Perion Community Ltd. introduced its second quarter 2025 monetary outcomes on August 11, demonstrating vital momentum in its promoting options enterprise with the primary year-over-year progress for the reason that third quarter of 2023. The worldwide promoting know-how firm reported income of $103 million for the quarter ended June 30, 2025.

In response to the monetary statements, promoting options income elevated 8.3% year-over-year to $80.6 million, representing 78% of complete income for the quarter. This marks a notable turnaround for the corporate’s core enterprise unit following six consecutive quarters of decline. The expansion comes as Perion’s strategic transformation continues to gain traction with its unified Perion One platform strategy.

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per 12 months.

Digital out-of-home (DOOH) promoting emerged as a standout performer, recording 35% year-over-year progress to succeed in $17.6 million in quarterly income. This progress fee considerably exceeds business projections, with eMarketer information indicating 8.1% compound annual progress for DOOH advert spending by way of 2028 in the USA. The section now represents 17% of Perion’s complete income, in comparison with 12% in the identical quarter of 2024.

“Our second quarter monetary efficiency displays our progress and early validation of our Perion One technique, marked by first quarter of year-over-year progress in Promoting Options income for the reason that third quarter of 2023, signaling that we’re starting to reap the fruits of our transformation,” based on Chief Govt Officer Tal Jacobson within the August 11 earnings name.

Retail media demonstrated continued energy with income rising 27% year-over-year to $22.3 million. In response to eMarketer projections, omnichannel retail media advert spending is predicted to develop at a 16.2% compound annual progress fee from 2023 to 2028 in the USA. Online advertising income elevated 5% year-over-year to $53.1 million, representing 52% of complete quarterly income.

Linked TV (CTV) income decreased 5% year-over-year to $9.7 million, accounting for 9% of complete income. Perion’s administration attributed this decline to funds shifts towards the second half of 2025 fairly than elementary market points. “CTV budgets transferring to H2,” Jacobson defined in the course of the earnings name, emphasizing the corporate’s channel-neutral strategy centered on buyer outcomes fairly than particular promoting mediums.

The corporate launched its Efficiency CTV resolution in the course of the quarter, designed to seize share in what Perion characterizes as a $36 billion streaming promoting market. “Our Efficiency CTV transforms CTV adverts right into a full-funnel, ROI-focused channel activation. By focusing campaigns on actual KPIs and return on advert spend, we’re turning what was historically an consciousness medium right into a measurable efficiency engine,” Jacobson acknowledged in the course of the earnings presentation.

This development aligns with broader industry trends displaying 72% of entrepreneurs planning to extend programmatic promoting funding in 2025, with Linked TV’s share of media budgets projected to double from 14% in 2023 to twenty-eight% in 2025.

Search promoting income declined 35% year-over-year to $22.4 million, representing 22% of complete income. This decline follows beforehand introduced modifications applied by Microsoft Bing in 2024, which have continued to impact Perion’s search business all through the present fiscal 12 months.

Perion’s acquisition of Greenbids, a man-made intelligence-first optimization firm, has progressed based on plan since completion in March 2025. Chief Monetary Officer Elad Tzubery reported that the combination “is totally on observe” with tangible synergies already producing new enterprise wins. “As of at this time, we already booked a couple of million {dollars} of Perion Algo offers from present Perion prospects,” Tzubery confirmed in the course of the earnings name.

The corporate’s contribution ex-TAC margin remained steady at 46% year-over-year. Adjusted EBITDA totaled $7.1 million, leading to a 7% adjusted EBITDA margin and 15% ex-TAC margin. Non-GAAP internet revenue reached $12.0 million, translating to non-GAAP diluted earnings per share of $0.26.

Money move from operations generated $21.3 million in the course of the quarter, with adjusted free money move reaching $20.7 million. The corporate maintained $318.5 million in money, money equivalents, short-term financial institution deposits, and marketable securities as of June 30, 2025.

Perion executed $33.4 million in share repurchases in the course of the quarter, buying 3.6 million shares. The corporate has amassed $86.7 million in complete share repurchases year-to-date below its present $125 million authorization program.

