Digital scams are extra frequent than ever, and language has performed an vital position in popularizing them.

In keeping with a current evaluation by Visa, fraudsters create messages that make the most of folks trusting “too-good-to-be-true texts and emails.”

Visa surveyed 6,000 adults from numerous international locations, together with Canada, Germany, and France.

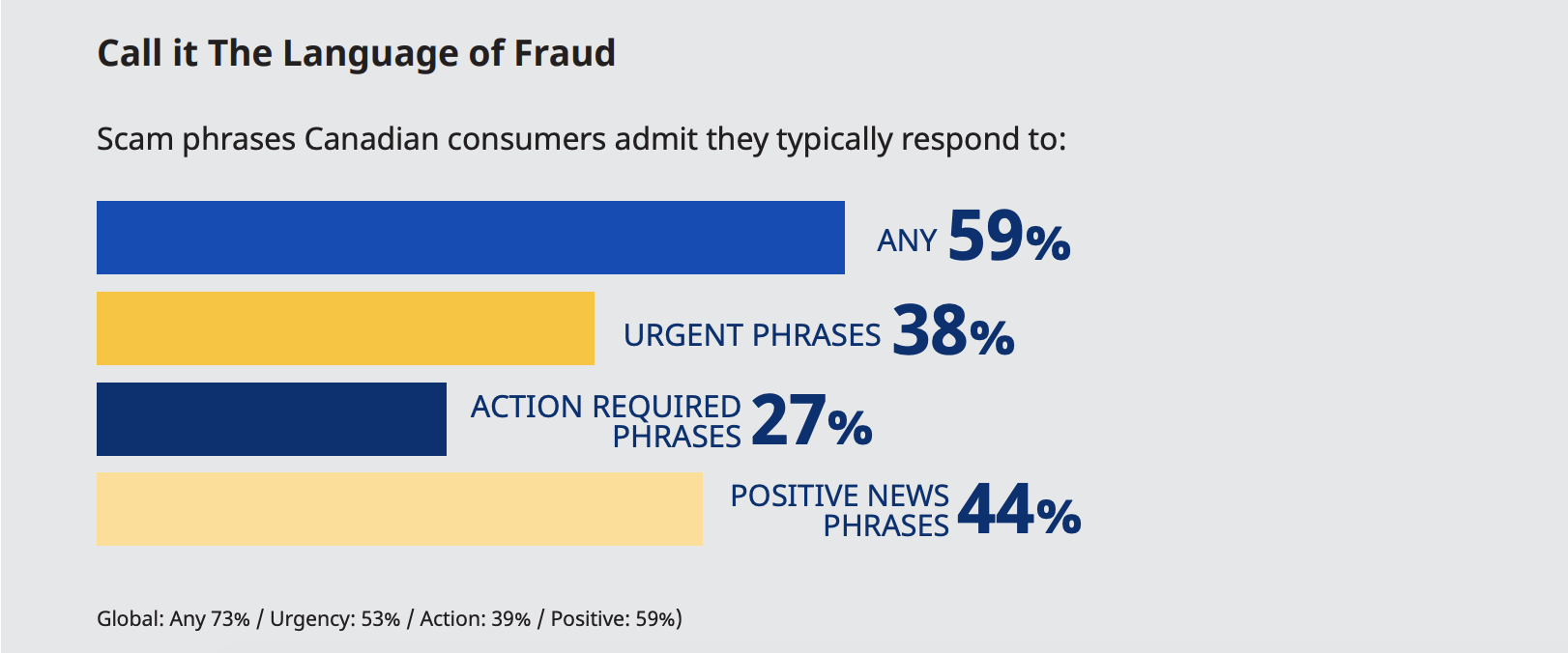

The evaluation discovered Canadians are extra assured than these surveyed globally about recognizing scams; 58 % of Canadians imagine they learn about fraudulent behaviours and might spot a rip-off, in comparison with 48 % globally. However that doesn’t imply they aren’t susceptible, and “The Language of Fraud,” as Visa calls it, performs a giant position.

The evaluation discovered 59 % of Canadians reply to frequent phrases scammers use. For instance, texts or emails containing “pressing,” “motion required,” or “constructive information” phrases usually obtain a response. An extra 35 % of surveyed Canadians mentioned they’ve fallen for a rip-off on a couple of event.

“A flip of phrase can flip a easy click on right into a breach of non-public data,” Visa mentioned.

Picture credit score: Visa

However digital scams aren’t the one factor folks should be cautious of.

Companies additionally want to pay attention to fraudulent exercise. In keeping with Moneris, a Canadian finance tech firm, fraud circumstances have elevated by almost 30 % since companies have resumed common exercise following pandemic restrictions. Figures are primarily based on fraud circumstances Moneris has investigated.

Almost half of those incidents come from the card-not-present class. These transactions relate to distant orders that don’t contain fee playing cards getting used by way of fee terminals.

Chargeback fraud is one other vital class. On this occasion, a fraudulent transaction leads the scammer to get their a reimbursement after they dispute a cost on their fee card.

There are numerous actions Canadians can take to maintain themselves and their companies secure. Visa recommends Canadians replace their password usually and keep away from clicking on hyperlinks in unsolicited messages. Moneris warns companies to guard their fee terminals and to evaluate their transactions for suspicious exercise usually.

Picture credit score: Shutterstock

Source link