A decade of big data investments, combined with cloud scalability, the rise of more cost effective processing and the introduction of advanced tooling, has catapulted machine intelligence to the forefront of technology investments. No matter what job you have, your operation will be AI powered within five years and machines may be doing your job in the future.

Artificial intelligence is being infused into applications, infrastructure, equipment and virtually every aspect of our lives. AI is proving to be extremely helpful at controlling vehicles, speeding medical diagnoses, processing language, advancing science and generally raising the stakes on what it means to apply technology for business advantage.

But business value realization has been a challenge for most organizations because of a lack of skills, complexity of programming models, immature technology integration, sizable up front investments, ethical concerns and lack of business alignment. Mastering AI technology and a focus on features will not be a requirement for success in our view.

Rather, figuring out how and where to apply AI to your business will be the crucial gate. That means understanding the business case, picking the right technology partner, experimenting in bite-sized chunks and quickly identifying winners on which to double down from an investment standpoint.

In this Breaking Analysis, we update you on the state of AI with a focus on interpreting the latest Enterprise Technology Research survey data around machine learning, AI and data. We’ll explore what it means for the competitive environment and what to look for in the future. To do so, we invited into our studios Andy Thurai, vice president and principal analyst at Constellation Research Inc. Andy covers AI deeply, and he knows the players and the pitfalls of AI investment.

AI assumptions

According to McKinsey, AI adoption has more than doubled since 2017, but only 10% of organizations report seeing significant return on equity (BCG and MIT).

Part of the challenge of AI is it requires data, good data and data proficiency, which is nontrivial. Firms that can master both data and AI will have a competitive advantage this decade.

The hyperscalers such as Amazon Web Services, Microsoft Corp. and Google LLC, as we’ll show you with the ETR data, dominate AI/ML mindshare, market share and share of wallet, and will likely continue to gain traction.

Having said that, there’s plenty of room for specialists, but they need to partner with cloud vendors for go to market productivity.

Finally, organizations will increasingly have to put data and AI at the center of their enterprises, and to do that, most will have to rely on vendor research and development to leverage AI/ML. In other words, they’ll buy it and apply it, rather than build it.

Here’s how Andy sees it:

First of all, the stat about only 10% of customers realizing a return on investment: That’s so true because most companies are still in the innovation cycle. So they’re trying to innovate and see what they can do to apply AI. Many times a model will be created to experiment and there will be a big focus on the technology, but often there’s not a good business case to solve. So they experiment, they realize the model is working and then they try to figure out where to apply it. So it’s like you found a hammer and then you’re trying to find the nail to hit kind of thing. That rarely works.

Listen to Andy Thurai’s additional comments on the premise.

