Computer graphics chipmaker Nvidia Corp. reported strong fourth quarter results today, beating expectations, one week after its bid to acquire rival Arm Ltd. for $66 billion fell through.

The company reported a net income of $3.003 billion, with earnings before certain costs such as stock compensation of $1.32 per share. Revenue for the quarter came to $7.64 billion, up 53% from one year before.

That was better than expected, with analysts looking for earnings of just $1.23 per share on revenue of $7.42 billion.

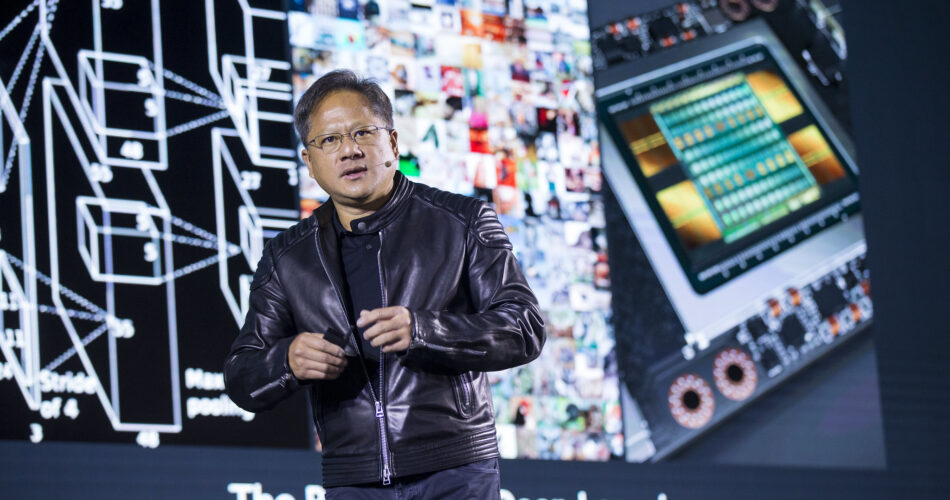

Nvidia founder and Chief Executive Jensen Huang said the company was seeing “exceptional demand” for its computing platforms.

“We are entering the new year with strong momentum across our business and excellent traction with our new software business models with Nvidia AI, Nvidia Omniverse and Nvidia DRIVE,” he said. “GTC is coming, we will announce many new products, applications and partners for Nvidia computing.”

Nvidia also offered an extremely strong outlook for the first quarter, saying it expects revenue of $8.10 billion, way above Wall Street’s forecast of $7.29 billion in sales. According to Huang, the bullish forecast is because Nvidia’s supply constraints are easing. He said he expects the company’s supply of products to increase substantially by the second half of the year.

Despite all the optimism and the strong results, investors chose to take their money and run, with Nvidia’s stock falling slightly in extended trading. It means the company’s stock is down more than 10% in the year to date. Analysts say this is likely due to investors looking for safer havens amid an inflationary environment, as opposed to any serous concerns over Nvidia’s prospects.

Nvidia has benefited over the past 12 months from increased interest for its graphics processors to power artificial intelligence applications such as speech recognition. As a result of that interest, Nvidia’s data center business reported $3.26 billion in sales during the quarter, up an astonishing 71% from a year ago.

During the quarter, Nvidia announced a big customer win in the shape of Facebook’s parent company Meta Systems Inc., which is adopting its graphics chips to power AI research.

Nvidia’s biggest market, for now at least, remains the gaming sector though. It said its gaming business pulled in $3.42 in sales, up 37% from a year ago, driven by demand for its latest GeForce graphics processing units.

Meanwhile, Nvidia’s professional visualization business, which accounts for chips that power high-performance applications such as computer-assisted design and rendering, saw sales jump 109% to $643 million. Huang said sales there were driven by hybrid work trends and demand for computer workstations.

The only disappointment was Nvidia’s automotive business, which saw sales fall 14% to $125 million. While automotive is not a primary focus, it does represent a growth market for the company. Nvidia blamed the slump in sales there on car maker’s supply challenges.

Nvidia’s last business is its specialized cryptocurrency mining processors, which did $24 million in sales in the fourth quarter.

The report comes just days after Nvidia announced it was calling off its effort to try and acquire the semiconductor design firm Arm from its parent company SoftBank Group. The deal was extremely controversial and faced a lot of opposition, leading Nvidia to call it off due to “significant regulatory challenges”, it said.

The deal had faced considerable scrutiny from regulators in the U.S., the U.K. and in China. All three countries raised concerns that Nvidia’s acquisition could lead to restrictions on the use of Arm’s intellectual property, which is essential for many modern mobile devices.

“We gave it our best shot,” Huang told analysts in a call today. “But the headwinds were too strong.”

Nvidia will pay a $1.36 billion charge for operating expenses as a result of its failure to close on the Arm deal.

Photo: Nvidia/Flickr

Show your support for our mission by joining our Cube Club and Cube Event Community of experts. Join the community that includes Amazon Web Services and Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger and many more luminaries and experts.

Source link