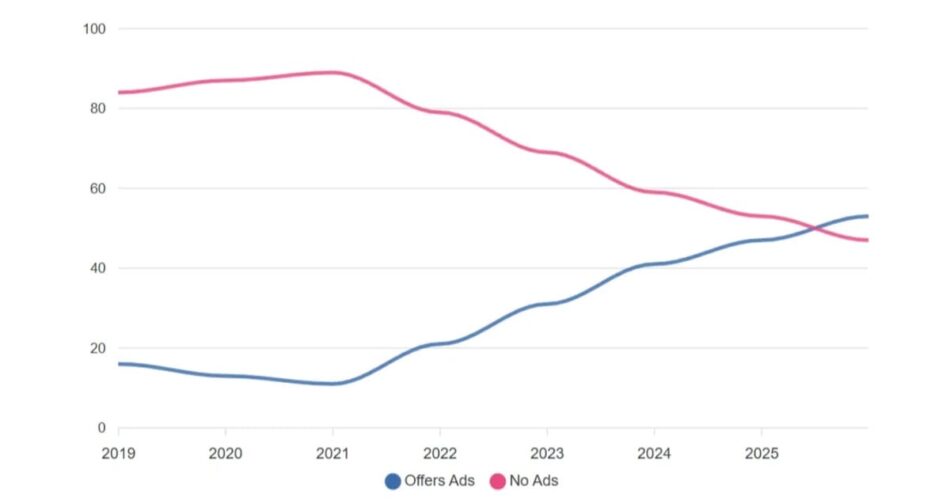

The e-mail e-newsletter trade skilled a elementary shift in monetization technique throughout 2025, with sponsored content material rising as the popular income mannequin whereas paid subscription adoption stagnated. In line with the sixth annual State of Newsletters report launched December 17, 2025, by InboxReads, 77% of newsletters submitted to the platform indicated curiosity in sponsorships and promoting partnerships, representing a rise from 72% within the earlier yr. This marked the primary yr that extra e-newsletter submissions supplied sponsorships than these declining promoting income.

In distinction, paid e-newsletter adoption remained flat at simply 2% of submissions, equivalent to 2024 figures. Publications providing paid upgrades alongside free content material declined from 12% to eight%, whereas totally free newsletters grew from 87% to 91% of submissions. The info suggests paid subscriptions, regardless of success tales on platforms like Substack, stay troublesome for many creators to execute successfully.

“That is the primary yr the place there hasn’t been a lot enhance within the share of paid and upgradable newsletters,” in line with the report. The findings point out that whereas subscription-based fashions generate sustainable revenue for established publications, the barrier to entry stays prohibitively excessive for rising newsletters searching for quick monetization.

The shift towards sponsorship income coincided with Substack’s determination to enter the promoting house, a major strategic pivot for a platform that beforehand positioned itself as champion of direct reader help. Substack’s promoting plans signify acknowledgment that almost all creators battle to construct subscription audiences massive sufficient to generate significant revenue by way of paywalls alone.

Subscribe PPC Land e-newsletter ✉️ for related tales like this one

Platform consolidation continues as Substack and beehiiv dominate market

Substack maintained its place because the dominant e mail service supplier in 2025, capturing 41% of e-newsletter submissions to InboxReads, a marginal enhance from 40% the earlier yr. The platform’s model recognition as successfully synonymous with e mail newsletters proved troublesome for opponents to beat, regardless of aggressive characteristic improvement elsewhere out there.

beehiiv, positioned as Substack’s major challenger, held 29% market share in 2025, declining barely from 33% in 2024. “Final yr, I used to be curious if it’d surpass Substack, however it’s powerful to beat the model recognition Substack has constructed,” in line with the report. The info demonstrates that whereas beehiiv maintained vital market presence, its progress trajectory slowed significantly in comparison with earlier years when it appeared positioned to probably overtake the market chief.

Mailerlite emerged because the third hottest platform with 5% of submissions in 2025, representing substantial progress from earlier years when it didn’t rank among the many high 5 suppliers. LinkedIn newsletters, leveraging the skilled community’s present person base, tied for third place with 4% of submissions. The platform’s funding in e-newsletter performance seems to be producing significant adoption amongst creators already embedded in LinkedIn’s ecosystem.

