Backside line: Intel executives love to inform an excellent story concerning the firm’s capacity to innovate and do it quick sufficient to catch the competitors, however it’s tough to take them significantly when the precise merchandise are at all times on the horizon. Nonetheless, the chip big says it is making vital progress on superior course of applied sciences that can transfer out of the lab in 2024 on the earliest.

Trade watchers have had their eyes set on Intel’s 3nm-based technologies, that are anticipated to debut in client CPUs as quickly as subsequent 12 months. Within the meantime, the corporate appears to be arduous at work on extra superior course of nodes equivalent to Intel 18A and 20A which might be central to its future as a semiconductor big.

In keeping with a Taiwanese information outlet, Intel’s Foundry Providers division has finished the tape-out course of for the 2 fabrication applied sciences. The publication cites the senior vice chairman and chairman of Intel China, who defined the primary chips primarily based on an Intel 18A course of may very well be made in a trial run someday within the second half of 2024. Nonetheless, mass manufacturing of business merchandise primarily based on it is not deliberate to begin till 2025.

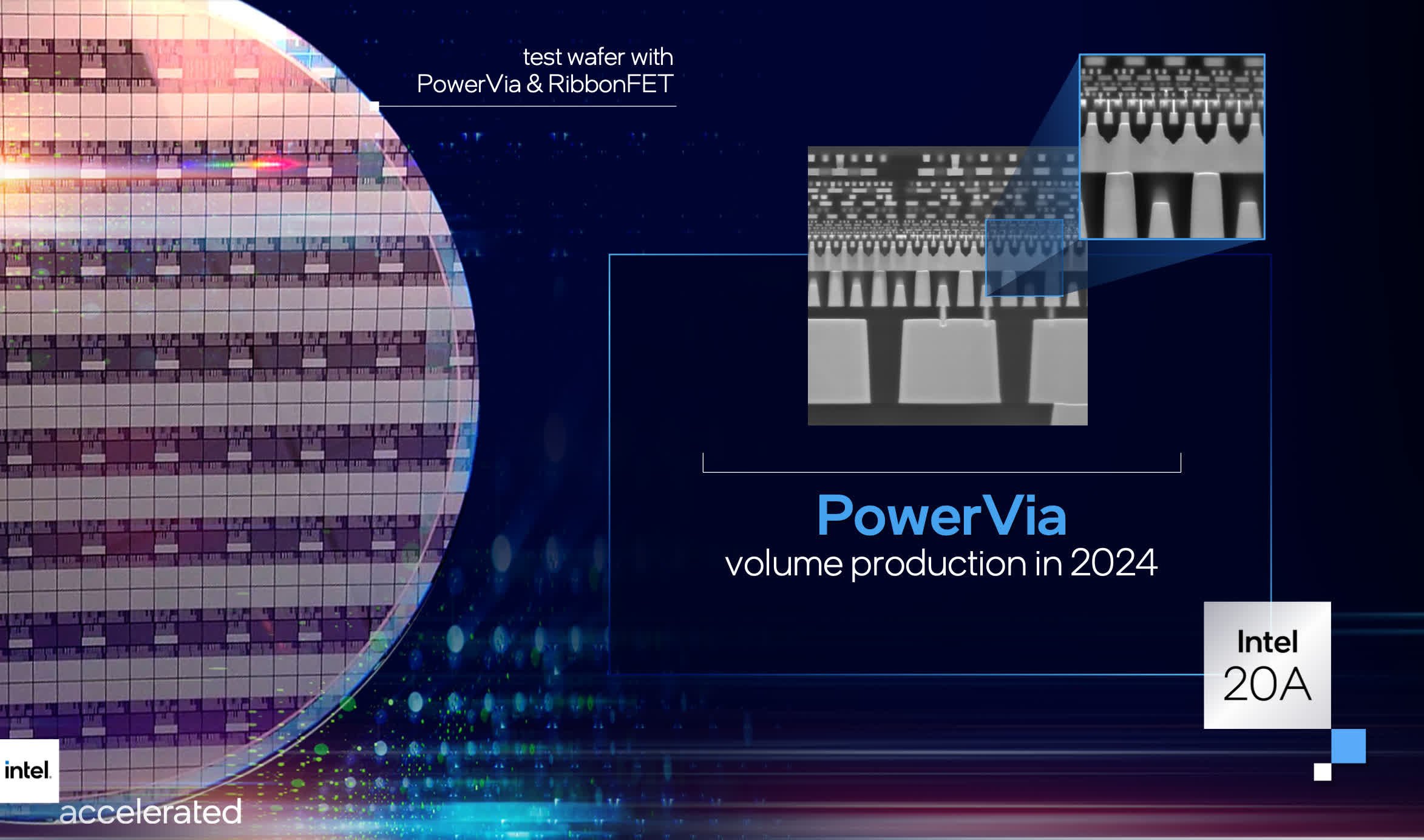

Each Intel 20A and Intel 18A are primarily based round one thing referred to as gate-all-around FET transistors (GAAFET), which is a common theme for all foundries growing course of nodes the place the transistor gate pitch is smaller than 3nm. Intel’s model of that is referred to as RibbonFET and represents a significant design change for the reason that introduction of FinFET in 2011.

One other benefit of Intel’s new tech is bottom energy supply (referred to as PowerVia). At the least in principle, this could enable for larger logic densities, larger enhance clock speeds, and decrease energy leakage — resulting in extra energy-efficient designs which might be anticipated to outperform these produced by corporations like Samsung Foundry or TSMC.

Additionally learn: How did TSMC get so good?

It is a large wager that would assist Intel’s Foundry Providers division safe giant chipmaking contracts within the coming years whereas making its merchandise extra aggressive with Arm-based and AMD designs. It is also a dangerous and expensive transition because it requires including a number of steps to the manufacturing course of and utilizing further supplies and gear when in comparison with earlier nodes.

Time, nonetheless, is just not on Intel’s aspect. The corporate made efforts to make sure it might be the primary to make use of bleeding-edge ASML Twinscan EXE scanners with 0.55 NA optics for the Intel 18A node, however this is able to have led to delays it could’t afford. Consequently, the corporate has chosen to depend on present EUV machines to deliver the method to market quicker.

Whether or not or not this technique will pan out as deliberate is anybody’s guess, however suffice it to say analysts aren’t practically as optimistic as Intel CEO Pat Gelsinger. The final sentiment is that the corporate is in a very bad place, and never simply due to lower consumer demand, the rise of homegrown silicon, or the fixed cost-cutting happening throughout the group. Intel’s Foundry Providers ambitions are a long-term dream that is not anticipated to materialize earlier than the tip of this decade.

Source link