For many years, manufacturing gross sales adopted a well-known rhythm. Commerce reveals, in-person conferences, plant excursions, and long-standing relationships did a lot of the heavy lifting. Advertising supported gross sales with brochures, spec sheets, and occasional campaigns, whereas offers have been largely pushed offline.

That rhythm has quietly modified.

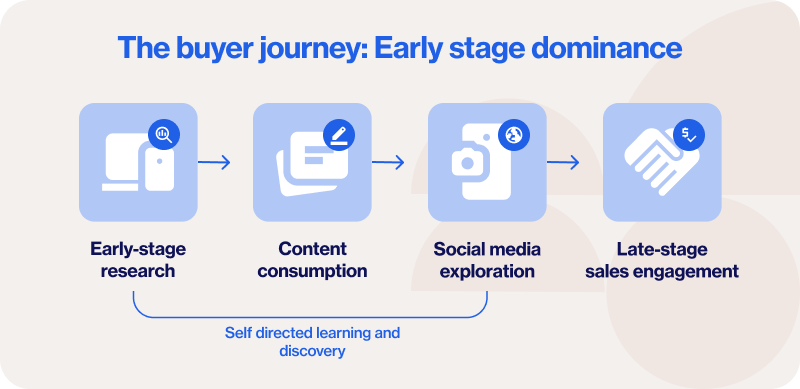

At this time, manufacturing consumers make most of their selections lengthy earlier than they communicate to a salesman. Analysis, comparability, shortlisting, and early validation now occur throughout digital channels, from search engines like google and web sites to content material platforms {and professional} networks. By the point gross sales will get concerned, consumers have already got opinions, expectations, and a transparent sense of which distributors really feel credible.

It is very important be exact right here. Once we speak about a digital-first purchaser journey, we’re not speaking about social media in isolation. Digital advertising contains web sites, search, content material, knowledge, and automation. Social media is without doubt one of the most influential layers inside that ecosystem, as a result of it connects info to individuals and turns analysis into belief.

This distinction issues, particularly in manufacturing.

Consumers are usually not changing conventional analysis with social media. They’re utilizing social platforms to validate what they discover via search, content material, and peer suggestions. LinkedIn posts, worker views, and visual experience usually turn into the deciding issue that separates credible suppliers from everybody else.

In apply, manufacturing consumers are usually 60% or extra of the way in which via their shopping for journey earlier than a kind fill or a gross sales dialog happens. Throughout this time, consumers analysis independently, evaluate suppliers, and align internally on which distributors really feel credible. If a model isn’t seen the place that analysis takes place, it’s successfully invisible when selections are made.

This shift isn’t theoretical. It’s already reshaping how manufacturing firms win or lose offers.

The fashionable manufacturing purchaser journey is digital first

Throughout B2B industries, analysis constantly reveals that consumers full most of their decision-making digitally earlier than partaking gross sales. Gartner describes today’s B2B buying journey as non-linear and largely self-directed, with consumers gathering info independently throughout a number of channels earlier than ever talking to a vendor.

Google’s research into B2B purchasing behavior reinforces this shift. In line with Google, greater than half of B2B buy selections are influenced by digital content material, and search performs a central function in early-stage analysis.

For manufacturing organizations promoting complicated merchandise with lengthy gross sales cycles, this issues deeply. Consumers are underneath stress to cut back threat. They wish to perceive choices, consider credibility, and construct inside alignment earlier than committing time to a gross sales dialog.

In case your model doesn’t seem throughout that analysis part, you aren’t a part of the choice set when it issues most.

Conventional industries, trendy consumers

Manufacturing is commonly described as a conventional trade, however its consumers function in a contemporary atmosphere. Resolution-makers are influenced by the identical digital behaviors shaping each different B2B sector.

Millennials and Gen Z now make up a rising share of each the manufacturing workforce and shopping for committees. McKinsey highlights that younger buyers expect digital-first experiences and more and more affect buying selections, even in complicated B2B environments.