Ghost skilled shocking decline, falling from 8% to 4% of submissions regardless of years of constant progress. The open-source platform’s retreat suggests issue competing in opposition to well-funded opponents providing extra complete characteristic units and advertising assets. Equipment, previously ConvertKit, and Mailchimp rounded out the highest 5 suppliers.

Historic information reveals how platform market dynamics have advanced since 2018. Substack’s market share remained comparatively flat however vital throughout the measurement interval, whereas beehiiv demonstrated constant progress from its launch. “Looks as if these two are dominating the house and the others are blips on the radar,” in line with the report, which famous the problem smaller suppliers face trying to compete in opposition to established platforms with substantial model recognition and community results.

Content material range expands whereas AI protection grows modestly

Tech, enterprise, and startup matters continued to dominate e-newsletter submissions in 2025, sustaining patterns established in earlier years. Nevertheless, AI-focused newsletters grew from 4% of submissions in 2024 to six% in 2025, reflecting the know-how’s integration throughout practically each trade sector through the yr.

Historic tendencies present software program improvement and programming newsletters declining as share of whole submissions since 2018, which the report attributes to newsletters evolving “from a distinct segment medium to masking matters for everybody.” The democratization of e-newsletter publishing enabled creators throughout numerous topic areas to ascertain audiences, lowering the dominance of technology-focused content material that characterised the medium’s early progress.

High e-newsletter matters stabilized in 2025 after years of shifting preferences, with tech capturing 16% of submissions, enterprise 11%, and startups 10%. Self-improvement, finance, advertising, programming, tradition, information, well being, training, productiveness, politics, and journey all registered between 3% and seven% of submissions. “I solely count on to see modifications going ahead if some new development in tradition emerges the best way AI did previously few years,” in line with the report.

Reader pursuits, measured by way of InboxReads person conduct fairly than creator submissions, diverged from submission patterns. Tech newsletters grew to become essentially the most visited class in 2025, dethroning sports activities which had beforehand held the highest place. Journey newsletters dropped out of the highest 10 visited classes totally, representing a shocking shift given their constant reputation in earlier years. Enterprise, advertising, and information all entered the highest 10 most-visited classes.

The disconnect between what creators submit and what readers devour suggests potential alternatives for e-newsletter creators in underserved classes the place viewers demand exceeds content material provide.

Purchase adverts on PPC Land. PPC Land has customary and native advert codecs by way of main DSPs and advert platforms like Google Adverts. Through an public sale CPM, you may attain trade professionals.

Weekly publishing stays customary regardless of format experimentation

Weekly e-newsletter publishing maintained its place because the trade customary in 2025, with 54% of submissions adopting this cadence. Every day newsletters captured second place at 19% of submissions, whereas month-to-month publishing remained least well-liked at simply 7%. The distribution intently mirrored 2024 figures, suggesting creators have reached consensus round optimum publishing frequency for viewers retention and content material sustainability.

Historic information exhibits weekly publishing declining progressively from its peak, falling from over 70% of newsletters in early measurement years to 54% in 2025. Every day sending constantly held the quantity two place throughout the measurement interval. Twice-weekly, biweekly, and month-to-month publishing grew from practically nonexistent classes to claiming significant percentages of the market, with 11% of newsletters publishing twice weekly and 9% adopting biweekly schedules in 2025.

The diversification of publishing schedules displays creators experimenting with cadences matching their manufacturing capabilities and viewers expectations. Every day newsletters demand substantial content material creation assets however can construct deeper viewers habits, whereas weekly publications enable extra complete protection of matters with out overwhelming subscriber inboxes. Month-to-month newsletters, regardless of their low adoption fee, stay viable for in-depth evaluation or specialised skilled content material.

Google Ad Manager now supports Ads in Email Newsletters

Google Ad Manager introduces a new beta feature allowing publishers to serve reservation and programmatic guaranteed ads within email newsletters.

E-newsletter mortality stays constant at regarding ranges

Ten % of newsletters submitted to InboxReads in 2025 had already change into inactive by the point of the report’s publication in December, representing a slight enhance from 8% in 2024. The comparatively secure mortality fee suggests constant challenges going through e-newsletter creators trying to take care of publishing schedules and viewers engagement over prolonged durations.