Geographic enlargement initiatives superior in the course of the quarter with strategic partnerships in Korea by way of KT Company and NHN AD, offering entry to the $21 billion Asia-Pacific DOOH market. Extra partnerships in Germany and Italy expanded the corporate’s European DOOH attain.

The growth in DOOH advertising reflects broader market dynamics as publishers adapt to new promoting codecs and programmatic capabilities throughout digital out-of-home environments. Publishers have till Could 1, 2025, to adjust to enhanced requirements for CTV and DOOH advert monetization as introduced by Google in March 2025.

Management modifications included the appointment of Anat Paran as Chief Working Officer, bringing operational and organizational experience to streamline world operations. The appointment follows Perion’s broader organizational restructuring below its Perion One technique implementation.

For the total 12 months 2025, Perion reiterated its steering vary of $430 million to $450 million in income and $44 million to $46 million in adjusted EBITDA. This steering displays administration’s confidence within the firm’s strategic transformation and market positioning throughout high-growth promoting segments.

The corporate’s quarterly efficiency demonstrates progress in its transition from conventional search-dependent income streams towards diversified promoting options spanning linked TV, digital out-of-home, retail media, and algorithmic optimization providers. This transformation positions Perion to capitalize on advertising and marketing funds shifts towards performance-driven, measurable promoting channels.

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per 12 months.

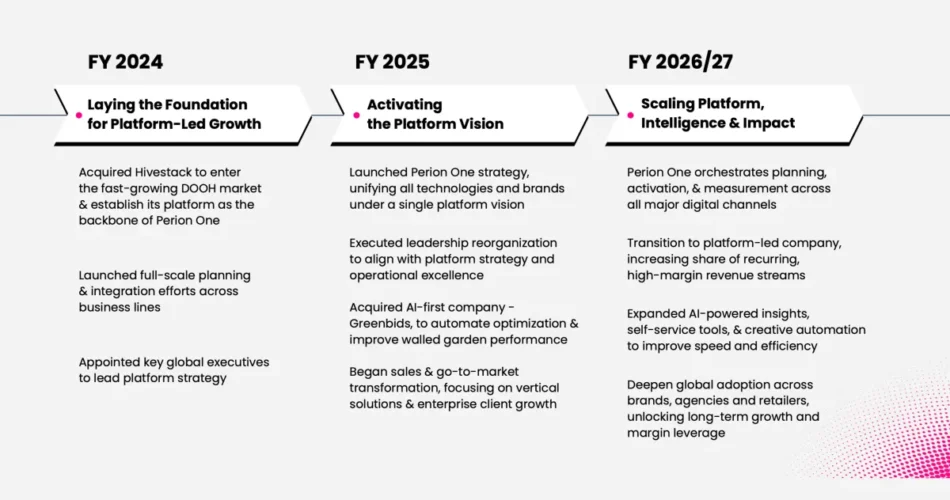

Timeline

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per 12 months.

PPC Land explains

Income – The basic monetary metric measuring Perion’s complete revenue from its promoting know-how providers. Throughout Q2 2025, income reached $103 million, representing the corporate’s skill to generate revenue throughout a number of promoting channels. Income composition shifted considerably towards promoting options, which now represents 78% of complete income, demonstrating the corporate’s profitable diversification away from search-dependent revenue streams. This metric serves as the first indicator of enterprise well being and progress trajectory.

Promoting Options – Perion’s core enterprise section encompassing digital out-of-home, linked TV, online advertising, and retail media providers. This division achieved 8.3% year-over-year progress to $80.6 million in Q2 2025, marking the primary optimistic progress since Q3 2023. The section represents Perion’s strategic deal with high-growth promoting channels that supply higher margins and progress prospects in comparison with conventional search promoting. It demonstrates the corporate’s evolution towards complete promoting know-how options.

DOOH (Digital Out-of-Dwelling) – Digital promoting displayed on screens in public areas corresponding to billboards, transit methods, and retail environments. DOOH emerged as Perion’s strongest progress driver, rising 35% year-over-year to $17.6 million in Q2 2025. This channel advantages from programmatic capabilities and real-time optimization, representing a major alternative within the $21 billion Asia-Pacific market. The section’s progress considerably outpaces business projections and displays rising advertiser demand for location-based concentrating on.

