Retail media could also be a brand new buzzword, however it’s an outdated idea. It’s media supplied by the retailers, with a brand new identify and digital makeover.

Assume again to that outdated cutout of Hulk Hogan standing on the fringe of your childhood grocery store aisle hawking chips. Retail media is like that however on the internet.

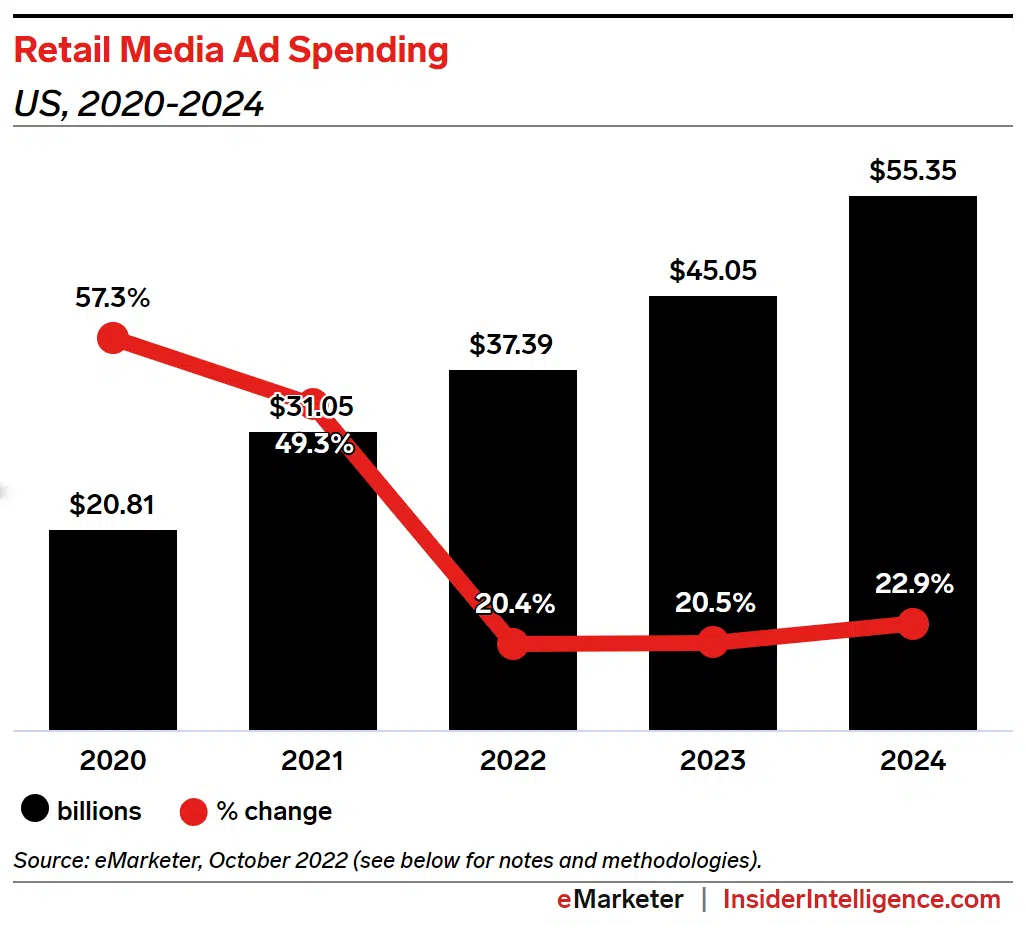

With retail media advert spending on tempo to develop over 20% in 2023 to upwards of $45 billion, it’s no shock that retailers of all sizes and styles are working for a chunk of the pie.

That pie is rising larger by the minute given the industries’ growing need for first-party data and corresponding retail-specific advert alternatives, that are continually evolving. Let’s not overlook, COVID occurred and fully upended customers’ method to retail.

Ecommerce demand has continued to develop, albeit at a slower tempo post-pandemic. However what’s additionally rising is customers’ want for a extra versatile and private buying expertise past digital.

Customers’ rising want for versatile achievement options

With Amazon being within the primary spot of high U.S. corporations by ecommerce share (~38%), suffice it to say they have digital down and cornered.

However Amazon lacks bodily retail places – which simply so occur to be important for the rising recognition of versatile achievement options, resembling purchase on-line, choose up in-store (BOPIS), click on and gather (C&C), curbside pickup, and extra.

What Amazon lacks, Walmart – its closest competitor within the digital house – has in droves. The retail big’s 4,700+ bodily retail places helped cement them as the most important U.S. retailer.

Bodily places apart, Walmart has a robust and rising digital providing. It’s ranked second within the U.S. for ecommerce share, closely pushed by its dominant digital grocery efficiency.

Curiously, grocery is a class not often seen in digital pre-2019 however is shortly increasing in reference to resolution developments and shopper wants.

This mix of dominant bodily attain with a rising digital powerhouse actually positions Walmart as a differentiated resolution with quickly increasing alternatives.

Get the day by day publication search entrepreneurs depend on.

