Elliott Administration Corp., the activist investor agency, has reportedly made a multibillion-dollar funding in Salesforce Inc.

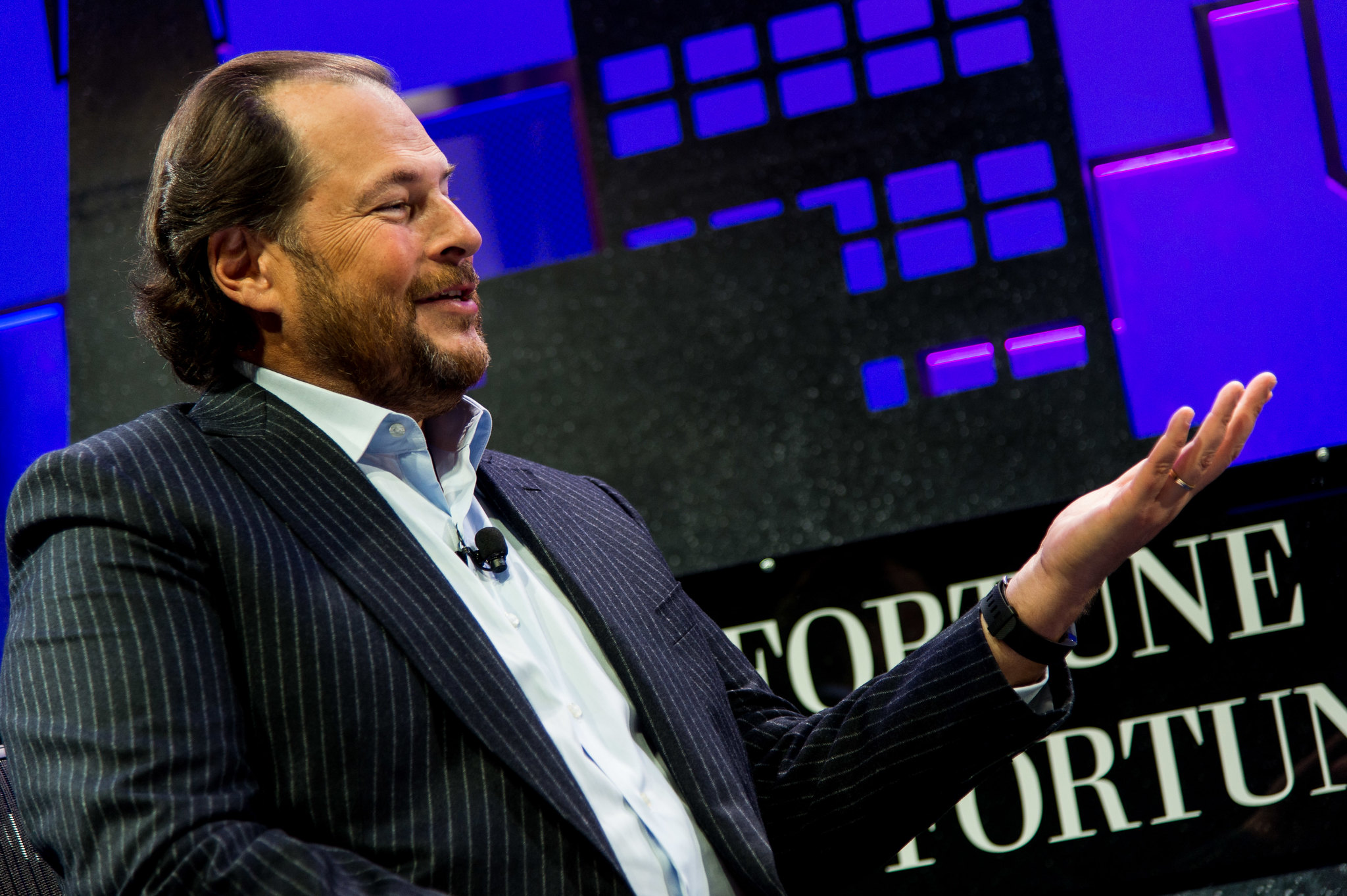

It’s a transfer that can possible pile the stress on Salesforce Chairman and co-Chief Government Marc Benioff (pictured) as he struggles to restart the corporate’s slowing progress.

