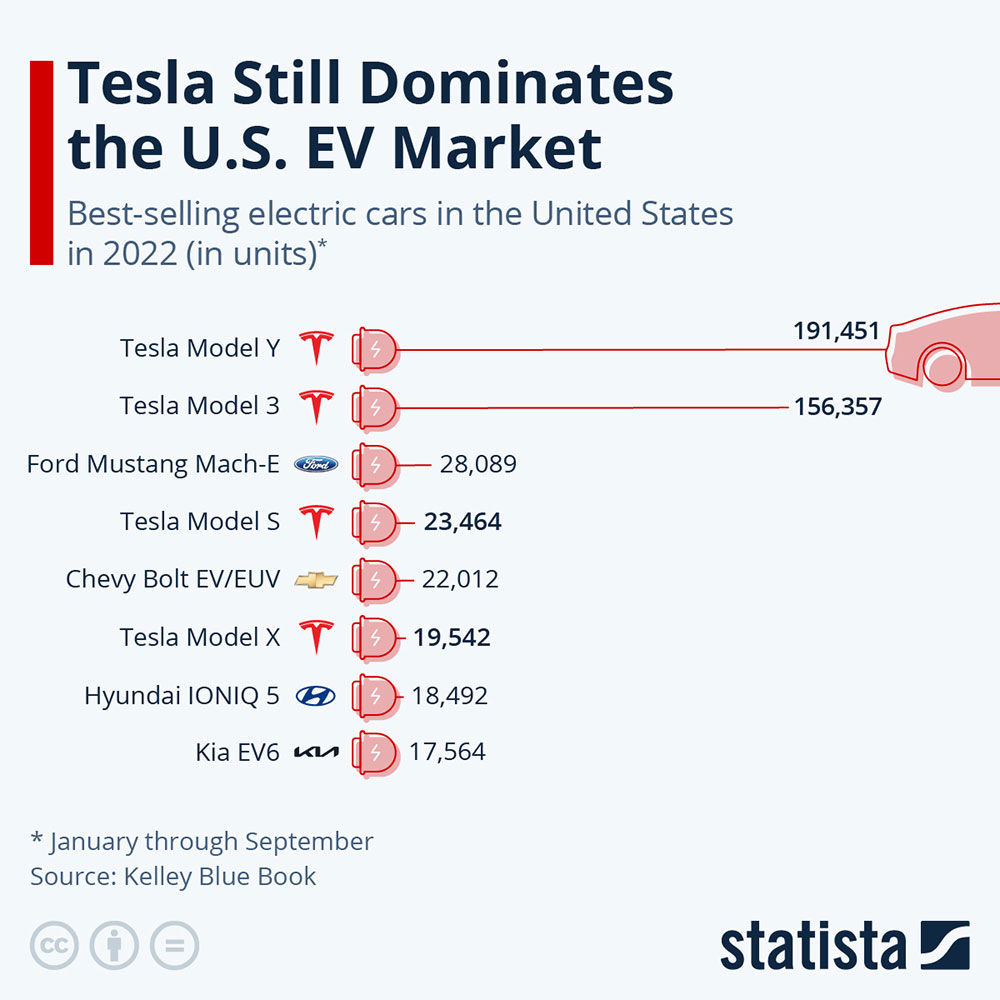

While founder and CEO Elon Musk’s unpredictable management of Twitter has forced Tesla stock into a precipitous decline, the car maker’s models continued to remain popular for most of 2022, according to Cox Automotive’s Kelley Blue Book.

For the first nine months of 2022, it reported four of the top six best-selling electric cars were Teslas. At the top of the ranking were the Tesla Model Y, with 191,451 units sold, and the Model 3, with 156,357 units. Finishing a distant third was the Ford Mustang Mach-E, with 28,089 units.

“With all the negative headlines surrounding Tesla and its increasingly controversial CEO Elon Musk in recent weeks, it’s easy to forget that the company’s cars are still very popular,” Data Journalist Felix Richter wrote Tuesday on Statista.

“While it’s too early to say whether Musk’s Twitter takeover and the turbulences that came with it will have a significant negative impact on demand for Tesla’s cars,” he continued, “its current position as the maker of the most popular electric cars in the United States and in many parts of the world is clear.”

Power of First Mover

In the EV space, Tesla has been wildly popular, and it remains so, observed Brent Gruber, executive director for Global Automotive at J.D. Power, a consumer research, data, and analytics firm based in Troy, Mich.

