Fee know-how firm Stripe Inc. is reportedly in talks to amass fintech startup Bridge Ventures Inc. for a worth of $1 billion.

According to Forbes, the acquisition talks, that are nonetheless beneath dialogue and topic to both occasion strolling away, could be Stripe’s largest deal to this point. Among the sources referenced by Forbes additionally word that regulatory concerns equivalent to licenses and compensation for workers, together with Bridge founders Zach Abrams and Sean Yu, remained potential hurdles.

Neither Stripe nor Bridge has commented on the reported acquisition discussions.

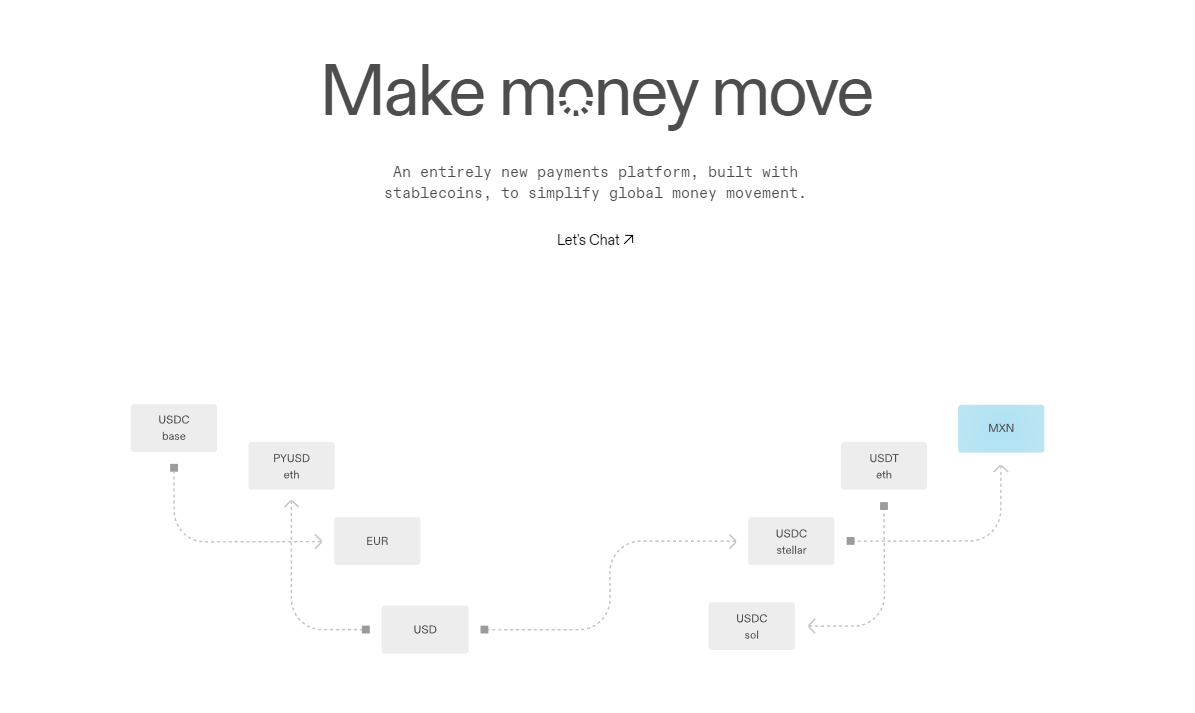

Based in 2022, Bridge is constructing a world fee community that makes use of stablecoins to simplify and enhance cross-border transactions. The corporate has as an intention to make transferring cash as quick and environment friendly because the web by considerably lowering prices in comparison with conventional monetary programs like SWIFT.

The Bridge platform has been designed to permit companies, governments and help organizations to ship, obtain and retailer stablecoins, equivalent to USDC and Tether, to make it simpler to handle funds throughout borders. The platform additionally gives infrastructure that builders can use to seamlessly combine stablecoin funds into their functions.

Core to their providing, Bridge seeks to supply customers true financial selection by permitting them to save lots of and spend in U.S. {dollars} or Euros utilizing stablecoins. The flexibleness in having the ability to take action is helpful in areas the place conventional banking providers could also be much less accessible.

“We imagine stablecoins will rework and enhance international cash motion,” the corporate writes on its web site. “Bridge creates the infrastructure vital for builders to take full benefit of this new medium.”

Coming into a possible acquisition, Bridge has raised $58 million, according to Tracxn, from buyers together with Sequoia Capital Operations, Ribbit Capital LP, Index Ventures and Haun Ventures LP. The corporate’s most up-to-date spherical was raised at a $200 million valuation and Bridge has additionally reportedly acquired curiosity in elevating a doable Collection B spherical at the next valuation.

Ought to a deal occur, the Bridge acquisition will improve Stripe’s present cryptocurrency providers. Going again to 2022, Stripe introduced the power for corporations to pay customers in cryptocurrency via its fee processing platform and the corporate has provided varied options since.

Aakash Sahney, head of product at Stripe Join, spoke with theCUBE, SiliconANGLE Media’s livestreaming studio, in July, the place he mentioned how Stripe is working with Amazon Net Companies Inc. to rework fee platforms for contemporary enterprise. The potential acquisition of Bridge would broaden on these providers.

Picture: Bridge

Your vote of assist is essential to us and it helps us preserve the content material FREE.

One click on beneath helps our mission to supply free, deep, and related content material.

Join our community on YouTube

Be a part of the group that features greater than 15,000 #CubeAlumni consultants, together with Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and lots of extra luminaries and consultants.

THANK YOU

Source link