Finance groups immediately are underneath strain to maneuver quicker, reply to altering situations, and make smarter, data-backed selections. AI-Powered Analytics helps finance professionals do exactly that—by making it straightforward to discover knowledge, uncover insights, and act on them in actual time.

Under are 5 impactful use circumstances the place AI is reshaping how finance groups handle rebates, monitor margins, and make smarter, quicker selections.

- Understanding Margin Breakdown to Reveal True Profitability

For finance professionals, evaluating profitability on the product stage is greater than only a reporting train—it’s the inspiration of sound monetary planning. Nonetheless, precisely accounting for provider rebates can typically obscure true margins, particularly when accruals are misapplied or inconsistently tracked.

AI-Powered Analytics simplifies margin breakdown by linking rebate accruals on to product strains, SKUs, or classes. By processing massive volumes of rebate and gross sales knowledge, AI identifies which merchandise are most impacted by rebates and surfaces which classes are underperforming after rebate impression.

For example, a finance crew would possibly uncover {that a} fast-moving product line exhibits robust gross margins, however after factoring in rebate accruals, the web profitability is considerably diminished. With that perception, they’ll reassess buying methods or renegotiate rebate constructions. In the end, AI delivers the readability finance groups must help knowledgeable, margin-protecting selections.

- Optimizing Declare Efficiency to Speed up Money Stream

In rebate administration, timing issues. Delays in declare processing can stall money inflows, disrupt money forecasting, and erode provider relationships. One of the crucial highly effective methods AI helps finance groups is by monitoring rebate declare efficiency and figuring out course of inefficiencies that reach the fee cycle.

With AI-Powered Analytics, finance professionals can monitor the lifecycle of every declare—from submission to approval and isolate the place bottlenecks happen. Whether or not it is lacking documentation, delayed provider responses, or inner course of lags, AI highlights the weak hyperlinks within the chain.

By figuring out these choke factors, finance groups can streamline the declare course of, maintain stakeholders accountable, and scale back days excellent. This enhanced visibility helps higher money stream administration and will increase operational agility. In high-volume environments, even a modest discount in declare cycle time interprets into significant monetary impression.

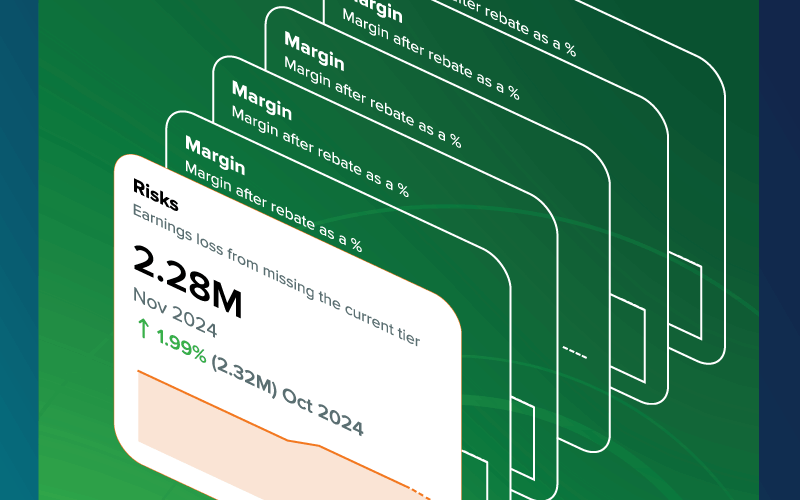

- Analyzing Put up-Rebate Margins to Safeguard Program Profitability

Buyer rebates are highly effective instruments for driving gross sales quantity, however they’ll additionally obscure the true cost-to-serve. With out understanding margins after rebate, finance leaders danger approving unprofitable offers that look favorable on the floor.

AI-Powered Analytics allows finance groups to trace margins each earlier than and after rebate software, making a dynamic view of web profitability. By means of real-time alerts and pattern monitoring, finance professionals can determine when rebate packages start to erode margins, permitting for well timed intervention.

Think about a state of affairs the place a brand new volume-based rebate program boosts gross sales however results in steep margin compression. AI highlights this shift early, prompting a collaborative evaluation with the gross sales crew to regulate thresholds or tiers earlier than additional losses accumulate. With AI, finance doesn’t simply react to margin modifications, they forestall them.

- Monitoring Income, Rebates, and Margin in One View

To make strategic selections, finance leaders want greater than remoted KPIs, they should perceive the complete monetary ecosystem. One of the crucial helpful use circumstances for AI-Powered Analytics is correlating income, rebate payouts, and post-rebate margins over time to offer a holistic view of efficiency.

By bringing these knowledge streams collectively into intuitive visualizations, finance groups can uncover key developments and root causes. For instance, a dip in income would possibly seem regarding till analytics reveal it was offset by a good rebate shift that preserved total margins. Conversely, steady income would possibly masks eroding profitability attributable to rising rebate liabilities.

This interconnected view empowers finance leaders to steadiness progress and profitability, determine seasonal impacts, and make proactive changes to technique. With AI, advanced relationships grow to be clear narratives that drive motion.

- Leveraging Good Dashboards & Insights

In lots of finance features, time is spent chasing experiences, reconciling numbers, and responding to advert hoc requests. AI-Powered Analytics replaces static experiences with customizable dashboards, good alerts, and pure language queries—giving finance groups the instruments to maneuver from reactive to strategic.

Customized dashboards present real-time entry to monetary KPIs, permitting finance leaders to observe accrual accuracy, payout forecasts, and rebate developments at a look —no SQL required. Good Evaluation robotically detects anomalies, comparable to sudden margin swings or unusually excessive rebate exercise, and alerts stakeholders accordingly.

Even non-technical crew members can have interaction with knowledge utilizing pure language search. As an alternative of requesting a report, they’ll ask questions like, “Which clients brought on a margin drop final quarter?” or “The place did rebate payouts exceed forecast?”—and get on the spot, visible solutions.

By democratizing entry to insights and automating evaluation, AI empowers finance groups to give attention to what issues: guiding the enterprise towards progress, resilience, and profitability.

Unleashing the Energy of AI-Powered Analytics in Finance

AI-Powered Analytics is reshaping the monetary panorama by equipping finance professionals with cutting-edge instruments to optimize processes, safe profitability, and bolster effectivity.

As companies cope with knowledge complexities and rising market calls for, the adoption of AI-driven options is now not non-obligatory—it is crucial. Organizations that hesitate danger being left behind, whereas those that embrace AI analytics now will rework overwhelming monetary knowledge into their best strategic asset. Tomorrow’s monetary leaders are making the choice immediately to revolutionize how they derive insights, mitigate dangers, and seize alternatives that may in any other case stay invisible.

Do not simply survive within the new monetary panorama—dominate it. Schedule a demo of AI-Powered Analytics immediately and rework each rebate greenback right into a aggressive benefit.

Source link