Many customers easing up on strategic investments, including AI

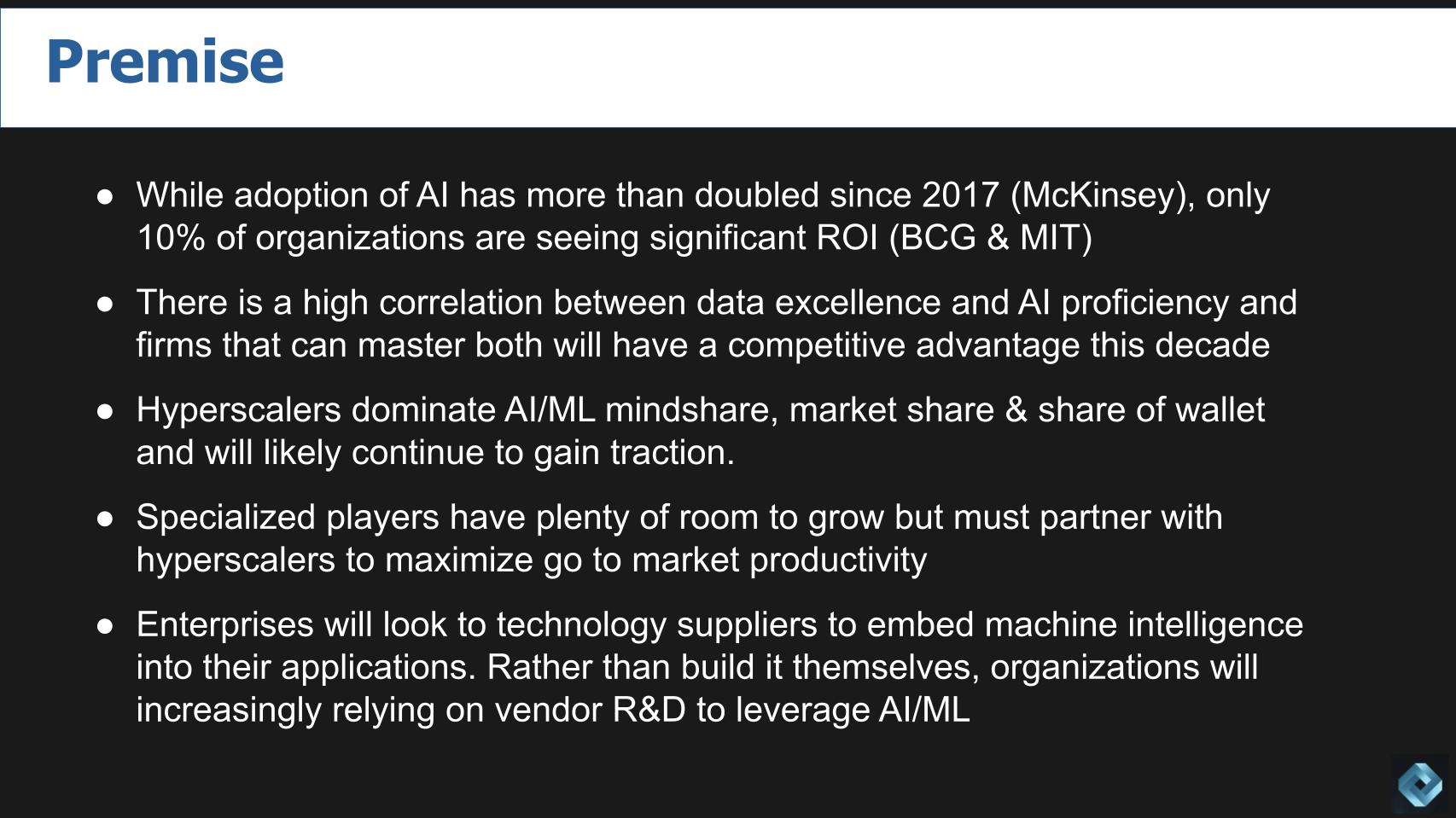

Let’s look at where ML/AI fit relative to the other hottest sectors in the ETR data set.

The above XY graph shows Net Score or spending velocity on the vertical axis and presence in the survey, called Sector Pervasion, for the October survey. The squiggly line on ML/AI represents the progression since the Jan. 2021 survey and you can see the downward direction. We position ML/AI relative to the other hot sectors, Containers, Cloud and Robotic Process Automation, which have consistently performed above the magic 40% red dotted line for most of the past two years. And we’ve included Analytics/Big Data for context and because it’s a relevant adjacency.

Note the green arrow moving toward 40%. ETR gave us a glimpse of the January survey, which is in the field with currently more than 1,000 responses and AI is breaking the downward trend.

Andy made the following key points about this data:

One of the things you have to keep in mind is when the pandemic happened, companies went into survival mode. So when somebody’s in that mode, what happens? The luxury and the innovations get cut. And this is exactly what happened with AI. So as you can see in the last seven quarters, which is almost dating back close to pandemic, everybody was trying to keep their operations alive, especially digital operations. How do I keep the lights on? So while the numbers spent on AI/ML is moving down on a relative basis, I still think embedded AI/ML spend is happening but may not be as visible. Things like employee experience or ITOps, AIOps, MLOps… some of those areas actually went up. There are companies like Atlassian, even though it had some platform issues, still saw spending momentum because they are offering the solution that was not previously available. So there are companies out there doing embedded AI for things like incident management for example that may not show up in this data. A lot of companies using “hidden” AI/ML in some of those areas are growing unbelievably well.”

