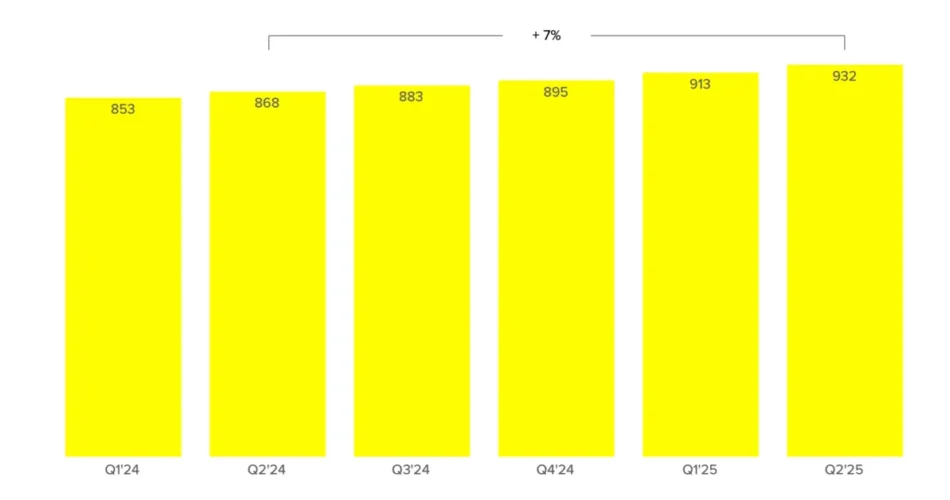

Snapchat proprietor Snap Inc. reported blended second-quarter 2025 outcomes on August 5, showcasing regular person development whereas grappling with promoting platform points that dampened income efficiency. The corporate reached 932 million month-to-month lively customers, representing a 7% year-over-year improve, however confronted headwinds that restricted promoting income development to 9%.

The Santa Monica-based social media firm introduced a number of important developments in its promoting know-how in the course of the quarter, with the broader rollout of Sponsored Snaps marking a key milestone in monetizing the platform’s most ceaselessly used floor.

In keeping with firm paperwork, Sponsored Snaps generated substantial efficiency enhancements for advertisers throughout Q2 2025. The format delivered “as much as a 22% improve when included in an advertiser’s broader Snap marketing campaign combine” and drove “an 18% carry in distinctive converters throughout app installs and app purchases.”

“The rollout of Sponsored Snaps is certainly a really significant and profound evolution of our advert enterprise,” CEO Evan Spiegel mentioned in the course of the earnings name. “As a result of Sponsored Snaps actually carry a local and extremely performant advert placement to probably the most ceaselessly used floor in Snapchat.”

The promoting format confirmed significantly robust engagement metrics. Firm information revealed that “after opening a Sponsored Snap from the chat feed, customers exhibit considerably larger engagement per full display advert view, driving a two instances improve in conversions, a 5x improve in click on to transform ratios, and a 2x improve in web site dwell instances in comparison with different inventories.”

Platform experiences technical challenges amid enlargement

Snap’s Q2 efficiency was impacted by a number of components, together with an inside promoting platform challenge that CFO Derek Andersen addressed in the course of the earnings name. The corporate skilled what Andersen described as “a change that allowed some campaigns to clear the public sale at considerably decreased costs.”

The technical downside contributed to promoting income development declining from roughly 9% in Q1 to only 1% in April earlier than recovering by means of Might. “Sadly, in our efforts to enhance advertiser efficiency, we shipped a change that brought on some campaigns to clear the public sale at considerably decreased costs,” the corporate acknowledged in its investor letter.

Further challenges included timing results from Ramadan and impacts from de minimis coverage modifications. These components mixed to restrict total promoting income development regardless of robust underlying metrics in person engagement and platform adoption.

AI and machine studying drive promoting efficiency

Snap’s continued funding in synthetic intelligence and machine studying infrastructure yielded measurable enhancements throughout key promoting metrics throughout Q2. The corporate reported that “AI and ML capabilities” contributed to “7-0 Buy quantity rising 39% year-over-year for commerce advertisers, and whole purchase-related advert income rising greater than 25% year-over-year.”

The platform launched Snapchat Sensible Marketing campaign Options, described as “an AI-powered suite designed to reinforce marketing campaign efficiency and simplify advertiser workflows.” This improvement contains Sensible Bidding performance that “dynamically adjusts bids to attain a desired price per motion.”

One case examine highlighted European sportswear model ICIW, which “noticed their ROAS double and conversion quantity improve by 80%, whereas lowering their price per motion by 50% after implementing Sensible Bidding.”

Every day lively customers elevated to 469 million, representing 9% year-over-year development, whereas month-to-month lively customers approached the corporate’s strategic goal of 1 billion customers globally. Geographic efficiency assorted considerably, with Remainder of World markets exhibiting the strongest development at 15% year-over-year for day by day lively customers.

North America markets introduced challenges, with day by day lively customers declining 2% year-over-year to 98 million, although the corporate emphasised that “North America distinctive Snap senders grew 2% year-over-year” and “North America MAU was flat year-over-year at 159 million.”

