Shopper confidence has been more and more risky because the presidential election. The brand new administration’s larger tariffs, decrease authorities spending and radical tax adjustments have unnerved many individuals. The College of Michigan’s Shopper Sentiment Index has fallen from 74 in December to 50.8 in April. After 5 months of declines, The Convention Board Shopper Confidence Survey surged in Could, however stays under the place it was in 2021.

Right here’s what customers and entrepreneurs are already doing to deal with the financial uncertainty.

Shoppers

Worth, not model, is driving selections: 76% of U.S. customers are both “very probably” (36%) or “considerably probably” (40%) to alter manufacturers for a greater value or worth, based on a survey by efficiency advertising agency Wunderkind. That’s much more pronounced amongst youthful customers, with 42% of Millennials and 37% of Gen Z within the “very probably” class.

“The fixed and unpredictable reversals and changes of tariffs lack constant context, that means customers don’t know easy methods to correctly plan for his or her fast budgetary future, a lot much less a long-term one,” mentioned Greg Zakowicz, senior ecommerce professional at advertising automation firm Omnisend.

There is no such thing as a loyalty: Practically 90% of customers will change manufacturers in the event that they see a major value hike, based on Wunderkind’s 2025 Could Entrepreneurs/Shopper Tariffs Impression report. What’s important? Two-thirds will bounce to a brand new model for a 20% or much less value distinction, with most saying the tipping level is 11%-20%. FYI: Whereas new tariffs range by nation, the present common of all tariff will increase is 17.8%, based on the Yale Budget Lab. That was calculated earlier than President Trump threatened the EU with a 50% tariff final week.

Dig deeper: In a world of tariffs and turmoil, marketing’s insight is a superpower

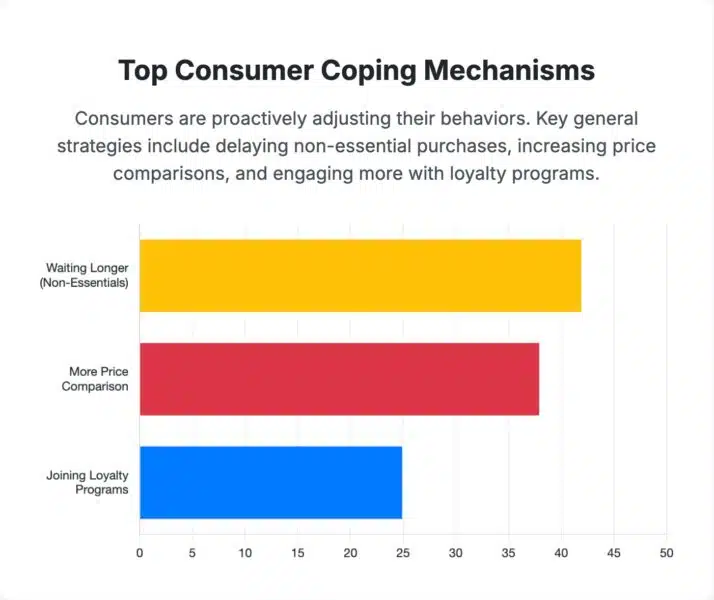

Vital shopping for adjustments underway: Shoppers are exhibiting extra self-discipline in discretionary spending.

- 42% are ready longer earlier than shopping for non-essential gadgets.

- Within the grocery and necessities class, 40% are switching to inexpensive or retailer/private-label manufacturers, and 33% are stockpiling when costs are decrease.

- For attire, 43% are ready for gross sales or promotions. Switching to inexpensive manufacturers (33%) and buying thrift or second-hand (29%) are additionally gaining traction.

- 47% are delaying the acquisition of high-ticket gadgets (over $200) till essential, 44% are ready for gross sales or promotions and 30% are switching to inexpensive manufacturers.

Right here for the long run: 36% of customers count on to really feel the financial squeeze “by way of the tip of 2025 or longer.” That’s greater than double every other reply. Older buyers are essentially the most pessimistic, with 49% of Boomers anticipating to be affected for at the least the remainder of the 12 months. Solely 17% consider tariffs gained’t considerably disrupt their buying habits. For entrepreneurs, this underscores the necessity for methods constructed for endurance.

Companies are as pessimistic as customers. A survey of SMB retailers by Omnisend discovered:

- 36.8% anticipate a detrimental enterprise influence from tariffs.

