A yr in the past, we requested U.S. customers how they felt about tariffs and whether or not these insurance policies had been altering how they store. This yr, we requested once more — and the solutions acquired extra settled.

Help for tariffs elevated from 34% in 2025 to 46% in 2026. And even with that assist, those self same consumers aren’t anticipating it to be cost-neutral: 56% say customers in the end bear the price by way of greater costs.

So no, consumers aren’t confused, and so they don’t suppose tariffs are “free.” It’s extra like, extra folks assist them even whereas anticipating costs to rise.

Tariff buying habits at a look

Right here’s what stood out most:

- Help is up yr over yr: 46% again tariffs, up from 34% in 2025, whereas 56% say customers bear the price

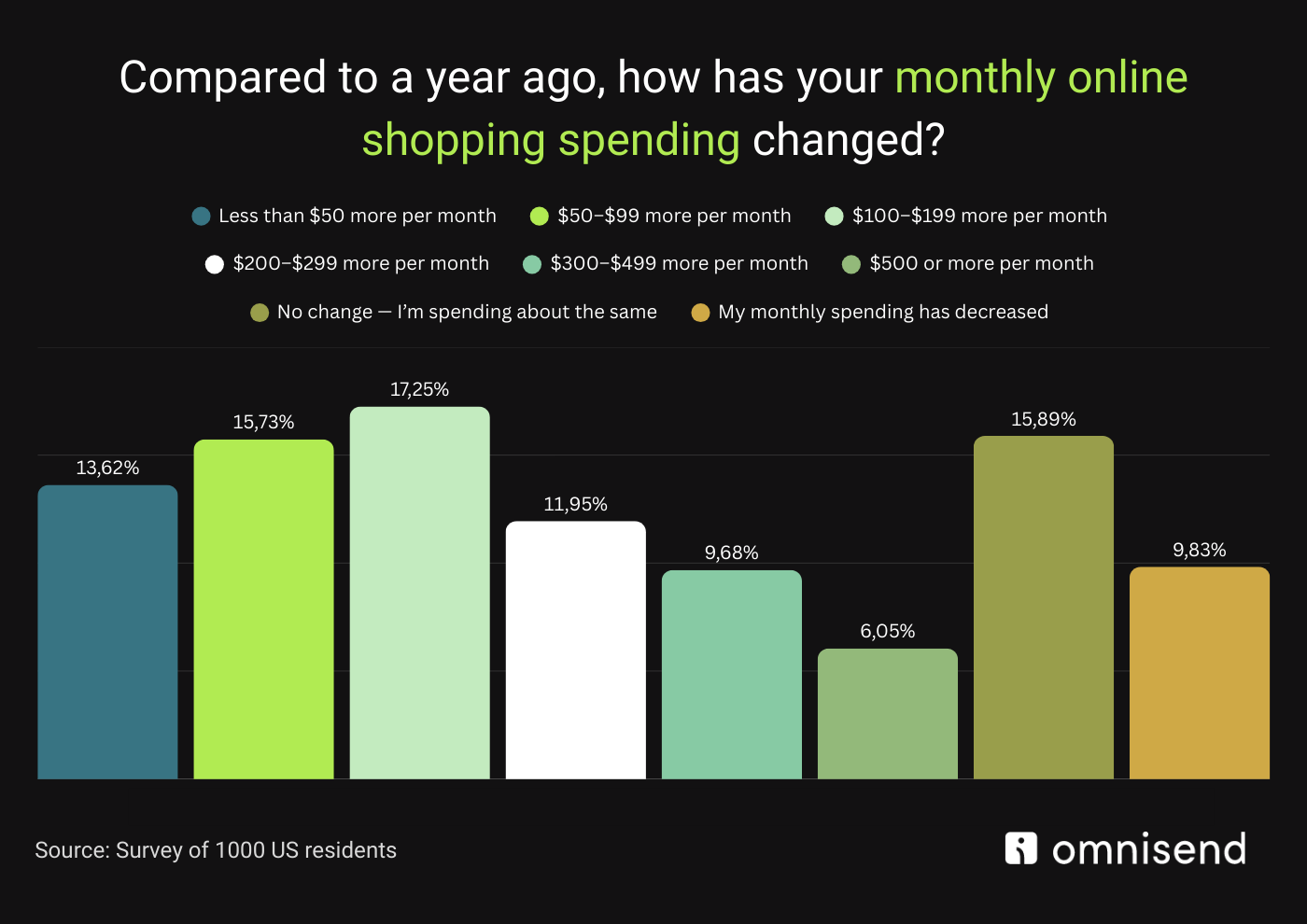

- Month-to-month budgets are up: Amongst consumers who elevated on-line spending, budgets rose by almost $190/month on common (weighted midpoint calculation)

- Tariffs are driving “Purchase American” habits: 68.7% say tariffs influenced their choice to purchase extra “Made within the USA” merchandise (33.0% “loads,” 35.6% “considerably”), and 57.5% made a acutely aware effort to take action previously yr

- Willingness to pay extra is up: 59% would pay further for U.S.-made items (vs. 40.1% in 2025) — 27.6% as much as 5%, 21.9% as much as 10%, and 9.2% greater than 10% — although 29.8% nonetheless prioritize worth over origin

- Cross-border buying creates actual friction: When ordering internationally, consumers report slower-than-expected supply instances (41%), surprising duties or taxes (17%) at supply, and extra dealing with or customs charges (24%) — experiences which are actively reshaping habits

- Belief and transparency are main points: 40.0% of consumers say they purchased a product they believed was Made within the USA solely to later uncover it wasn’t; 27.8% stored the product, whereas 12.3% returned it

What folks consider vs. what they do

Regardless that many patrons count on tariffs to lift costs, they aren’t essentially chopping spending. Amongst customers who reported that their on-line buying spending elevated over the previous yr, month-to-month budgets had been up by almost $190 on common (based mostly on a weighted midpoint calculation).