Content material engagement drives promoting stock development

Highlight, Snap’s short-form video function, continued increasing its position inside the platform ecosystem. The service “reached greater than 550 million month-to-month lively customers on common in Q2” with “time spent rising 23% year-over-year, now contributing greater than 40% of whole content material time spent.”

This development created further promoting stock alternatives. “International time spent watching content material and the variety of content material viewers elevated year-over-year in Q2, reflecting the multi-year funding in our machine studying infrastructure and the continued development in Highlight,” the corporate reported.

The platform additionally launched creator-focused instruments, with “1000’s of creators” becoming a member of the Snap Star program. Information confirmed “Highlight posts by Snap Stars rising greater than 145% year-over-year in North America in Q2.”

Augmented actuality maintains momentum regardless of competitors

Snap’s augmented actuality capabilities remained a key differentiator, with customers partaking with “AR Lenses in our digital camera greater than 8 billion instances every day.” The corporate reported that “over 400,000 creators from practically each nation have constructed greater than 4 million Lenses utilizing our industry-leading AR instruments.”

Throughout Q2, “greater than 350 million Snapchatters engaged with AR daily on common,” based on firm metrics. In style AI-powered lenses generated substantial engagement, with “90’s Faculty Photographs AI Lens, Totally different Eras AI Lens, and Cartoon World AI Lens collectively seen over one billion instances.”

The platform expanded AR creation accessibility by means of new instruments together with “Lens Studio iOS app and a brand new web-based Lens Studio creation software at lensstudio.snapchat.com.” These developments assist the corporate’s preparation for its shopper Specs AR glasses launch deliberate for 2026.

Subscription income offers development diversification

Snapchat+ subscription service demonstrated robust efficiency, with the corporate stating that subscribers “approached 16 million in Q2, a rise of 42% year-over-year.” Different Income, primarily pushed by subscriptions, “elevated 64% year-over-year to succeed in $171 million in Q2.”

The quarter noticed the introduction of Lens+, “a brand new Snapchat+ subscription tier that gives entry to unique new AI video Lenses, Bitmoji Recreation Lenses, in addition to early entry to new options.” This enlargement represents efforts to construct recurring income streams past conventional promoting.

Monetary efficiency displays platform transitions

Complete income reached $1.345 billion, up 9% year-over-year, although development charges fell wanting earlier quarters as a result of promoting platform challenges. The corporate generated $41 million in Adjusted EBITDA and $24 million in Free Money Circulation, demonstrating continued progress towards profitability.

Infrastructure investments remained substantial, with prices reaching $0.84 per day by day lively person in Q2. These investments primarily supported “ML and AI fashions to drive improved advertiser efficiency and content material personalization, in addition to the continued robust development in our world group.”

Market positioning amid aggressive panorama

Snap’s promoting developments happen inside an more and more aggressive social media promoting setting. The platform’s introduction of Sponsored Snaps represents a major strategic shift, putting promoting immediately inside personal messaging areas beforehand reserved for private communications.

Business context reveals social platforms persevering with to broaden promoting surfaces to keep up development charges. Snap’s strategy differs from opponents by emphasizing the personal, genuine communication setting that characterizes its person base.

Engineering restructure targets enterprise alignment

The corporate introduced organizational modifications designed to “higher align Snap’s engineering and know-how investments with our enterprise priorities.” This restructuring distributes engineering groups to assist particular enterprise capabilities, with core functions reporting to Co-Founder Bobby Murphy and monetization engineering reporting to Chief Enterprise Officer Ajit Mohan.

“This new, distributed construction will empower our groups to take larger possession and drive continued innovation for our group and promoting companions,” the corporate acknowledged in its investor communication.

Q3 outlook displays measured expectations

Waiting for Q3 2025, Snap supplied income steering of $1.475 billion to $1.505 billion, suggesting continued modest development amid ongoing market uncertainties. The corporate expects day by day lively customers to succeed in roughly 476 million, sustaining the regular person development trajectory established in latest quarters.

Adjusted EBITDA steering for Q3 ranges from $110 million to $135 million, reflecting the corporate’s continued give attention to balancing funding with income development and profitability progress.

Subscribe the PPC Land publication ✉️ for comparable tales like this one. Obtain the information daily in your inbox. Freed from adverts. 10 USD per 12 months.

Timeline

August 5, 2025: Snap declares Q2 2025 monetary outcomes exhibiting income development of 9% year-over-year

June 2025: Sponsored Snaps rollout expands to extra areas and bidding goals

Q2 2025: Introduction of Lens+ subscription tier and Snapchat Sensible Marketing campaign Options

April 2025: Platform experiences advertising auction pricing issuesaffecting income development

Q1 2025: Snap reaches 900+ million monthly users however faces promoting headwinds

February 2025: Updated creator monetization program launches with new eligibility necessities

Subscribe the PPC Land publication ✉️ for comparable tales like this one. Obtain the information daily in your inbox. Freed from adverts. 10 USD per 12 months.

