Ouch! The financial institution that financed many Silicon Valley startups simply ran out of cash within the second-biggest financial institution collapse in US historical past. The failure will significantly injury the enterprise capital economic system and is already hurting your complete banking sector. Nevertheless, the chance of a 2008-style collapse is low.

Silicon Valley Financial institution failed Friday, placing virtually $175 billion, together with cash from a few of the largest tech firms, below the Federal Deposit Insurance coverage Company’s (FDIC) management. The financial institution had been a big enterprise capital funding supply for know-how firms, the New York Occasions reported.

The establishment is exploring a possible sale because it halts all share buying and selling. The FDIC will hold the Silicon Valley Financial institution’s deposits and property on the lately constructed Nationwide Financial institution of Santa Clara, which must be operational by Monday. Silicon Valley Financial institution-issued checks will nonetheless clear.

Nevertheless, the financial institution’s insurance coverage coverage solely covers deposits below $250,000. Accounts over that quantity will ultimately obtain certificates to be partially paid again for his or her uninsured cash. Lower than three p.c of Silicon Valley Financial institution’s deposits had been insured because it handled many Large Tech corporations.

Silicon Valley Financial institution had used its bountiful capital from enterprise funds to put money into bonds, which produced dependable returns because of low-interest charges. Between 2018 and 2021, the financial institution’s deposits grew from $49 billion to $189.2 billion. Nevertheless, final 12 months’s federal rate of interest hikes upended the technique.

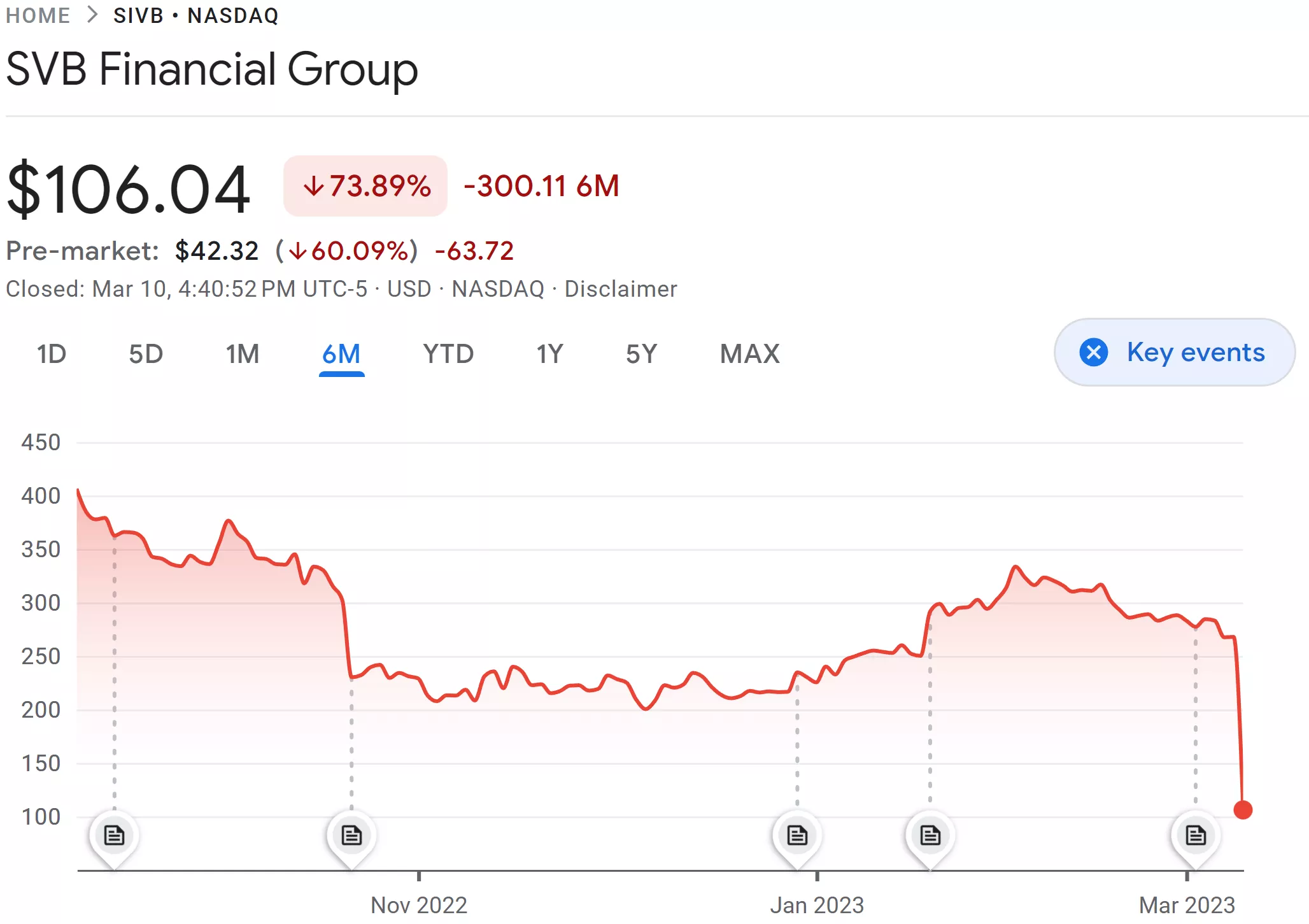

The financial institution responded with some cautionary measures this week, however the bulletins of these strikes began a panic. Silicon Valley Financial institution bought some securities at a loss, promoting $21 billion in investments, borrowing $15 billion, and elevating money by an emergency inventory sale. The poor reception to those selections triggered a financial institution run as its inventory value plummeted.

The fallout triggered Signature Financial institution and Western Alliance to finish Friday greater than 20 p.c down. PacWest Bancorp dropped by over 35 p.c. Different giant banks, nonetheless, like JPMorgan and Wells Fargo, are tremendous, ending barely up on Friday. Financial institution of America and Morgan Stanley suffered minor declines.

The autumn of Silicon Valley Financial institution is the most important US financial institution failure because the collapse of Washington Mutual in 2008 – the biggest in American historical past — which affected $300 billion in buyer deposits.