One of the things we often hear from prospects and clients is that they wish they had a better idea of what their own audience, prospects, and customers were really thinking when they requested a piece of content.

For example, our client wanted to better understand where their prospects were in their overall buying journey and what pain points they were experiencing. Said another way, they were attempting to identify their potential buyer’s intent.

Buyer intent data has long been relegated to company-level observations associated with IP address mapping and tracking users across web pages without their consent. Such intent data is helpful in understanding extremely top-of-funnel behavior but lacks the discrete context and depth of learnings that buyer-level intent data can deliver. Buyer-level, and fully permissioned, intent data builds on those fundamentals and delivers invaluable directly provided by buyers as they consume content specific to their various business and technical challenges.

Fortunately, this is something that NetLine now has greater visibility into.

The Challenge

As shared in a recent blog, businesses across the globe are being forced to accelerate digital business transformation plans by at least five years through 2024 to survive in a post-COVID-19 world. This shift involves a permanently higher adoption of remote work and digital touchpoints for customers and employees alike.

Meeting the needs of this transformation requires a modern hybrid cloud solution that unifies infrastructure and frees data to move where it needs to be, allowing a data-centric business to adapt and change direction quickly in the name of gaining a competitive advantage.

But making a decision on cloud technology investment can be challenging. Factor in the number of technology options being added every week and IT decision-makers are left wondering if they’ve made the right decisions.

The Goal

Identify and understand how leading IT decision-makers are attempting to simplify their cloud management landscape and progress through their cloud journey.

Such observations should exclusively be captured via first-party interactions with IT buyers as they voluntarily registered and consumed related content.

How This Data Was Captured

By tapping into dramatic scale beyond the limitations of their own content, our customer leveraged NetLine’s Intent Discovery product to secure first-party sourced intent-rich data squarely aimed at accelerating sales outcomes. Empowered by NetLine’s entire content universe, the client put to good use all 12,000+ assets, billions of data points, and the 35,925,120 different ways of filtering buyers actively performing research.

Unlike traditional intent data, Buyer-Level intent Discovery helps you better understand the challenges, priorities, and purchase timeline of your ideal targets. Nothing is hidden behind obfuscated datasets and/or black box proprietary scores.

Perhaps most importantly, Intent Discovery acts as an always-on monitor of all B2B content consumption behavior as professionals are actively researching content specific to their challenges. Monitoring activity is then mined on a real-time basis and intercepted once a buyer has met or exceeded each element required to define intent—capturing custom, intent-rich, customer-specific insights directly from the prospect.

The Questions

To answer the questions, we engaged 400+ senior-level IT decision-makers to assess their experiences and cloud management aspirations.

These data results are the responses from their unique feedback.

