Shares in NetScout Systems Inc. soared in common buying and selling after the cybersecurity firm delivered a robust earnings beat in its fiscal third quarter.

For the quarter that ended Dec. 31, NetScout reported non-generally accepted accounting rules earnings of $73 million or $1 per share, up from $66.5 million or 89 cents per share in the identical quarter of the earlier 12 months. Income got here in at $269.5 million, up from $262.2 million. Analysts had been expecting earnings per share of 68 cents on income of $240.59 million.

Product income within the quarter got here in at $149.5 million, up from $144.3 million within the third quarter of fiscal 2022. Service income got here in at $120.1 million, up from $117.8 million the earlier 12 months.

Web revenue from operations was $63.8 million within the quarter, whereas as of Dec. 31, NetScout at $416.2 million in money, money equivalents and marketable securities. Notably, the determine was down from $703.2 million as of March 31 because of an accelerated share repurchase program and the reimbursement of an excellent debt stability in a revolving credit score facility.

Highlights within the quarter embody NetScout asserting the interoperability of its Omnis Cyber Intelligence with Amazon Safety Lake, powered by Amazon Internet Companies Inc., to ship clients superior community detection and response insights. NetScout additionally introduced the launch of the DPI Consortium, a non-profit group established to enhance patent high quality and deter frivolous patent claims.

“We superior our strategic aims and delivered strong monetary ends in the third quarter,” NetScout’s President and Chief Government Officer Anil Singhal, mentioned in a statement. “Sturdy service assurance efficiency, supported by the acceleration of service supplier orders beforehand forecast to happen in our fourth quarter, drove increased quarterly gross sales, margins and profitability 12 months over 12 months.”

For its outlook, NetScout predicted robust development going ahead, with non-GAAP EPS anticipated to be between $2.06 and $2.10 for its full fiscal 12 months 2023 on income of between $905 million to $915 million. Analysts had been predicting EPS of $2 on income of $909 million.

Traders liked the numbers, with NetScout shares closing common buying and selling up 13.93% to $36.06 on a day the Nasdaq Composite was up a much more average 1.76%.

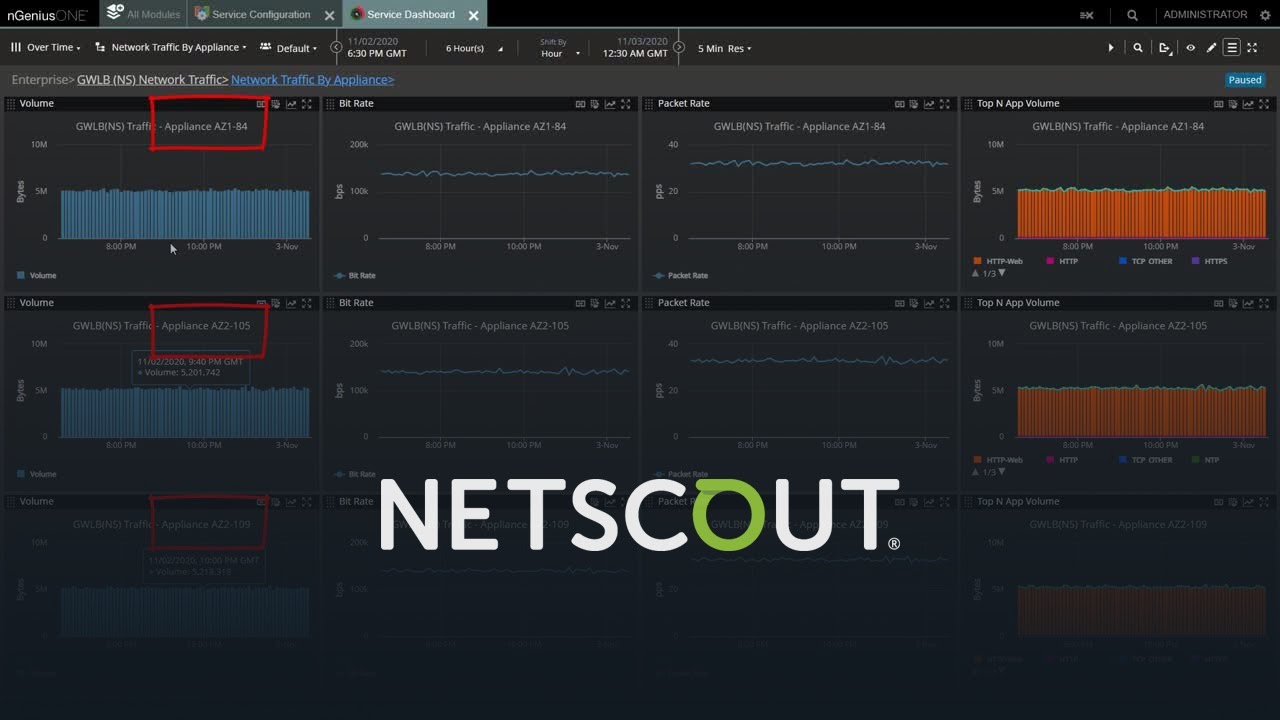

Picture: NetScout/YouTube

Present your help for our mission by becoming a member of our Dice Membership and Dice Occasion Group of specialists. Be part of the group that features Amazon Internet Companies and Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger and lots of extra luminaries and specialists.

Source link