That improve seemingly displays a mixture of elements, comparable to greater costs, tariff-related prices, and adjustments in buying habits — together with a better willingness to pay modest premiums for U.S.-made items.

“Customers aren’t confused about tariffs — they know precisely the place the price reveals up, and it’s on the receipt,” stated Marty Bauyer, Ecommerce Professional at Omnisend. “The survey confirmed that as an alternative of merely buying much less to save cash, individuals are buying otherwise. They’re in search of fewer surprises, clearer pricing, and sellers they belief — and more and more, meaning selecting home choices each time they will.”

Tariffs are reshaping the place Individuals store

For a lot of consumers, cross-border ecommerce has grow to be extra difficult than it was once, and that have is altering habits:

- 32.0% say they now stick with U.S.-based sellers

- 23.4% actively keep away from ordering from worldwide sellers

- 21.1% solely store internationally if duties are proven upfront

On the identical time, worldwide buying hasn’t disappeared. 36.1% say they nonetheless order internationally when costs are considerably decrease. So the sample right here is fairly easy: consumers will nonetheless purchase throughout borders, however they’re much less prepared to take care of uncertainty.

“Tariffs didn’t kill cross-border ecommerce — they only raised the usual,” Bauyer stated. “When consumers get hit with lengthy supply home windows, shock duties, or further charges on the door, they don’t simply complain. They modify their habits. Predictability has grow to be a product function, and sellers that may’t present it are dropping floor.”

Shopping for American is trending — however sellers don’t make it simple

Sure, customers need to purchase extra U.S.-made merchandise. However a lot of them battle to search out them on-line.

Solely 29.0% say it’s very simple to search out and buy Made within the USA merchandise on-line, whereas 25.9% say it’s considerably or very troublesome.