Listen to why Andy Thurai thinks AI is seeing some headwinds.

AWS, Microsoft and Google are dominant in ML and AI

Databricks stands out as the notable independent

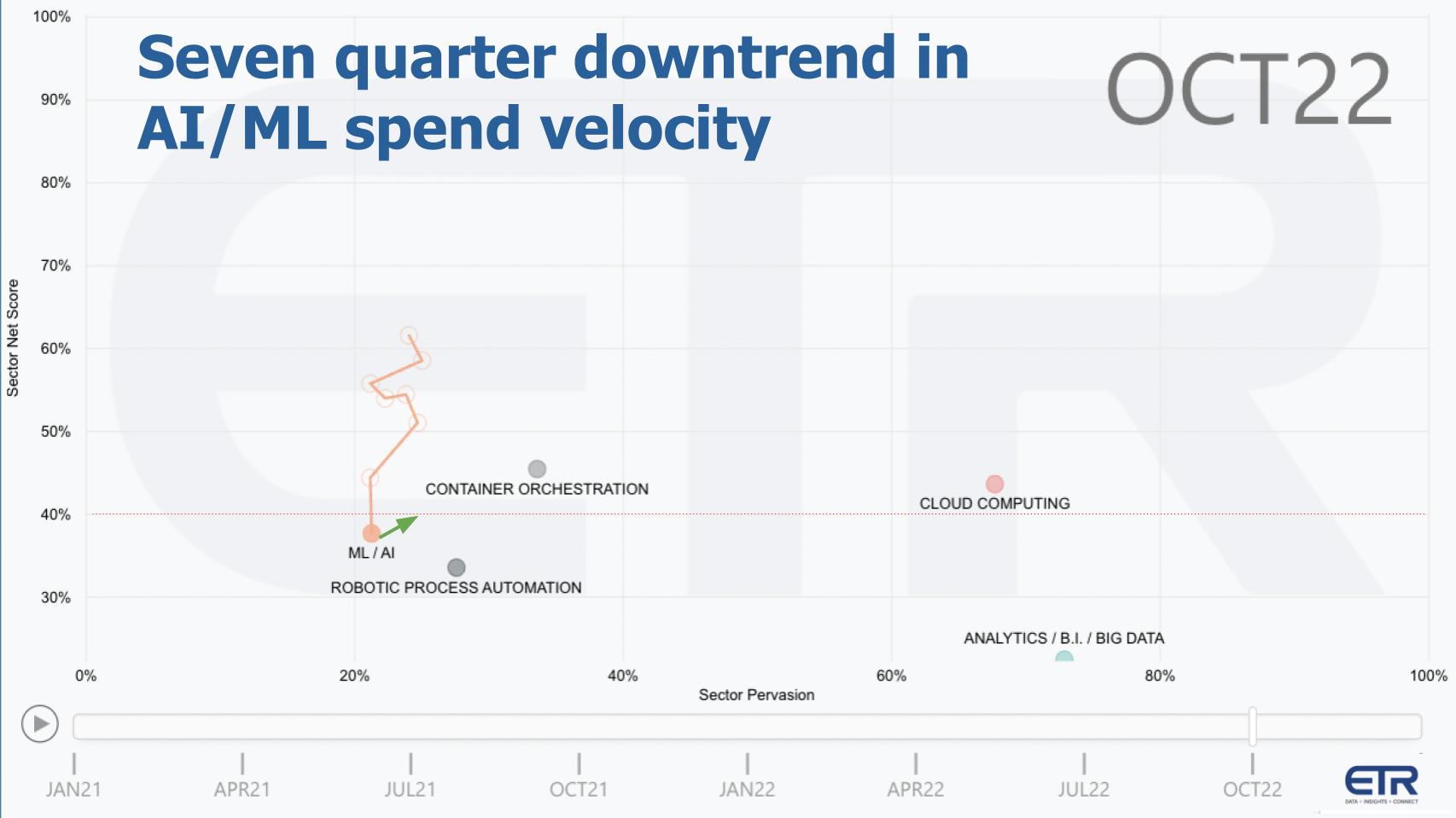

Let’s now unpack the ML/AI sector in the ETR data and look at the players that hit the radar in the survey.