The information was first reported right now by the Wall Street Journal, which mentioned particulars of Elliott’s plans for Salesforce couldn’t be discovered at the moment. Nevertheless, Elliott’s normal ways are to push for board illustration after which stress firms into making operational modifications, with an goal to spice up total profitability.

Issues may definitely be going a lot better for Salesforce at current. Earlier this month, the corporate introduced plans to lay off 10% of its staff, whereas lowering workplace area in some markets.

Asserting the layoffs, Benioff cited the financial slowdown that has resulted in lots of its prospects lowering spending on software program. As well as, he admitted that the corporate had employed too many new employees as its income surged through the COVID-19 pandemic.

Salesforce had nearly 80,000 international workers on its books on the finish of October 2022, up from simply over 49,000 in January 2020, firm filings present.

These additional workers have gotten a legal responsibility as Salesforce’s income progress slows. In its fiscal 2022 third quarter outcomes, the corporate reported income of $7.84 billion, up 14% from a 12 months earlier. Although that won’t appear too unhealthy, it nonetheless represents a major slowdown from the 27% income progress Salesforce recorded in the identical interval a 12 months earlier.

The slowing progress meant that Salesforce’s inventory has taken a beating, down by about 50% from the place it was in late 2021.

Salesforce has endured additional upheaval inside its highest government ranks. Final 12 months, it was introduced that Benioff’s co-CEO Bret Taylor will depart the company on the finish of January, leaving Benioff the only real CEO as soon as extra. Taylor had shared management of the corporate with Benioff for a few 12 months. Nevertheless, sources informed the Journal that Benioff had become frustrated that Taylor was spending an excessive amount of time in his position as Twitter Inc.’s chairman, and never sufficient with Salesforce’s product and engineering groups.

Simply days after Taylor’s upcoming departure was introduced, Stewart Butterfield, the co-founder and CEO of Slack Applied sciences Inc., who joined Salesforce when it acquired his messaging firm for $27 billion final 12 months, additionally announced his determination to go away.

Elliott’s subsequent steps with Salesforce stay to be seen, however the activist investor sometimes pushes for government modifications and gross sales of varied property, and even the corporate itself. Beforehand, Elliott has focused the likes of Twitter Inc., PayPal Holdings Inc., AT&T Inc. Final 12 months, it pressured Pinterest Inc. so as to add senior Elliott portfolio supervisor Marc Steinberg to its board.

Elliott’s most well-known marketing campaign concerned the previous storage large EMC Corp. On account of Elliott’s stress, EMC finally agreed to promote itself to Dell Applied sciences Inc. for $67 billion back in 2017 — at the moment, one of many greatest acquisitions in tech historical past.

Salesforce has already needed to take care of one activist investor. In October, the hedge fund Starboard Worth LP revealed it had additionally taken a stake in Salesforce, although it has thus far kept away from calling for modifications.

Analyst Holger Mueller of Constellation Analysis Inc. mentioned Elliott and Starboard each clearly imagine that Salesforce is undervalued and under-performing in contrast with a few of its friends, and that it might do a lot better with the fitting administration and a change in its method. “Activist traders generally is a blessing, relying on how they get together with the goal firm’s senior management,” the analyst mentioned. “A very good instance is Pershing Sq. at ADP, which remodeled that firm right into a a lot stronger funding. Nevertheless, they will additionally create large issues for firm executives in the event that they disagree with their ideas. So it is going to all rely on if Benioff sees eye-to-eye with Elliott and Starboard or not.”

Elliott indicated that it hopes to cement working relationship with Benioff. “We sit up for working constructively with Salesforce to understand the worth befitting an organization of its stature,” Elliott Managing Companion Jesse Cohn, who has beforehand sat on the boards of administrators of know-how companies like Twitter, Citrix Programs Inc. and eBay Inc., informed the Journal.

Photograph: FORTUNE Global Forum/Flickr

Present your help for our mission by becoming a member of our Dice Membership and Dice Occasion Group of specialists. Be part of the neighborhood that features Amazon Internet Providers and Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger and lots of extra luminaries and specialists.

Source link