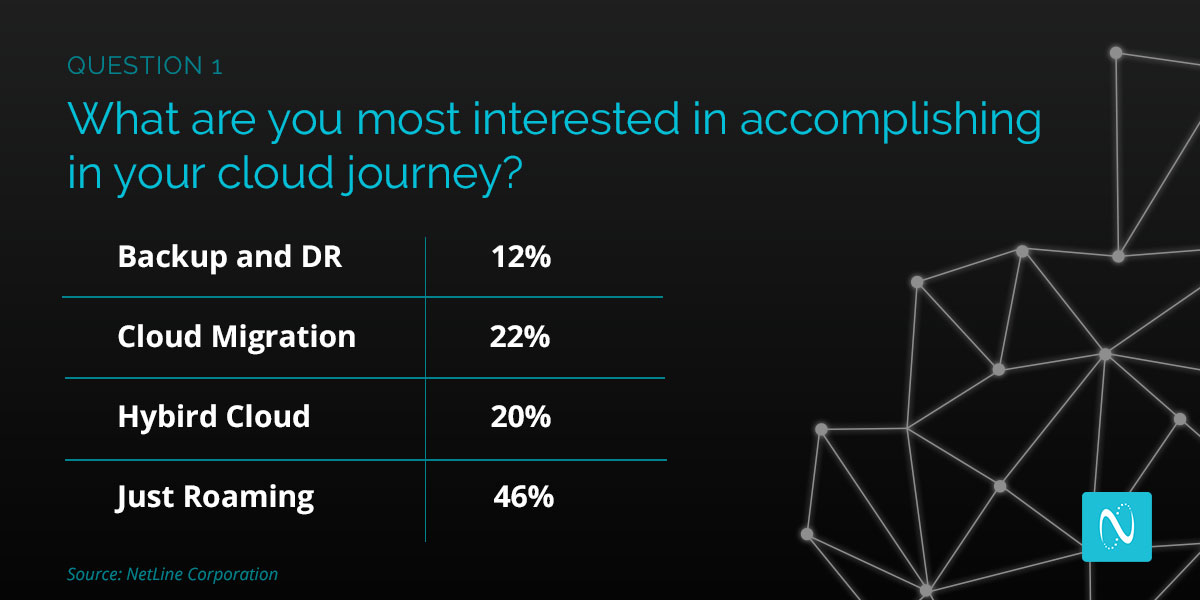

1. What are you most interested in accomplishing in your cloud journey?

While many professionals were merely doing their research on the specifics of cloud management—46% of Senior decision-makers shared that they were just roaming for information when answering what they were looking to accomplish in their cloud journey—there were plenty of insights to be extracted.

While many professionals were merely doing their research on the specifics of cloud management—46% of Senior decision-makers shared that they were just roaming for information when answering what they were looking to accomplish in their cloud journey—there were plenty of insights to be extracted.

For instance:

- More than 34% of all Computer as Technology professionals said that Cloud Migration was their top priority, as did 30% of Biotech and Pharmaceutical pros.

- IT decision-makers in the Manufacturing sector were 357% more likely to cite Cloud Migration as their number one target to accomplish in their cloud journey.

- 50% of Legal and Automotive employees, respectfully, were most interested in gaining a better grasp on their Hybrid Cloud options. In comparison to their peers in other industries, they are 146% more likely to share this sentiment.

- 29.41% of Media and 21.05% of Government professionals, however, were most interested in shoring up their Backup and Data Recovery capabilities.

- Insurance industry IT leadership were purposeful and 42% less likely to state that they were “Just Roaming” indicating a predisposition to be further down the funnel in their personal cloud journey.

While this is merely an educated guess, it’s safe to say that professionals from the Construction, Corporate Services, and Travel/Hospitality/Entertainment industries are just now trying to get a handle on how a cloud strategy makes sense for their businesses. For the Travel/Hospitality/Entertainment field specifically, this guess is further supported by the answers provided in Question 2.