So consumers do what consumers at all times do when one thing issues to them — they begin doing further homework:

- 41.2% learn product descriptions and labels extra rigorously

- 32.5% use market filters or search phrases

- 31.1% go to Made-in-USA–particular web sites

- 18.7% contact manufacturers on to ask the place merchandise are made

Even with all that effort, 40% nonetheless say they purchased one thing they believed was Made within the USA, solely to later uncover it wasn’t. Simply an “oopsie” from the vendor’s aspect?

“When 4 in 10 consumers say they purchased one thing considering it was Made within the USA and it in the end wasn’t, that’s not a minor inconvenience — that creates a belief drawback,” Bauyer stated. “And belief is pricey to rebuild. If manufacturers need to win on this atmosphere, origin can’t be obscure, buried, or implied. It needs to be clear, constant, and verifiable.”

Consumers pays extra for U.S.-made items

Customers are open to paying a premium for merchandise made within the U.S. (which is nice information when you promote them). 59% say they’d pay a premium, up from 40.1% in 2025.

However they’re not open to paying any premium. Right here’s what consumers say they’d tolerate:

- 27.6% would pay as much as 5% extra

- 21.9% would pay as much as 10% extra

- 9.2% would pay greater than 10% extra

And almost 29.8% say worth nonetheless issues greater than the place the product is made.

So sure — “Made within the USA” can justify the next worth. Simply don’t count on it to work as a clean examine.

“That is the place manufacturers need to watch out,” Bauyer stated. “Sure, consumers pays extra — however not indefinitely, and never with no motive they will perceive. The winners would be the manufacturers that pair a good premium with clear worth: transparency, reliability, and a buying expertise that doesn’t punish folks with hidden prices.”

What ecommerce manufacturers ought to do subsequent?

If tariffs are shifting habits towards predictability, belief, and transparency, ecommerce manufacturers have a reasonably clear playbook right here.

1. Make product origin inconceivable to overlook

Don’t bury it in a dropdown or go away it “implied.” If you wish to win consumers who care about home merchandise, make it apparent on:

- Product pages

- Collections

- Filters

- Onsite search outcomes

2. Lead with total-cost transparency

With 21.1% avoiding worldwide buying except duties are proven upfront, hidden charges are a conversion killer. If further prices exist, don’t make clients uncover them as if it’s a plot twist.

3. Compete on predictability (not simply worth)

The cross-border ache factors are loud:

- 41% say supply was slower than anticipated

- 24% confronted dealing with/customs charges

- 17% acquired hit with duties/taxes at supply

Which means supply velocity, reliability, and return insurance policies aren’t “good extras.” They’re dealbreakers.

4. Clarify worth adjustments proactively

Customers already consider they’re paying the tariff prices anyway. So if costs shift, don’t let that flip into silent resentment. Electronic mail + SMS may also help set expectations earlier than consumers get to checkout.

5. Deal with belief like a conversion lever

With 40% experiencing Made-in-USA confusion, clear labeling is a aggressive benefit. Not as a result of consumers desire a lecture. As a result of they need to purchase one thing with out feeling tricked.

“Tariffs have turned transparency into technique,” Bauyer added. “Should you can present consumers precisely what they’re paying, the place the product comes from, and when it should arrive, you’re not simply lowering friction. You’re constructing confidence, and confidence is what drives conversion when budgets are tight.”

Methodology

This Omnisend survey was performed January 10-14th, 2026, amongst U.S. customers. Quotas had been positioned on age, gender, and place of residence to realize a nationally consultant pattern of U.S. customers.

The “almost $190 extra per thirty days” determine represents a weighted common improve amongst respondents who reported greater month-to-month on-line buying spending. Respondents chosen spending improve ranges (e.g., lower than $50, $50–$99, $100–$199, $200–$299, $300–$499, $500+). Omnisend calculated the common month-to-month improve by assigning a midpoint worth to every vary and weighting it by the variety of respondents in every class. The $500+ class was calculated conservatively utilizing $500 because the midpoint.

Need to dive deeper into the information?

Source link