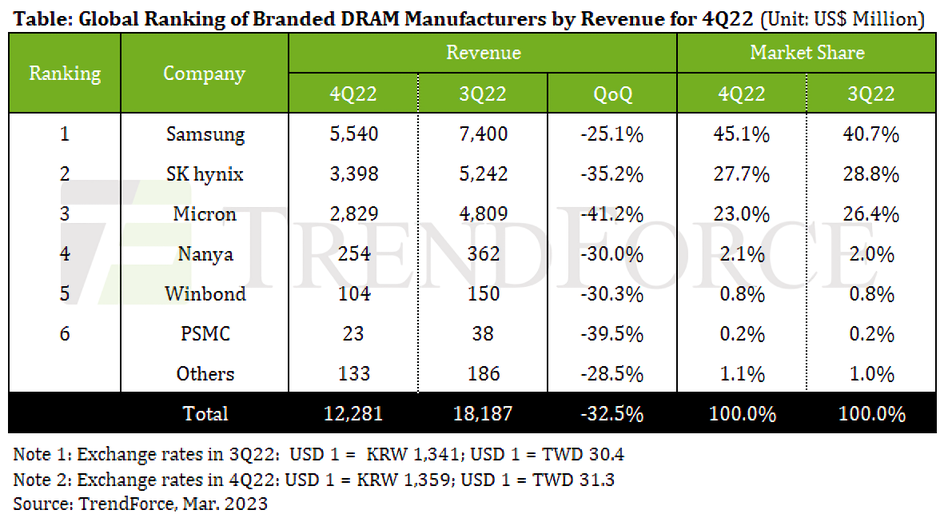

In context: The newest report from market intelligence supplier TrendForce additional illustrates the grim predicament the worldwide DRAM market discovered itself in on the finish of 2022. Based on the agency’s analysis, world DRAM income slid 32.5 % quarter over quarter to $12.3 billion in This fall. That’s down from $18.19 billion within the third quarter and practically rivals the file QoQ decline of 36 % from the ultimate quarter of 2008 through the world recession.

TrendForce stated the first reason for the income drop was a decline in common promoting value caused by a speedy accumulation of stock in Q3 2022 as a consequence of a freeze in demand. Scared of dropping market share, suppliers negotiated less-than-favorable contracts at decrease costs to get stock shifting.

The highest three DRAM producers – Samsung, SK Hynix and Micron – noticed quarter over quarter income dip by 25.1 %, 35.2 % and 41.2 %, respectively. In actual fact, all the high six DRAM makers skilled important QoQ income drops.

Samsung was probably the most aggressive when it got here to slicing costs and was thus capable of improve its market share from 40.7 % in Q3 to 45.1 % within the ultimate quarter of 2022. Each SK Hynix and Micron noticed their market shares lower barely in This fall from Q3, from 28.8 % to 27.7 % for SK Hynix and from 26.4 % to 23 % for Micron.

TrendForce notes that server DRAM noticed the sharpest value cuts in This fall, with contract costs of DDR4 and DDR5 merchandise sliding 23 % to twenty-eight % and 30 % to 35 %, respectively.

Micron executives throughout an analyst name on Thursday announced plans to speed up layoffs that would cut back its workforce by 15 % this yr. The corporate will even write down stock within the newest fiscal quarter and reduce chip manufacturing to take care of the weak market. Shares in Micron are down greater than three % on the information, presently buying and selling at $55.18.

Picture credit score: Liam Briese

Source link