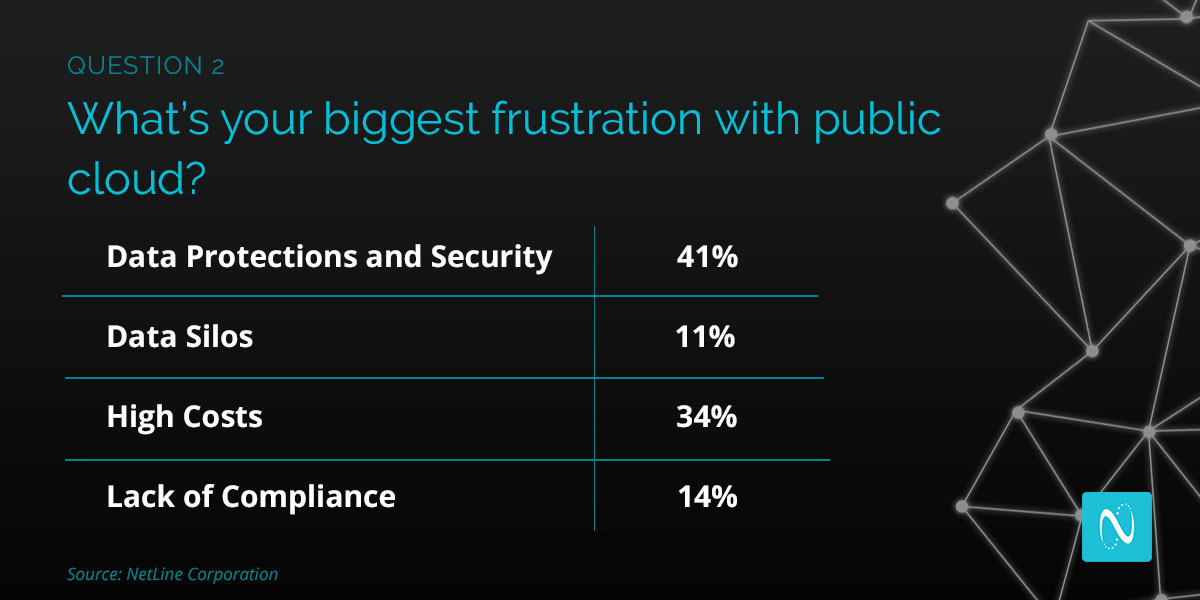

2. What’s your biggest frustration with the public cloud?

For this question, there were two very clear frustrations associated with the public cloud: The high cost and the data protections and security issues.

Here are some of the other highlights:

- 100% of responses captured by IT buyers within the Construction and Manufacturing industries stated the High Cost was their greatest frustration

- IT leadership within the Corporate Services vertical were 836% more likely to cite Data Silos as their largest frustration associated with public cloud solutions.

- 50% of respondents from the Biotech and Pharmaceuticals and Travel/Hospitality/Entertainment fields listed the public cloud’s Lack of Compliance as a major challenge.

- Overall, the primary concern for all respondents around the public cloud was Data Protections and Security, accounting for 41.15% of all answers. Professionals from the Automotive (58.33%), Insurance (57.9%), Legal (50%), Education (47.46%), and Utility/Energy (45%) fields were the five most represented industries in this group.

- The High Cost of the public cloud was a big concern for 34.38% of participants. Construction and Manufacturing fields aside (100% each), the Travel/Hospitality/Entertainment (50%), Retail and Consumer Goods (48.72%), Media (47%), Healthcare/Medical (46.3%), and Computers and Technology (36.6%) fields were the five most represented in this group.

At a macro-level, (beyond the overwhelming answers to data protections and security and the high costs associated with the public cloud) there doesn’t seem to be any hardline connection of one’s industry’s perceived need to protect their data at all costs vs. the need to keep cost in mind.

For example, while Insurance professionals said data protections (57.9%) was more of a priority than the high cost (31.58%) of the public cloud, professionals in the Healthcare/Medical field leaned more toward the cost side of things (46.3% to 38.89%).

The Results

What our customer now has, beyond high quality, first-party leads every client can generate through NetLine, is a greater understanding of where their potential clients are in their unique buying journey.

They now know that 58% of Senior Leaders in the Automotive industry Data Protections and Security as their biggest frustration. They also are aware that IT leaders within the Pharma and Travel industries are 262% more likely to state that a “Lack of Compliance” is their biggest frustration with the public cloud.

From a price perspective, they now know that IT buyers within the Construction and Manufacturing industries are 190% more likely to be highly sensitive to costs associated with public cloud solutions. Curiously, and perhaps paradoxically, IT decision-makers within the Government sector were 43% less likely to have sensitivity to price. All of this is extremely useful for their business and allows their Marketing and Sales teams to refine their messaging to become more impactful.

Buyer-Level Intent Discovery removes the guesswork that comes with every lead and instead provides context to what each prospect needs and what your buying audience craves. Insights like these are more valuable than gold, as they set the table for more productive and more fruitful interactions, relationships, and, hopefully, sales.

How Your Business Can Better Understand the Intent of Your Audience

In today’s hyper-competitive vendor market, it is more important than ever to understand the real-time pain points and in-market tendencies of your future buyers.

NetLine’s Intent Discovery product helps businesses accelerate its sales cycle by capturing first-party intent data by intercepting and engaging the buyer with customized validation questions. With this one-of-a-kind product, B2B Marketers can gain first-party insights for immediate activation and seamless remarketing/sales acceleration.

For more information on how you can move beyond account-level insights and start your buyer-level intent discovery journey, contact us, or visit our website.

Source link