they flip up, and we proceed to count on to see this pattern flip down within the coming months, as per previous cyclical patterns, with the one uncertainty being as to when this can occur.

Forecast Replace

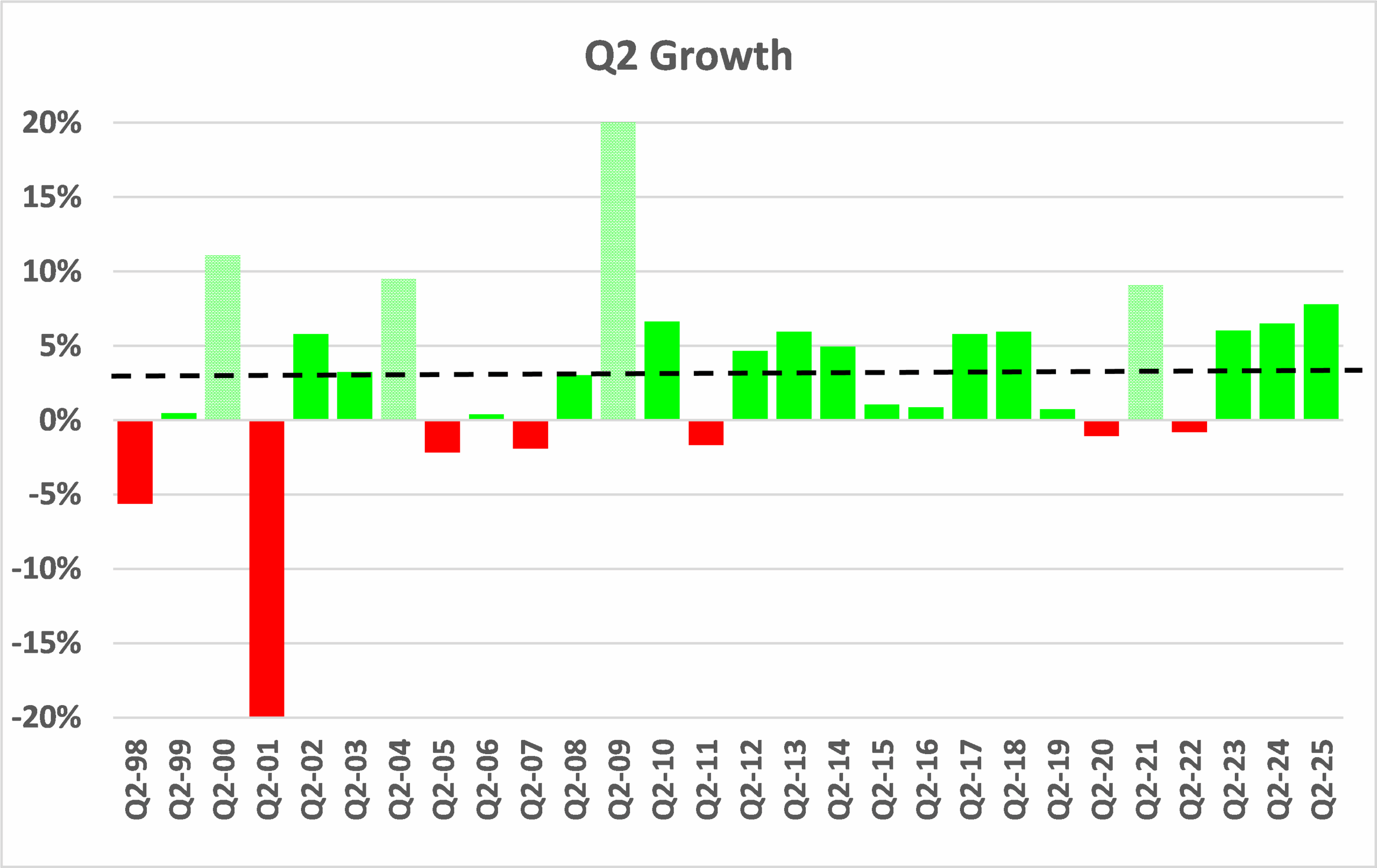

With the June outcomes now in, at 7.4 % general quarter-on-quarter development, the second quarter romped residence quite a bit stronger than anybody predicted, both by earlier firm steering, which ranged from minus 10.7 % (Kioxia) to plus 14.6 % (SK Hynix), historic second quarter tendencies, or our 1.4 % forecast.

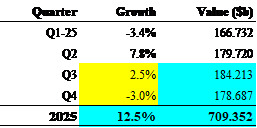

2025 SC Progress By Quarter

(US$)

Supply: WSTS/Future Horizons

Q2 development has averaged 2.9 % since 1998, with solely 4 outcomes larger that Q2-2025’s 7.8 %, specifically in 2000, 2004, 2009 and 2021, every time on the peak of a decent supply-side pushed chip market increase, pushed by capability shortages and powerful end-market demand.

Determine E11(b) – Q2 Progress Pattern – 1998-2025

(P.c of US$)

Supply: WSTS/Future Horizons

On the macro stage, with the annualised gross sales of non-Reminiscence ICs up 24.0 % in June vs. 23.0 % in Could and 25.6 in April, and Reminiscence ICs up 11.9 %, vs. 17.5 % in Could and 23.8 % in April, the annualised development charges proceed to color a seemingly rosy outlook.

A deeper look below the hood exhibits a extra confused and doubtlessly bleaker image. As has been the case since this present ‘increase’ began, the market has been pushed by an financial anomaly of declining unit development, ensuing from the Covid-boom market shortages, however concurrently growing ASPs, in defiance of regular provide and demand economics and 70 plus years of chip business historical past.

An excellent nearer look reveals a deeply bifurcated market, one pushed by the present AI increase and the remaining, with the previous comprising high-priced (for now) GPUs and unique HBM merchandise, each with close to monopolist provide chains and deep pocketed, primarily data-centre infrastructure clients, resistant to regular price-sensitive market pressures.

When your infrastructure funding programmes are costing lots of of billions of {dollars}, the tens of thousand-dollar chip prices are misplaced within the noise. Not so if you’re constructing a thousand-dollar sensible cellphone or lap-top laptop, or perhaps a 100k greenback automobile.

Be careful for these high-prices ASPs to break down, as soon as the AI infrastructure increase runs its course, because it inevitably will. No increase lasts without end; all markets finally saturate. As well as, pull-forwards are merely robbing future development and stockpiles will finally deplete.

As for the second-half yr outlook, the present AI ecstasy, commerce barrier dangers, cargo pull-forwards and stockpiling are all clearly in play, which, together with broader financial considerations, have resulted in a doubtlessly catastrophic environment of heightened threat and uncertainty.

All this uncertainty, together with the on-going US tariff and commerce flip-flops, is making the outlook for Q3 and the remainder of the yr more and more unpredictable. The rapid key problem is solely to experience and survive the present market tsunami.

At this level within the cycle, it will be smart to bear in mind Gordon Moore’s much less revered second legislation, specifically ‘Over the long run, the typical IC ASP converges to $1’, or the very fact the typical income per sq. centimetre of processed silicon has been fixed at US$ 9 for the reason that creation if the IC.

If you’re not promoting these high-priced AI-related gadgets, you’re presently residing in a a lot totally different world, nonetheless bathed in recession, and extra intently following the normal business tendencies.

Learn The Full Report Right here: https://www.futurehorizons.com/page/137/

Source link