Walmart’s present advert choices

Though Walmart is taking part in a little bit of catch-up on platform sophistication and advert alternatives in comparison with {industry} friends like Amazon and Google, they’re doing it at an unimaginable tempo.

Earlier than 2021, almost all promoting efforts have been managed by Walmart, besides for his or her stand-alone self-serve search advert unit, sponsored merchandise.

Leap a few brief years forward they usually have expanded their search and show efforts aggressively, leading to three new self-serve service strains with:

- Sponsored manufacturers.

- Show self-serve (DSS).

- Walmart DSP.

Walmart nonetheless affords a managed service for first-party sellers with spend commitments and deep pocketbooks, however it’s clear to see their precedence in opening superior advert alternatives to a wider vendor base.

To not point out the numerous recent partnership announcements to facilitate enlargement into social, dwell stream, CTV and different partaking advert alternatives.

Earlier than we get forward of ourselves and bounce to what’s subsequent, let us take a look at Walmart’s present advert alternatives that sellers of all sizes can leverage to drive model efficiency and relevancy on and off the platform.

Walmart’s core search providing, sponsored merchandise allow you to leverage search phrases and product information to serve advertisements towards customers’ search intent.

This advert unit typically captures customers throughout the intent part of the client journey, on condition that the advertisements are served alongside natural placements throughout the search engine outcomes web page (SERP).

They generally have digital-focused, return-based objectives since this advert unit is closest to the purpose of buy.

- Availability: First get together and third get together

- Funnel place: Intent

Sponsored manufacturers

Sponsored model advertisements are top-of-page search banner advertisements served towards customers’ search intent.

They’re nice for:

- Shifting barely up the funnel into brand-building techniques.

- Leveraging aggressive techniques and class share enhancements given the key phrase focusing on construction and top-of-page placement.

These PPC advert items comprise a model emblem, which can result in a shelf (sub-category) or search web page, and as much as three merchandise, which can redirect to a product web page.

- Availability: First get together and third get together

- Funnel place: Consideration, intent

Self-serve show

Walmart DSS (Onsite)