- 13.2% count on it to be “important.”

- 64% count on customers will spend much less over the subsequent 12 months.

Entrepreneurs

Entrepreneurs are adjusting costs and prioritizing owned channels and knowledge.

Don’t say “tariff”: Corporations dislike elevating costs for causes past their management. In the event that they do, the very best apply in advertising is to be clear and trustworthy about why it’s occurring. Nevertheless, utilizing the phrase tariff can draw the wrath of President Trump, as seen with Amazon, Walmart, Mattel and others.

The Convention Board even issued an advisory about utilizing the “T” phrase.

“Keep away from breaking out tariff-induced prices, which could possibly be interpreted by some as a political assertion, to keep up neutrality. As an alternative, clarify that enter, import, or sourcing prices have risen with out mentioning the time period ‘tariffs’ instantly, which could be too politically charged.”

It’s price noting that 81% of U.S. customers report excessive consciousness of stories about tariffs, based on the Wunderkind survey. So, they know why costs are rising, even in the event you don’t inform them.

Dig deeper: Winning customer loyalty starts with straight talk about tariffs

Costs are certainly going up: 57% of entrepreneurs say they’re selectively rising costs in tariff-impacted classes, and 72% of manufacturers are rising costs because of the tariffs, based on Wunderkind.

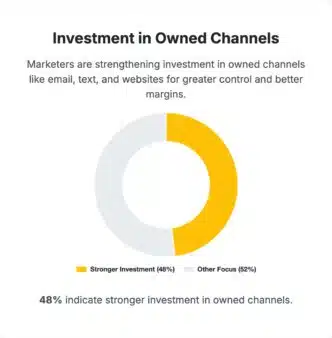

Turning to owned channels: Except for pricing, entrepreneurs are making some huge strategic adjustments. The commonest transfer, 48% of respondents say, is focusing extra on owned channels like electronic mail, textual content and web sites. That factors to a transparent shift towards choices that provide extra management, stronger margins, and a direct line to the client.

“Manufacturers might have to re-evaluate their pricing methods to account for added headwinds, reminiscent of tariff prices, and actually perceive their shifting buyer behaviors,” mentioned Cary Lawrence, CEO of client analytics firm Decile. “Doubling down on personalization to mitigate value or low cost sensitivities is now not non-obligatory — it’s a requirement.”

That explains why 48% of entrepreneurs mentioned first-party knowledge progress is their high alternative for 2025. That signifies a foundational shift in direction of leveraging owned knowledge for personalization, segmentation, and retention.

Moreover, performance-based advertising options are the highest precedence for martech funding (56%), exhibiting a requirement for applied sciences that ship assured, measurable outcomes. Entrepreneurs are additionally testing new product pricing and worth bundles (45%) and rising promotional gives and reductions (40%) as a part of their response.

Dig deeper: 3 ways to turn tariff turmoil into marketing gold

Unhappy holidays forward? Whereas customers contemplate the fast value influence, entrepreneurs are planning for the influence on vacation buying. Greater than two-thirds (68%) say they’re modifying vacation methods. They’re shifting from reactive to proactive planning, testing messaging and gives earlier within the 12 months to refine execution forward of peak vacation demand.

Retailers will probably see essentially the most acute results as manufacturing prices improve dramatically for abroad manufacturing. Along with elevating costs, retailers will minimize spending to retain margins, and as you realize, advertising is a favourite place to chop. Social, search and retail media because the channels most certainly to see a drop in advert spend, based on a report by Advertiser Perceptions. That’s as a result of they over-index on efficiency advertisers and types, notably these primarily based in China.

“Traditionally, model promoting has struggled in powerful financial occasions, whereas efficiency has been extra resilient,” the report mentioned. “This would be the case this time, however the manufacturers with the biggest efficiency budgets (retailers) will probably be impacted most severely general.”

Then again, firms that make investments extra in upper-funnel adverts could be higher positioned to climate the influence.

Going into 2025, entrepreneurs anticipated their budgets to remain the identical, and advertisers noticed strong progress for media budgets. Now, as tariffs are raised, then lowered, then raised not-quite-as-high, nobody can say what’s subsequent. What we do know is that far fewer cargo ships are arriving in U.S. ports and customers are pulling of their wings. These are probably the very best financial indicators to plan round.

Source link