Citing December survey data from JDP, Gruber noted that among shoppers looking to buy a vehicle in the next 12 months, four out of 10 who are “very” or “somewhat” likely to purchase an EV were considering the Tesla brand. “This is second only to Chevrolet,” Gruber told TechNewsWorld.

“However,” he continued, “the percentage of those likely EV shoppers who are considering Tesla has declined by five-percentage-points from November.”

Tesla is still benefiting from being a first mover in the EV market, contended Chris Jones, chief analyst with Canalys, a global market research company.

“There was very little competition, and there still isn’t very much competition,” Jones told TechNewsWorld.

“Tesla also had status appeal that at the time the Nissan Leaf, Chevy Volt, the BMW i3 just didn’t have,” he added.

Another attractive feature for early customers, he continued, was over-the-air updates of the Tesla’s software. “Only now can some of its competitors do that,” he said. “So Tesla was a decade ahead in software updates and ability to improve the vehicle as it got older.”

Charging Advantage

Being a “pure play” electric car company operating at scale is another advantage Tesla has in the market — in addition to being the only EV maker with a charging network, added Rob Enderle, president and principal analyst at the Enderle Group, an advisory services firm in Bend, Ore.

“The other car companies are ramping up their electric vehicles but have experienced supply problems as they ramped to volumes thanks to the pandemic, war, and other supply issues,” Enderle told TechNewsWorld.

Chart Credit: Statista

Tesla’s charging network is an important element of its offering, maintained Mike Ramsey, vice president and analyst for automotive and smart mobility at Gartner. “Their charging network is a basic differentiator between them and other brands selling electric vehicles,” he told TechNewsWorld.

Gruber noted that vehicle charging is one of Tesla’s notable advantages over its competitors. In JDP’s 2022 charging studies, Tesla received awards for highest satisfaction with Level 2 permanently mounted home chargers, public Level 2 charging, and DC fast charging.

In the public charging study, Gruber observed that the wide availability of the Tesla charging network, ease of use — particularly with the payment/account process — and network reliability helped the network perform well.

He added that one of the standout metrics for Tesla in the home charging study was also ease of use.

Bumpy Road Ahead

While 2022 appears to have been a good year for Tesla sales, storm clouds may be on the horizon. “Musk’s Twitter escapades, coupled with his move to the political right, have alienated the typical left-leaning Tesla buyer, hurting sales and forcing discounting and other practices to move vehicles,” Enderle maintained.

“Our local Tesla dealer appears to be up to its neck in overstock due to slowing sales, suggesting Tesla’s numbers may be transitioning down or overstated,” he said.

“Since Tesla sells through their stores, there is no third-party validation of their sales numbers, and they have likely been overstating for some time to prop up rapidly declining valuations,” he explained.

“As FTX showcased,” he continued, “oversight on corporations is almost non-existent, bringing to question much of what is reported by every public company, particularly those under high stress like Tesla and Twitter.”

Competition is also heating up. “Shoppers have an increasing selection of EVs to choose from,” Gruber said.

“The number of products coming from OEMs is rising at a rapid rate,” he continued. “Those products now fill voids in popular segments and from brands with high loyalty rates, such as the Ford F-150 Lightning and Toyota bZ4X.”

“Competition is increasing, and we’re seeing that in our data,” he added.

Musk Cycles

Ramsey agreed that competition will be a future challenge for Tesla. “They’ve shown the way for startups like Rivian and Lucid,” he said. “Those guys are going to get stronger and stronger.”

“Meanwhile, traditional car companies are adding more and more electric vehicles to their lineups that are going to be much more affordable than what Tesla has,” he observed.

“New competitors like Lucid and Rivian are causing Tesla pain,” added Enderle. Anecdotally, he noted that two of his neighbors have Rivians now, and one that owns a Tesla is considering a Rivian.

“In addition,” he continued, “better electric vehicle solutions from various car makers will put more pressure on the company, but the firm’s biggest problem is Musk, and fixing him has proven problematic.”

“He has forced Tesla to provide incentives to sell cars, resulting in a catastrophic decline in Tesla’s valuation and Musk’s net worth,” he contended. “It has also increased the number of potential Tesla buyers considering alternatives.”

Ramsey pointed out, however, that Tesla’s CEO has been a mix for the company for a long time. “Since the dawn of the company, Elon Musk has been vital to Tesla’s success and has been a source of some of its problems,” he said. “He has gone through periods where he has been more of a detriment than a benefit, but it goes in cycles.”

Source link