The chart above shows the same XY dimensions and the players in the ML/AI sector within the survey. The table insert in the above graphic shows how the companies are plotted – Net Score and N’s in the survey. The hyperscalers are dominant in both market presence and spending momentum on their AI tools. Databricks Inc. is right in the mix, showing strong as a specialist. Then you go to a of seven AI-focused players including Anaconda, DataRobot Inc., H2O.ai Inc., Dataiku Inc., C3.ai Inc., SparkCognition Inc., and OpenText Corp. with Magellan. Then there’s the large, legacy enterprise players, Oracle Corp. and IBM Corp., which have AI offerings.

To the earlier point made by Andy, companies such as Salesforce Inc. and ServiceNow Inc., which offer AI tooling as part of their enterprise software offerings, don’t show up in the ETR ML/AI taxonomy. it’s similar with CrowdStrike Holdings Inc. and Palo Alto Networks Inc. in security, or Dell Technologies Inc. and Hewlett Packard Enterprise Co. in infrastructure, Splunk Inc. and Dynatrace Inc. in observability, and RPA specialists such as UiPath Inc. All of these companies and many others are actively embedding machine intelligence into their platforms and they won’t show up in the ETR ML/AI sector.

Back to the premise: As technology vendors invest in AI through R&D to make their products more intelligent, benefits will confer to customers. But differentiation and direct ROI will require more than just deploying vendor products. Thinking through process improvements, human capital management and the overall business case will be critical.

Here’s how Andy interprets the hyperscaler landscape:

The first point is AWS is more about Lego building blocks. We’ll give you all the components that you need. Whether it’s SageMaker, MLOps or CodeWhisperer… whatever you want. They’ll give you the blocks and then you’ll build things on top of it. Google took a different path. Google did a lot of work with their acquisition of DeepMind and other things. They’ve been way ahead of the pack when it comes to AI tech. Now, I think Microsoft’s move of partnering and making a huge investment in OpenAI is unbelievable. Of course, everybody’s talking about ChatGPT. Remember, as Warren Buffet says, that when my laundry lady is talking to me about stock market, it’s heating up, and that’s the way it is with ChatGPT.

As it pertains to the smaller independents, they must partner with hyperscalers for a variety of reasons, especially go-to-market productivity.

Listen to Andy Thurai discuss why smaller players have no choice but to partner with hyperscalers.

AI decision points are shifting from technical features to ROI

Before we move on, let’s share some other findings from ETR on why people adopt AI. The data historically shows that: 1) feature breadth; and 2) technical capabilities were the main decision points for AI adoption. According to Andy, that’s changing:

I can guarantee you, if you look at the latest data that’s coming in now, those two will be secondary and tertiary points. The No. 1 would be about ROI. And how do I achieve it? I’ve spent ton of money on all of my experiments. This is the same theme I’m seeing across the board when talking to everybody who’s spending money on AI. I’ve spent so much money on it. When can I get it live in production? How quickly can I get a return? Because the board is breathing down their neck. You already spent this much money. Show me something that’s valuable. So the ROI is going to become — I’m predicting this for 2023 — the No. 1 factor in AI decisions.

Listen to Andy Thurai’s prediction about how buyers’ decision factors will change in 2023.