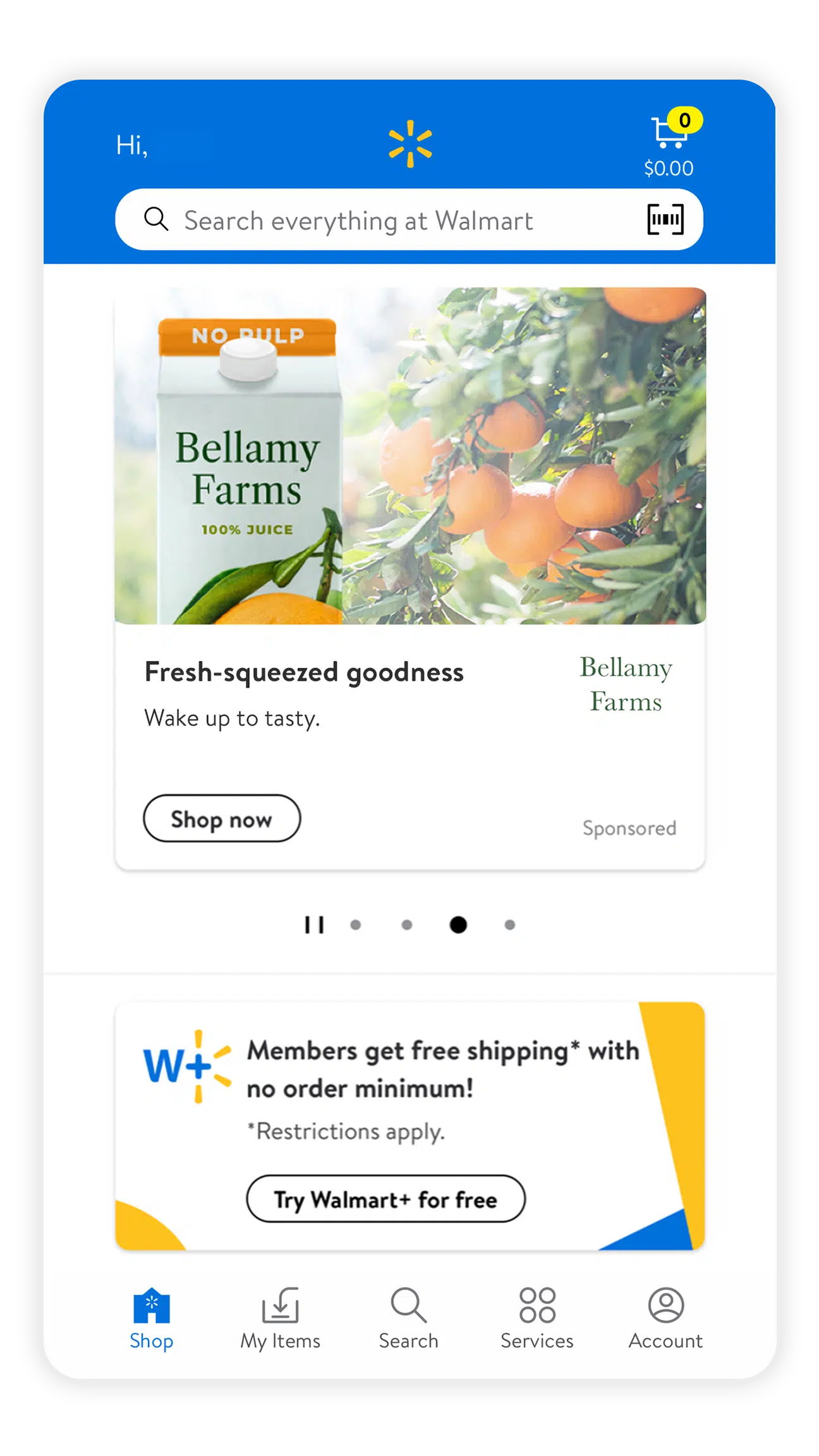

Walmart show self-serve (DSS) is a nimble, self-serve platform that provides advertisers management over their onsite Walmart show promoting efforts.

Inside DSS, advertisers can leverage Walmart audiences to serve show belongings to customers throughout Walmart.com through quite a few focusing on techniques.

This platform comes with an automatic inventive builder and environment friendly marketing campaign setup for agility at scale.

Moreover, the DSS platform consists of digital and in-store efficiency reporting to higher perceive complete influence.

- Availability: First get together

- Funnel place: Consciousness, consideration

Walmart DSP (Offsite)

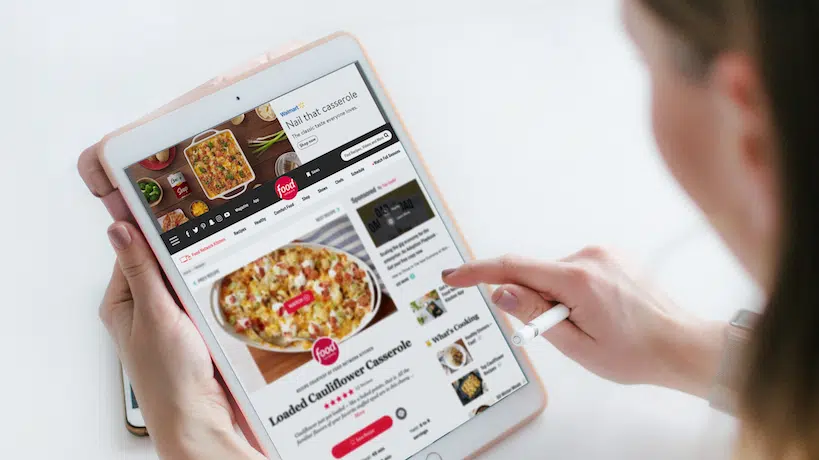

Walmart DSP is a demand-side platform that marries the ability of The Commerce Desk’s industry-leading know-how with Walmart’s expansive omnichannel first-party information.

This results in a differentiated provide that enables advertisers to leverage Walmart audiences to serve advertisements throughout The Commerce Desk’s stock throughout the open net.

With the additional benefit of Walmart’s closed-loop reporting, sellers could have a transparent view of the influence that their omnichannel advert efforts are having all through all factors of the client journey, each on and offline.

- Availability: First get together

- Funnel place: Consciousness, consideration

What’s in retailer for Walmart advertisers and easy methods to get forward

As you’ll be able to see from the above developments, Walmart understands advertisers’ want for accessing and performing on first-party information at scale.

Current social, dwell stream and video partnerships level to the retailer’s bid to serve customers in search of extra interactive and private buying experiences.

Finally, Walmart is laying the groundwork for advertisers to leverage their information inside these new and interesting advert codecs.

Provided that the final replace we acquired on this space was in mid-September of final yr, I’d anticipate additional developments within the coming months.

Do not get me incorrect – advert enlargement is nice however it’s solely half the battle. Understanding the influence of these advertisements is simply as necessary, if no more, each on-line and in-store.

Walmart has an uphill battle on this division given their excessive in-store and money transaction charges. They’re taking steps to shut that hole, which incorporates the enlargement of Walmart+.

Walmart+ has seen constant progress and now accounts for as much as 25% of complete ecommerce gross sales, in keeping with a latest examine by Shopper Intelligence Analysis Companions (CIRP).

As well as, Walmart can also be working to shut the loop by way of packages like cashback rewards, in partnerships with resolution suppliers like Ibotta. This can be a main precedence for manufacturers throughout the board so I’d anticipate this to be a spotlight throughout the coming yr.

In the event you take something from this piece bear in mind this…

Walmart has the bodily infrastructure to satisfy customers’ evolving buying wants and the pocketbook and roadmap to claw away at digital market share.

Their information is rising and so are the methods during which they’re permitting advertisers to leverage it. Certain, they nonetheless have resolution gaps, however they don’t seem to be scared to attempt issues and are aggressively working to shut them.

For sure, I anticipate 2023 to be a yr of evolution. Buckle in as a result of the retail media race is on, and Walmart has a pole place.

Opinions expressed on this article are these of the visitor writer and never essentially Search Engine Land. Workers authors are listed here.

Source link