Elliott Administration Corp., the activist investor agency, has reportedly made a multibillion-dollar funding in Salesforce Inc.

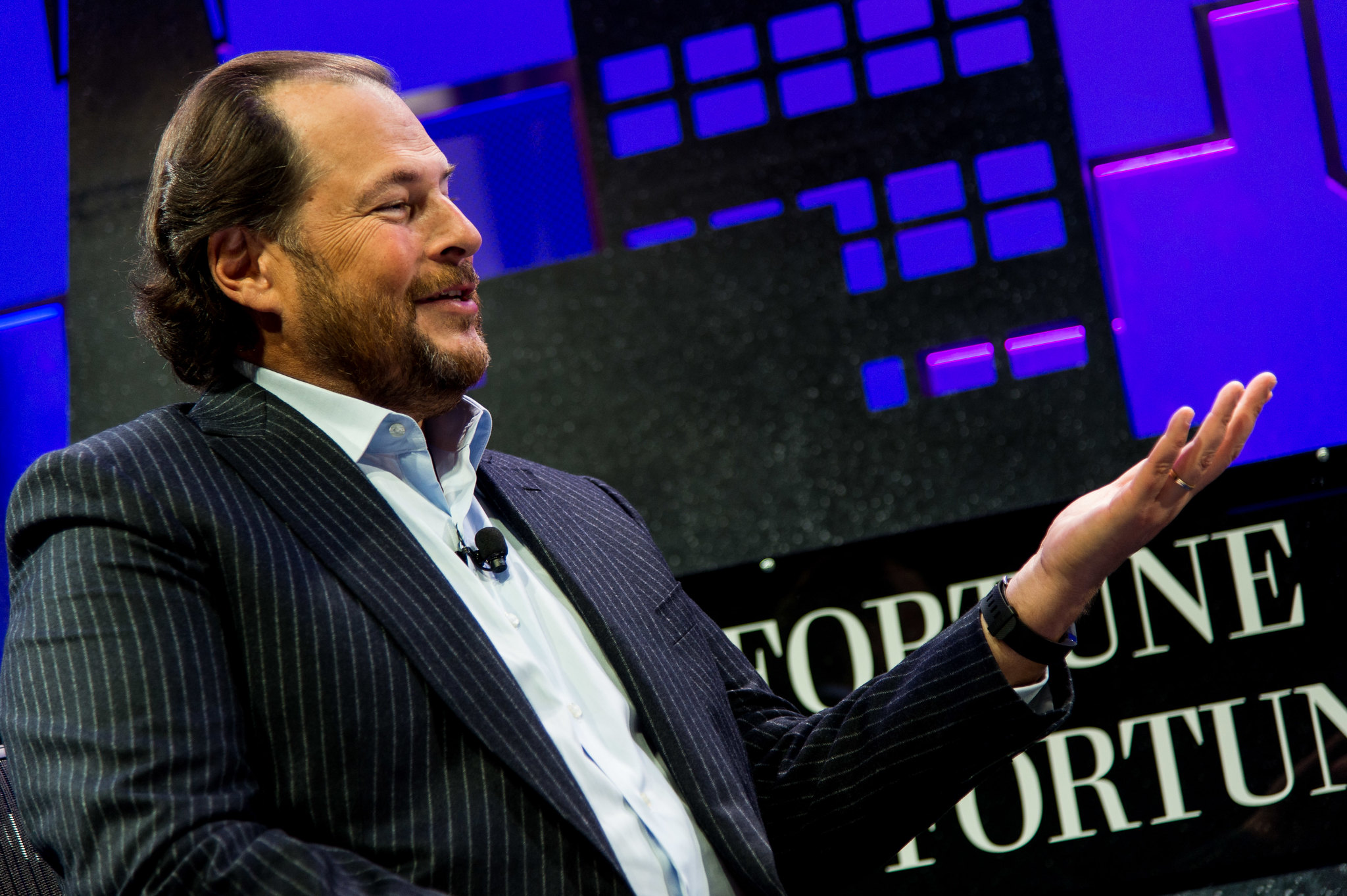

It’s a transfer that may doubtless pile the stress on Salesforce Chairman and co-Chief Government Marc Benioff (pictured) as he struggles to restart the corporate’s slowing progress.

The information was first reported at this time by the Wall Street Journal, which stated particulars of Elliott’s plans for Salesforce couldn’t be discovered presently. Nonetheless, Elliott’s commonplace ways are to push for board illustration after which stress corporations into making operational adjustments, with an goal to spice up total profitability.

Issues might definitely be going a lot better for Salesforce at current. Earlier this month, the corporate introduced plans to lay off 10% of its staff, whereas decreasing workplace area in some markets.

Asserting the layoffs, Benioff cited the financial slowdown that has resulted in lots of its clients decreasing spending on software program. As well as, he admitted that the corporate had employed too many new employees as its income surged in the course of the COVID-19 pandemic.

Salesforce had nearly 80,000 international staff on its books on the finish of October 2022, up from simply over 49,000 in January 2020, firm filings present.

These additional staff have gotten a legal responsibility as Salesforce’s income progress slows. In its fiscal 2022 third quarter outcomes, the corporate reported income of $7.84 billion, up 14% from a yr earlier. Although that won’t appear too dangerous, it nonetheless represents a big slowdown from the 27% income progress Salesforce recorded in the identical interval a yr earlier.

The slowing progress meant that Salesforce’s inventory has taken a beating, down by about 50% from the place it was in late 2021.

Salesforce has endured additional upheaval inside its highest govt ranks. Final yr, it was introduced that Benioff’s co-CEO Bret Taylor will depart the company on the finish of January, leaving Benioff the only real CEO as soon as extra. Taylor had shared management of the corporate with Benioff for a couple of yr. Nonetheless, sources advised the Journal that Benioff had become frustrated that Taylor was spending an excessive amount of time in his position as Twitter Inc.’s chairman, and never sufficient with Salesforce’s product and engineering groups.

Simply days after Taylor’s upcoming departure was introduced, Stewart Butterfield, the co-founder and CEO of Slack Applied sciences Inc., who joined Salesforce when it acquired his messaging firm for $27 billion final yr, additionally announced his resolution to depart.

Elliott’s subsequent steps with Salesforce stay to be seen, however the activist investor usually pushes for govt adjustments and gross sales of varied belongings, and even the corporate itself. Beforehand, Elliott has focused the likes of Twitter Inc., PayPal Holdings Inc., AT&T Inc. Final yr, it compelled Pinterest Inc. so as to add senior Elliott portfolio supervisor Marc Steinberg to its board.

Elliott’s most well-known marketing campaign concerned the previous storage big EMC Corp. On account of Elliott’s stress, EMC finally agreed to promote itself to Dell Applied sciences Inc. for $67 billion back in 2017 — at the moment, one of many largest acquisitions in tech historical past.

Salesforce has already needed to take care of one activist investor. In October, the hedge fund Starboard Worth LP revealed it had additionally taken a stake in Salesforce, although it has to date shunned calling for adjustments.

“We stay up for working constructively with Salesforce to understand the worth befitting an organization of its stature,” Elliott Managing Accomplice Jesse Cohn, who has beforehand sat on the boards of administrators of know-how companies like Twitter, Citrix Techniques Inc. and eBay Inc., advised the Journal.

Photograph: FORTUNE Global Forum/Flickr

Present your assist for our mission by becoming a member of our Dice Membership and Dice Occasion Neighborhood of specialists. Be part of the group that features Amazon Internet Providers and Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger and plenty of extra luminaries and specialists.

Source link