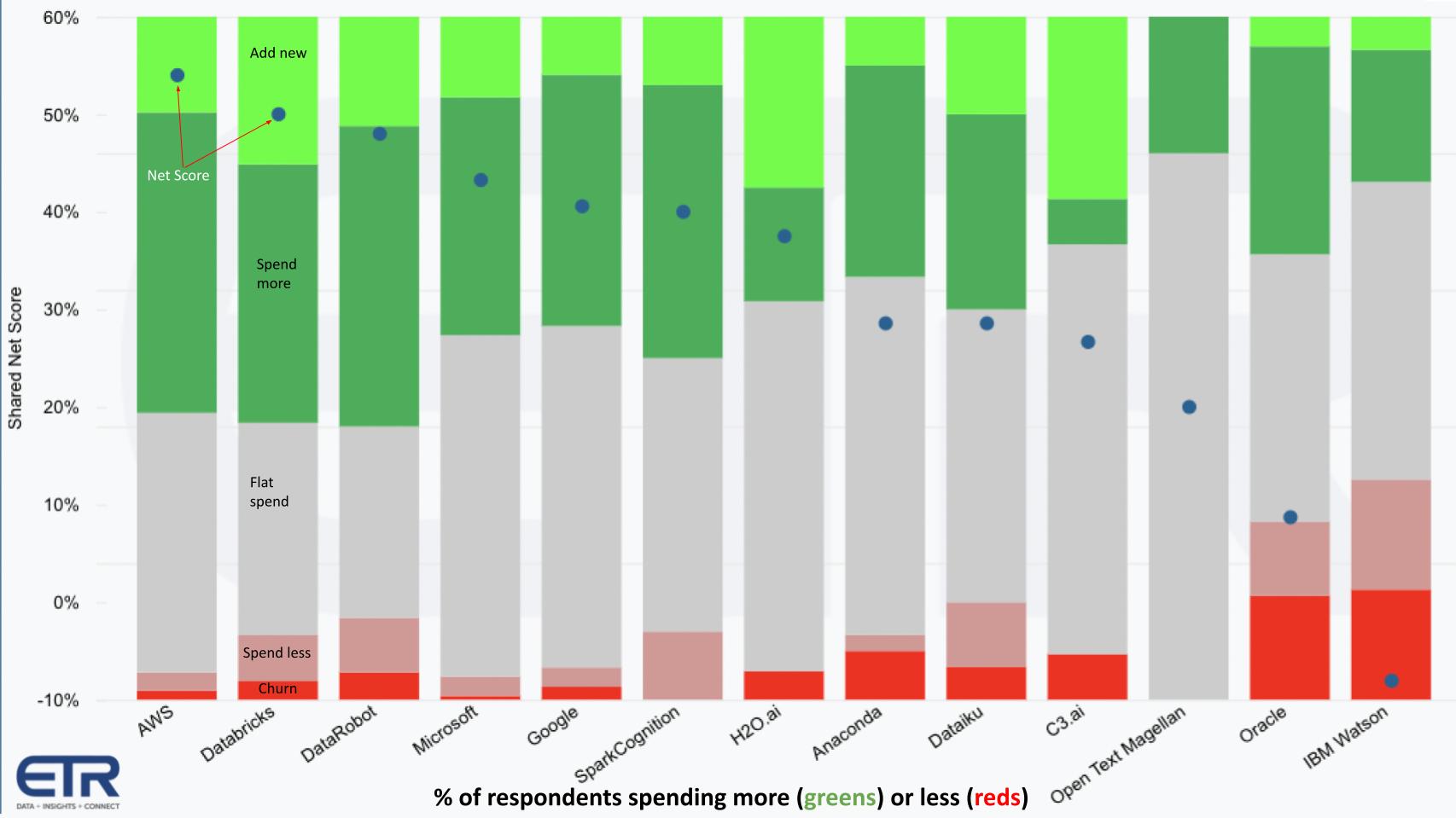

Customer spending patterns for the top AI players

Hyperscalers show low churn in AI… not the case for Oracle and IBM

Let’s look at some of the top players in AI and break down their spending profiles.

The chart above shows how Net Score is calculated. Pay attention to the second set of bars showing Databricks where we’ve annotated the colors. The lime green is new adds, the forest green is spending up 6% or more, the gray is flat spend, the pinkish is spending 6% down or worse, and the red is churn. Subtract the reds from the greens and you get Net Score, which is shown by the blue dots highlighted by the arrows.

AWS has the highest Net Score and very little churn but notably, Databricks and DataRobot are next with Microsoft and Google also showing very low churn.

But Oracle (N=46) and IBM (N=62) are showing much higher platform defections in the ETR survey.