Even skilled consumers who worth long-term relationships now anticipate digital proof earlier than partaking. They search for consistency, experience, and relevance throughout channels. A restricted or outdated digital presence creates friction and uncertainty, no matter how sturdy a gross sales relationship could also be.

Beneficial for additional studying

Why gross sales groups enter the shopping for course of later than ever

Gross sales groups right this moment are assembly consumers at a a lot later stage of the journey. By the point a purchaser reaches out, they’ve usually already:

- Outlined the issue internally

- Researched resolution classes

- Shortlisted credible distributors

- Validated choices via content material {and professional} networks

LinkedIn’s B2B research reveals that skilled networks play a vital function in validation and belief constructing, significantly when a number of stakeholders are concerned.

This adjustments the function of gross sales. Conversations are now not about primary schooling. They’re about confirming selections that consumers have already made.

Advertising now carries rather more duty for shaping these early perceptions.

The place manufacturing advertising usually falls behind

Many giant manufacturing organizations nonetheless rely closely on commerce reveals, sales-led outreach, and static web sites. These ways nonetheless matter, however they now not cowl sufficient of the customer journey.

Manufacturing consumers are usually not ready for occasions to study. They’re actively looking out year-round. They’re evaluating suppliers who constantly publish, are lively on LinkedIn, and empower staff to share experience publicly.

When advertising doesn’t mirror this actuality, the dangers compound:

- Consumers uncover opponents first

- Manufacturers really feel more durable to guage

- Gross sales conversations begin defensively

- Advertising struggles to show income impression

Digital visibility is now a income subject

This shift isn’t about traits. It’s about income safety and progress.

Analysis constantly reveals that manufacturing firms that spend money on digital advertising obtain stronger outcomes. Oktopost’s analysis shows that producers who spend money on digital channels, together with content material and social media, report larger success and improved inbound efficiency.

Digital visibility influences consciousness, confidence, belief, and deal velocity. Familiarity reduces perceived threat. Decreased threat accelerates selections.

Advertising’s function is now not to help gross sales from the sidelines. It actively shapes when and the way alternatives are created.

How manufacturing advertising leaders have to adapt

To adapt, manufacturing advertising groups have to rethink the place they make investments.

First, they have to present up earlier. Academic content material ought to handle purchaser questions earlier than gross sales engagement.

Second, they have to deal with search, content material, and social as related quite than separate. Social media amplifies digital content material and provides human validation to analysis.

Third, advertising and gross sales should align round purchaser conduct. Gross sales ought to perceive what consumers devour digitally. Advertising ought to perceive what consumers ask as soon as gross sales are concerned.

Digital-first doesn’t imply digital-only. It means digital-aware.

How Oktopost helps manufacturing entrepreneurs affect consumers earlier

Oktopost helps manufacturing organizations adapt to the fashionable purchaser journey by turning social media right into a measurable, strategic extension of their digital advertising technique.

With Oktopost, groups can handle a LinkedIn-first presence, empower staff to share experience in a structured approach, and measure how social exercise influences consciousness, engagement, and pipeline. Oktopost helps alignment between advertising and gross sales by connecting social knowledge with the broader B2B tech stack.

Manufacturing consumers are already researching digitally. Oktopost helps guarantee your model is a part of that analysis.

Request a consultation with a marketing expert to see how main manufacturing organizations affect shopping for committees earlier than gross sales become involved.

Regularly requested questions

Manufacturing consumers wish to scale back threat. Digital analysis helps them perceive choices, evaluate distributors, and construct confidence earlier than committing time to a gross sales dialog.

No. Consumers nonetheless worth relationships, however they anticipate digital proof of experience and credibility earlier than partaking with gross sales.

LinkedIn helps consumers validate distributors by seeing actual individuals, experience, and consistency. It usually reinforces or challenges impressions shaped via web sites and search.

As a result of consumers full a lot of their schooling, analysis, and shortlisting independently via digital channels earlier than reaching out.

Manufacturers that seem early in digital analysis construct familiarity and belief, decreasing threat and accelerating shopping for selections.

Source link