Linked TV (CTV) – Streaming tv content material delivered by way of internet-connected gadgets, representing a quickly rising promoting channel. Regardless of a 5% year-over-year decline to $9.7 million in Q2 2025, Perion launched its Efficiency CTV resolution to seize share within the $36 billion streaming market. CTV promoting permits for exact viewers concentrating on and measurement capabilities much like digital promoting, making it enticing to performance-focused entrepreneurs in search of options to conventional tv promoting.

Perion One – The corporate’s unified know-how platform consolidating all promoting options below a single model and infrastructure. Introduced in February 2025, this strategic initiative goals to offer Chief Advertising and marketing Officers with complete, built-in promoting capabilities throughout a number of channels. The platform leverages synthetic intelligence and information integration to optimize marketing campaign efficiency and measurement. Perion One represents the corporate’s imaginative and prescient of turning into the centralized platform for advertising and marketing executives, much like how Salesforce serves gross sales groups.

Yr-over-year – A monetary comparability technique measuring efficiency in opposition to the identical interval within the earlier 12 months, eliminating differences due to the season. This metric proved essential for Perion’s Q2 2025 outcomes, displaying the primary optimistic promoting options progress since Q3 2023. Yr-over-year comparisons present traders and analysts with clear development indicators, notably essential for Perion because it transitions from declining search income to rising promoting options. The metric demonstrates sustainable enterprise momentum past short-term fluctuations.

Development – The enlargement of enterprise metrics together with income, market share, and operational scale. Perion’s Q2 2025 efficiency confirmed assorted progress patterns: 35% in DOOH, 27% in retail media, and 5% in online advertising. Development measurement encompasses each monetary efficiency and strategic positioning in high-potential markets. The corporate’s progress technique focuses on channels with superior long-term prospects, reflecting administration’s dedication to constructing sustainable aggressive benefits in rising promoting applied sciences.

Quarter – A 3-month monetary reporting interval used to measure enterprise efficiency and talk outcomes to stakeholders. Q2 2025 (April-June) marked a major milestone for Perion with the return to promoting options progress. Quarterly reporting supplies common perception into enterprise trajectory and allows well timed strategic changes. For Perion, the quarter represented validation of its transformation technique and positioning for continued momentum by way of the rest of fiscal 12 months 2025.

Million – The financial unit used all through Perion’s monetary reporting, reflecting the corporate’s substantial scale within the promoting know-how market. Key figures embody $103 million in complete income, $21.3 million in working money move, and $318.5 million in money reserves. The constant use of tens of millions demonstrates Perion’s place as a major participant within the world promoting ecosystem, with ample monetary sources to execute strategic initiatives and climate market volatility whereas investing in progress alternatives.

Search – Conventional search engine promoting representing Perion’s legacy enterprise section, primarily affected by Microsoft Bing market modifications. Search income declined 35% year-over-year to $22.4 million, now representing 22% of complete income in comparison with larger historic percentages. Whereas declining, search income continues offering money move to fund investments in higher-growth segments. The search enterprise demonstrates Perion’s profitable transition from dependence on a single channel towards diversified income streams with higher long-term prospects.

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per 12 months.

Abstract

Who: Perion Community Ltd., a worldwide promoting know-how firm led by CEO Tal Jacobson and CFO Elad Tzubery, serving manufacturers, businesses, and retailers throughout digital promoting channels.

What: Second quarter 2025 monetary outcomes displaying first year-over-year progress in promoting options income since Q3 2023, pushed by 35% DOOH progress and 27% retail media enlargement, alongside launch of Efficiency CTV resolution.

When: Outcomes introduced August 11, 2025, overlaying the quarter ended June 30, 2025, with continued momentum anticipated by way of the second half of fiscal 12 months 2025.

The place: International operations spanning North America, Europe, Asia-Pacific, and Latin America, with current enlargement into Korea and strengthened European partnerships in Germany and Italy.

Why: Strategic transformation below Perion One platform imaginative and prescient goals to offer unified promoting know-how options addressing fashionable advertising and marketing complexities, positioning the corporate to seize progress in high-value segments like CTV, DOOH, and retail media whereas decreasing dependence on declining search income streams.

Source link