The days between Christmas and New Year’s Eve are known for sleeping, eating and losing track of time.

It’s also a particularly effective period to buy digital advertising, given that ad prices are low and people are scrolling on their phones.

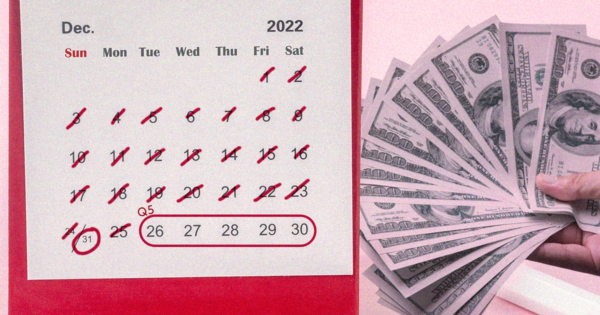

Q5, the adspeak for this period, is elastic, with some marketers saying it stretches all the way from mid-December when companies can no longer guarantee packages will ship by Christmas, to mid-January. All agree the term refers to the liminal space between Christmas and the new year. It’s also associated with advertising on Meta, and the company posts educational material for marketers to encourage them to take advantage.

What separates Q5 from the rest of the calendar is that it falls at the end of the busy holiday shopping season, where many brands direct the bulk of their advertising budgets. With holiday marketers out of digital auctions, theoretically, ad prices are cheaper while many people are still shopping, thanks to increases in time spent online.

In the last week of 2022, ads on Meta were 12% cheaper than the week prior, according to data from the clients of performance marketing agency Tinuiti. Year-over-year growth in sales attributed to the ad unit Sponsored Products was larger during Q5 than the rest of December, per Tinuiti data.

But this year, Q5 was a particularly effective time to advertise. Costs per thousand impressions (CPMs) on Meta during Q5 declined 28% year-over-year, an average of the data provided to Adweek from three digital agencies, one CMO and Varos, an analytics firm that tracks the spend of direct-to-consumer and software-as-a-service brands (albeit each measured across slightly different time periods).

Several sources said advertising on Meta delivered better performance than last year, as the company improves its tech, which has been upended by Apple’s privacy changes in spring 2021.

“It’s always worked, but this year was arguably one of the best Q5s I’ve experienced in my 12 years running Facebook ads,” said David Herrmann, CEO of paid social DTC-focused agency Herrmann Digital.

Marketers diversifying spend

The year-over-year decrease in ad prices during Q5 on Meta reflects a more general pattern during the back half of 2022, as CPMs leveled off from stratospheric highs in 2021, said Andy Taylor, vp of research at Tinuti. Across the agency’s clients, CPMs on Meta were down 28% between Q5 2022 and Q5 2021, comparable to the 29% year-over-year decline around Black Friday week this year.

The longer view shows the cost of ads on Meta has increased, with CPMs during Q4 2022 still up by low double-digits compared to the same time period in 2020, Tinuiti found.

A lot of that magic [is happening] on TikTok.

Michael Lisovetsky, co-founder of digital agency Juice

But some marketers attributed the decline in prices in part to the fact that fewer advertisers are participating in Meta’s auctions, with more and more diversifying their spend to other platforms, especially as Meta becomes more mature and the competition for eyeballs grows, said Michael Lisovetsky, co-founder of digital agency Juice.

“The saturation leads to more expensive outcomes and more expensive outcomes make it less useful to the businesses it’s serving,” he said. “People just pull back.”

Meta’s response to Apple’s privacy changes can also decrease prices, said Natasha Blumenkron, senior director of paid social at Tinuiti.

More granular targeting is more expensive, and as the changes have made buying small audiences less effective, more advertisers are buying broadly for less, Blumenkron said. Also, with Meta encouraging brands to upload more of their own first-party data, it can be easier for marketers to match with the right customers without wasting money on the wrong ones, she added.

A rebound in performance

Three agency sources said Meta was not only cheaper this Q5, but more effective, with two noting impressive click-through rates.

Sources attributed this increase in performance in part to Advantage+, a tool Meta rolled out late last year that tasks its machine learning with finding the right customers instead of advertisers building custom audiences.

Marketers got so spoiled with how good and cheap Facebook was.

Cody Plofker, CMO of beauty brand Jones Road Beauty

Lisovetsky, however, said Meta’s performance during Q5 was uneven and that the platform is still a long way from its golden age, around 2014.

“If you shot at a dartboard you would do well,” he said. “There was generous targeting and cheap CPMs and less competition. It was the perfect set of ingredients to lead to great outcomes. A lot of that magic [is happening] on TikTok.”

It’s too early to know if Meta is on a hot streak, but marketers should take advantage of any window of opportunity, said Cody Plofker, CMO of beauty brand Jones Road Beauty, who oversees the company’s media buying.

“Marketers got so spoiled with how good and cheap Facebook was,” Plofker said. “We are getting that moment right now, [but] it probably won’t last.”

Meta did not respond to comments before press time.

Source link