Abstract

Who: Snap Inc., the dad or mum firm of Snapchat, together with its 932 million month-to-month lively customers and promoting companions

What: Q2 2025 earnings report exhibiting 9% income development to $1.345 billion, expanded Sponsored Snaps promoting format delivering important conversion enhancements, and continued person development regardless of platform technical challenges

When: Outcomes introduced August 5, 2025, masking the quarter ended June 30, 2025, with key developments together with Sponsored Snaps broader rollout in June

The place: International platform operations with assorted regional efficiency – North America exhibiting person decline whereas Remainder of World markets demonstrated robust 15% development in day by day lively customers

Why: Outcomes replicate Snap’s strategic give attention to monetizing its extremely engaged person base by means of revolutionary promoting codecs whereas investing closely in AI, machine studying, and augmented actuality capabilities to keep up aggressive positioning within the social media panorama

Key Phrases Defined

Sponsored Snaps: The promoting format represents Snap’s most vital monetization innovation, putting branded content material immediately inside the Chat inbox the place customers spend most of their time. This native promoting strategy differs from conventional show adverts by showing as messages from manufacturers, creating what the corporate describes as genuine relationship-building alternatives. The format’s effectiveness stems from its integration into the platform’s core communication perform, producing considerably larger engagement charges and conversion metrics in comparison with different promoting placements throughout Snapchat’s ecosystem.

Every day Energetic Customers (DAU): This metric measures registered customers who go to Snapchat no less than as soon as throughout a 24-hour interval, serving as a major indicator of platform engagement and advertiser attain potential. Snap’s 469 million DAU in Q2 2025 represents the muse for promoting stock and income technology. The geographic distribution of DAUs impacts income efficiency considerably, with North American customers producing larger common income per person in comparison with rising markets, making regional development patterns essential for understanding platform monetization tendencies.

Promoting Income: The first income stream encompasses funds from manufacturers and companies for numerous advert placements throughout Snapchat’s platform, together with conventional Snap Adverts, Sponsored Snaps, and augmented actuality experiences. Income development confronted challenges in Q2 resulting from technical platform points and market situations, highlighting the sensitivity of digital promoting spending to each inside operational components and exterior financial pressures affecting model advertising budgets.

Machine Studying: Snap’s algorithmic programs energy content material advice, promoting focusing on, and person expertise personalization throughout the platform. These AI-driven capabilities immediately influence promoting efficiency by enhancing advert relevance and placement effectiveness. The corporate’s investments in ML infrastructure allow real-time optimization of promoting campaigns, contributing to improved conversion charges and advertiser return on funding, which in the end drives platform income development and aggressive positioning.

Month-to-month Energetic Customers (MAU): This broader engagement metric captures customers who entry Snapchat no less than as soon as inside a 30-day interval, offering perception into platform attain and development trajectory. At 932 million MAU, Snap approaches its strategic purpose of serving 1 billion customers globally. This metric signifies the overall addressable viewers for advertisers and demonstrates the platform’s scale relative to competing social media providers, influencing advertiser funding selections and media planning methods.

Augmented Actuality (AR): Snap’s AR know-how allows customers to overlay digital content material onto real-world environments by means of smartphone cameras, creating interactive experiences that differentiate the platform from opponents. With over 8 billion day by day AR lens engagements, this know-how serves each person leisure and promoting functions. AR capabilities assist model experiences that conventional digital promoting can not replicate, offering distinctive worth propositions for advertisers in search of revolutionary buyer engagement strategies whereas positioning Snap for future {hardware} developments.

Highlight: Snap’s short-form video content material function competes immediately with TikTok and Instagram Reels, capturing over 40% of whole content material viewing time on the platform. This engagement creates substantial promoting stock alternatives whereas supporting creator monetization applications. Highlight’s development contributes to total platform stickiness and person retention, offering advertiser entry to trending content material environments the place manufacturers can obtain viral attain and cultural relevance by means of strategic content material partnerships.

Income Development: The 9% year-over-year improve displays Snap’s potential to broaden monetization regardless of going through technical challenges and market pressures throughout Q2 2025. Development charges in digital promoting usually point out platform well being, aggressive positioning, and advertiser confidence. Snap’s income efficiency in comparison with {industry} benchmarks influences investor sentiment and strategic selections relating to platform investments, person acquisition spending, and know-how improvement priorities.

ARPU (Common Income Per Person): This monetary metric divides whole income by common day by day lively customers, indicating the platform’s monetization effectivity and geographic market worth. Regional ARPU variations show promoting market maturity variations, with North American customers producing considerably larger income than rising market customers. ARPU tendencies affect strategic selections about market enlargement, person acquisition investments, and have improvement priorities for maximizing long-term income potential.

Sensible Marketing campaign Options: Snap’s AI-powered promoting instruments automate marketing campaign optimization, bidding methods, and viewers focusing on to enhance advertiser efficiency whereas lowering handbook administration necessities. These options handle small and medium enterprise wants for simplified promoting instruments whereas competing with comparable choices from Google, Meta, and different digital promoting platforms. The effectiveness of those automated instruments immediately impacts advertiser satisfaction, marketing campaign efficiency, and platform competitiveness within the evolving digital advertising panorama.

Source link