Andy had some pointed comments regarding IBM Watson:

A couple of things that stands out to me. Most of them are in line with my conversation with customers. One is how bad IBM Watson is doing. So look, IBM has been at the forefront of innovating for many, many years now. And over the course of time, they moved from a product innovation-centric company to more of a services company. And they began making a majority of revenue from services. Now things are changing. Arvind [Krishna] has taken over, he came from research. So he’s doing a great job of trying to reinvent IBM as a company. But they have a long way to catch up. IBM Watson, if you think about it, played Jeopardy like, what 15 years ago?

Listen to Andy Thurai explain why Watson failed to live up to its early high expectations.

The surprising performance of DataRobot

Andy had these additional thoughts on the other AI players shown on the chart above:

AWS is No. 1, as it should be. But what what actually caught me by surprise is how DataRobot is holding. I mean, look at that. The net new addition [lime green] and/or expansion [forest green], DataRobot seems to be doing well. That surprises me.

Listen to Andy Thurai discuss the momentum of AWS the surprise that is DataRobot.

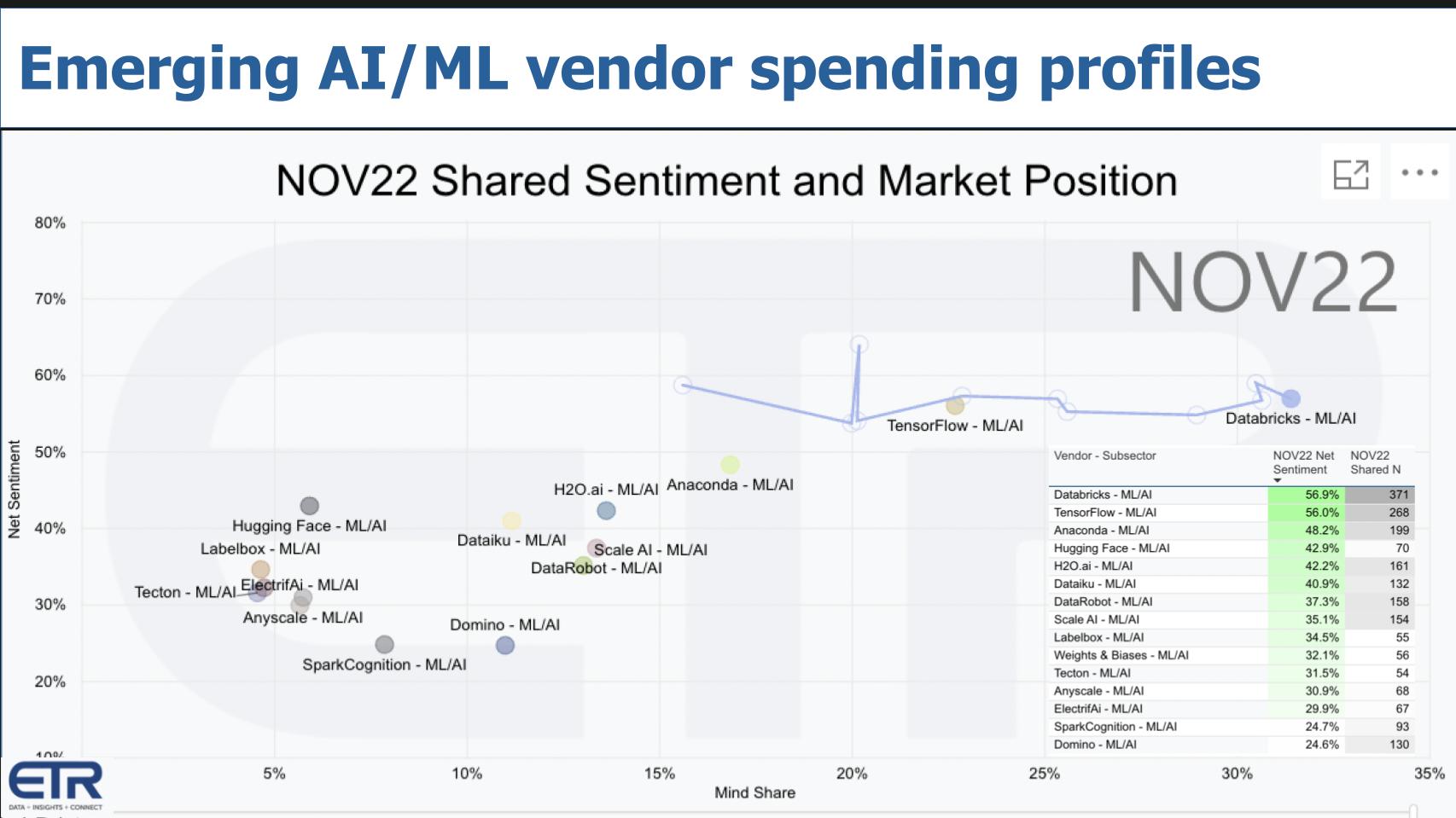

Emerging AI players vie for mindshare

Databricks is the dominant private firm

We hit the bigger names in the ML/AI sector, so now let’s look at the emerging technology companies.

One of the gems of the ETR data set is the Emerging Technology Survey – ETS. It’s now run four times per year and is exclusively focused on private companies that are potential disruptors, M&A candidates and, if they’ve raised enough money, acquirers of companies as well. Databricks and Snyk Ltd. would be good examples of buyers hoping to go public at some point.

Above we show the emerging companies in the ML/AI sector of the ETR data set. The dimensions are Net Sentiment on the Y axis and Mind Share on the X axis. Basically the ETS study measures awareness and intent to buy – or not buy. So ETR uses a methodology similar to Net Score where the negatives are subtracted from the positives. And Mind Share is vendor awareness shown on the horizontal axis.

The inserted table shows Net Sentiment and Ns in the survey, which informs the position of the dots.

You’ll also notice we’re plotting TensorFlow. We know that’s not a company, but it’s there for reference, since open-source tooling is an option for customers.

We’ve also drawn a line for Databricks to show how relatively dominant they’ve become in the past 10 ETS surveys – going back to late 2018.

