- Excessive-capacity DDR5 DRAM costs surged sharply from late 2025 to early 2026

- TrendForce forecasts predict continued value progress regardless of obvious stabilization in retail

- Server-focused modules have absorbed most wafer output, tightening PC provide

A current pricing development from PCPartPicker suggests reminiscence costs could also be settling after months of volatility, notably for higher-capacity kits.

That obvious calm contrasts sharply with seperate TrendForce forecasts which point out contract costs for PC DRAM may rise considerably in early 2026.

These conflicting signals reflect a market in which short-term retail averages and longer-term supply agreements are moving along different trajectories.

Supply adjustments reshape availability

The gap between observed prices and forward-looking contracts has widened, creating uncertainty rather than reassurance for buyers tracking DDR5 DRAM prices.

Reminiscence suppliers have made clear changes to the way it allocates manufacturing capability throughout product classes.

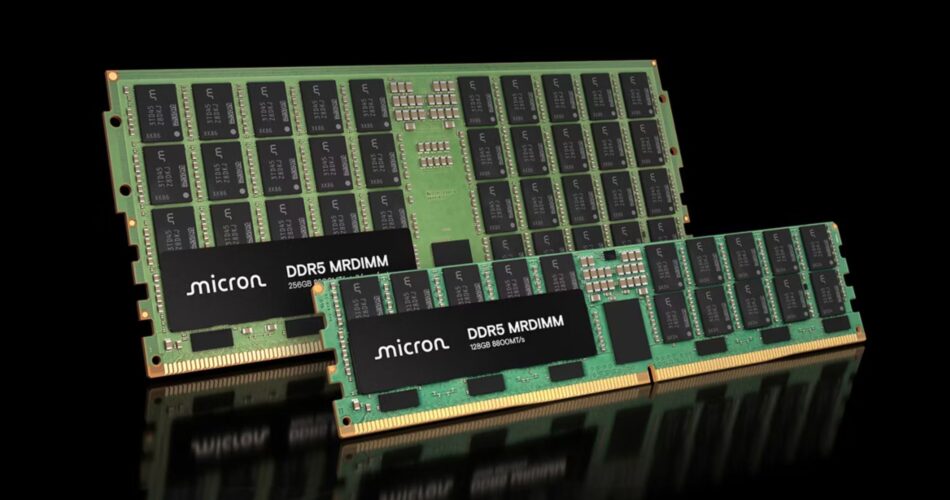

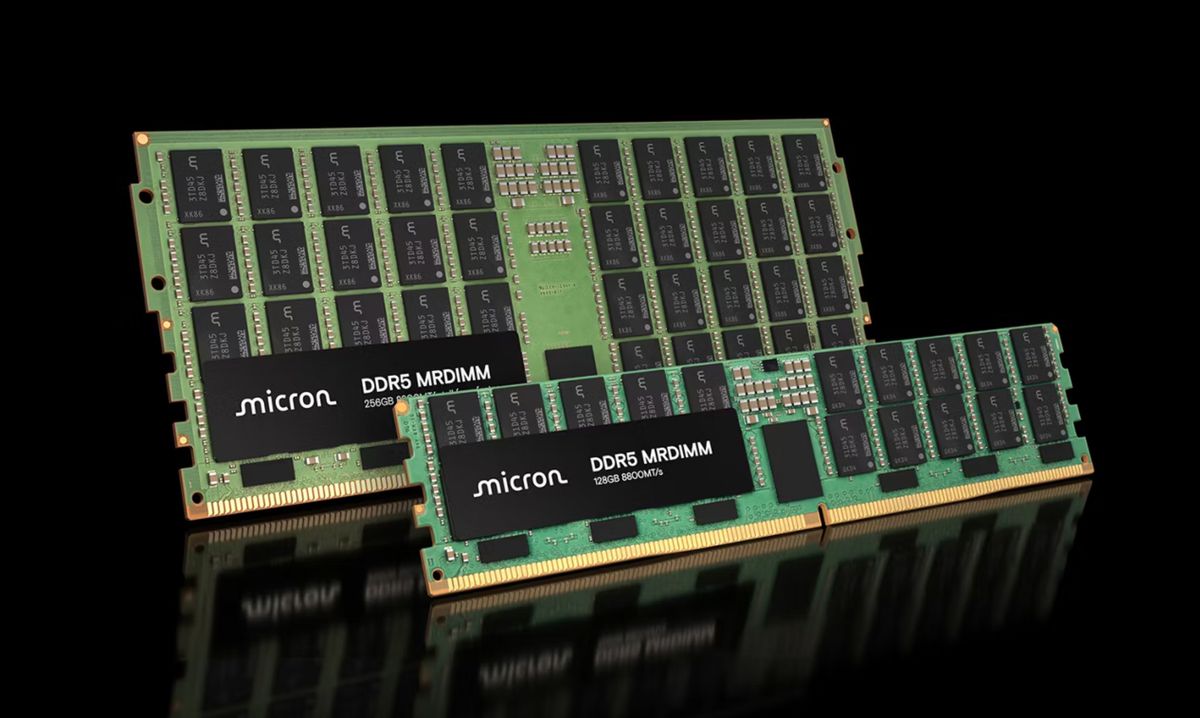

Server-focused modules have more and more absorbed out there wafer output, leaving laptops and associated merchandise uncovered to tighter provide circumstances.

Suppliers have paired this shift with selective allocation practices that favor giant authentic gear producers whereas decreasing volumes out there to unbiased module makers.

This provide self-discipline has created room for upward contract revisions as suppliers slender historic value gaps between PC and server reminiscence.

TrendForce knowledge monitoring common promoting costs per gigabit reveals restricted motion all through most of 2025.

From the primary quarter by the third quarter of the 12 months, each PC and server reminiscence traces stay largely flat, indicating managed provide and regular demand.

That sample adjustments abruptly throughout the last quarter of the 12 months, when costs for each segments start rising virtually concurrently.

Server-class DDR5 RDIMM costs improve extra sharply, whereas PC-focused SODIMM costs comply with a gentler upward slope, confirming that the shift was market-wide quite than remoted.

The most important motion seems between late 2025 and the primary quarter of 2026, when contract costs rise quickly.

TrendForce projections present continued will increase by the rest of 2026, though at a slower tempo after the preliminary bounce.

Importantly, the forecast doesn’t present any reversal or correction as soon as costs attain larger ranges.

As an alternative, each PC and server DRAM seem to settle right into a sustained larger vary, with server reminiscence sustaining a constant premium per gigabit.

Demand from large-scale AI deployments sits on the middle of this unstable pricing scenario.

Data center operators proceed to broaden memory-dense techniques to assist coaching and inference workloads, growing consumption of high-capacity DDR5 modules.

This sustained pull from AI infrastructure has bolstered provider choice for server and knowledge middle reminiscence, not directly tightening availability for PC-focused merchandise.

Many observers have described the current slowdown in value will increase as stabilization, though the underlying knowledge doesn’t point out improved affordability.

Costs seem to degree off solely after reaching ranges that restrict buying exercise.

This sample means that stability could mirror resistance from consumers quite than more healthy provide circumstances.

If demand stays constrained whereas suppliers keep present allocation methods, elevated pricing may persist longer than many market individuals count on.

Follow TechRadar on Google News and add us as a preferred source to get our professional information, evaluations, and opinion in your feeds. Be sure to click on the Comply with button!

And naturally it’s also possible to follow TechRadar on TikTok for information, evaluations, unboxings in video type, and get common updates from us on WhatsApp too.