You also see the position of about a dozen other emerging vendors including: Anaconda, H2o.ai, Scale AI, DataRobot, Dataiku, Domino, Hugging Face, Labelbox, ElectricfAI, Tecton, Anyscale and SparkCognition.

Here’s how Andy interprets this data:

Remember we talked about how Oracle is not necessarily the database of the choice [for AI]? Databricks is trying to solve some of the issue for AI/ML workloads. And the problem is there is no one company that can solve all of the problems. For example, if you look at the names in here, some of them are database names, some of them are platform names, some of them are MLOps companies... and some of them are feature-based companies like Tecton.

It’s a mix of those companies. You got Hugging Face in here, which does NLP.

Most of these companies are going to get acquired. My prediction would be most of them will get acquired because look, at the end of the day, hyperscalers need these capabilities, right? So they’re going to either create their own, AWS is very good at doing that. But the other ones, like Azure, they’re going to look at it and say, “You know what, it’s going to take time for me to build this. Why don’t I just go and buy you?” Or even the other players like Oracle or IBM Cloud... they might even take a look at them. So at the end of the day, a lot of these companies are going to get acquired or merged with others.

Listen to Andy Thurai’s predictions on possible M&A activity in the AI market.

OK, let’s wrap with some final thoughts.

The AI winter is not coming

Despite the challenge of leveraging AI, we’re not repeating the AI winter of the 1990s. Machine intelligence is a superpower that will permeate every aspect of the technology industry.

AI and data strategies must be connected. Leveraging first party data will become increasingly important to AI competitiveness and shortening time-to-value.

Getting cloud “right” matters in AI. Hyperscalers continue to capture more share of data, a key ingredient to AI success. They have native tools and integrated ecosystem partners that will continue to strengthen through the decade.

Real-time AI inferencing (e.g. at the edge) will become an increasingly important force. It will usher new economics in silicon, new tooling, new companies, and could disrupt cloud norms by the end of the decade

We gave Andy the last word and asked him to give his final thoughts.

Listen to Andy Thurai summarize the state of AI in seven minutes.

Keep in touch

Many thanks to Andy Thurai of Constellation Research for his insights and participation in this Breaking Analysis segment. Alex Myerson and Ken Shifman are on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email [email protected], DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at [email protected].

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.