The attrition fee highlights the problem of e-newsletter sustainability past preliminary launch enthusiasm. Creators face ongoing calls for for content material creation, viewers progress, and income technology whereas competing for consideration in more and more crowded inboxes. The ten% failure fee captures solely newsletters that survived lengthy sufficient to be submitted to a listing, suggesting precise e-newsletter mortality could also be considerably increased when accounting for publications that by no means attain public launch.

Profitable newsletters require not solely compelling content material but in addition constant publishing self-discipline, efficient viewers improvement methods, and viable monetization fashions. The comparatively excessive mortality fee amongst directory-submitted newsletters, which presumably signify extra dedicated creators than those that by no means formally launch, underscores the medium’s difficult economics for creators with out present audiences or income sources.

Curiosity in cross-promotion partnerships declined considerably in 2025, with 61% of e-newsletter submissions indicating willingness to take part in comparison with 74% the earlier yr. The decline continues a multi-year development as creators reassess the effectiveness of cross-promotion methods that originally appeared to supply environment friendly viewers progress.

“I do assume ineffective automated cross promotions had some half to play right here because it diluted the success of the strategy and possibly turned some creators off,” in line with the report. Early cross-promotion success tales led to proliferation of automated advice platforms that matched newsletters based mostly on class similarity fairly than real viewers alignment. The ensuing subscriber acquisition usually delivered low engagement charges as readers added by way of automated suggestions demonstrated restricted curiosity within the really helpful publications.

Subtle creators more and more favor selective partnerships with complementary newsletters serving related audiences fairly than broad cross-promotion packages. The shift towards extra strategic collaboration displays maturation of e-newsletter viewers improvement practices as creators acknowledge that subscriber high quality issues greater than uncooked listing dimension for each engagement metrics and monetization success.

The cross-promotion decline additionally suggests creators are diversifying their progress methods past newsletter-to-newsletter referrals. Social media promotion, SEO, and paid acquisition campaigns provide various viewers improvement channels which will ship extra predictable outcomes than partnership-dependent cross-promotion packages.

Outlook suggests continued platform consolidation and monetization evolution

The 2025 State of Newsletters report reveals an trade reaching maturity in a number of dimensions whereas persevering with to draw new creators throughout numerous matters. Substack and beehiiv have established dominant positions that seem troublesome for opponents to problem with out substantial differentiation or useful resource benefits. Smaller platforms face ongoing strain to both carve out distinctive niches or danger changing into irrelevant in a market characterised by sturdy community results and model recognition benefits.

Sponsorship monetization will possible proceed rising as creators acknowledge the challenges of constructing subscription audiences. The promoting mannequin affords extra predictable income for publications with modest however engaged audiences, even because it introduces potential conflicts round editorial independence and viewers belief. Platforms are responding to demand for promoting infrastructure, with Substack’s entry into sponsored content material representing acknowledgment that almost all creators want monetization paths past subscriptions.

“For those who’re an knowledgeable in a distinct segment that is not being catered to it is value beginning a e-newsletter there,” in line with the report, suggesting alternatives stay for creators in specialised matters regardless of total market maturity. The variety of e-newsletter matters continues increasing, although tech, enterprise, and startup content material maintains outsized illustration amongst new publications.

The constant 10% mortality fee amongst submitted newsletters signifies that sustainability challenges persist for creators coming into the medium. Profitable newsletters require not solely content material experience but in addition understanding of viewers improvement, platform capabilities, and monetization methods that align with particular viewers traits and creator capabilities.

Subscribe PPC Land e-newsletter ✉️ for related tales like this one

Timeline

- December 15, 2020: First State of Newsletters report highlights progress throughout pandemic yr

- December 22, 2021: Second annual report paperwork continued e-newsletter growth

- December 19, 2022: Third State of Newsletters report tracks platform evolution

- December 12, 2023: Fourth annual report analyzes monetization tendencies

- December 18, 2024: Fifth State of Newsletters report exhibits beehiiv progress

- December 17, 2025: Sixth annual State of Newsletters report reveals sponsorship dominance over paid subscriptions

Subscribe PPC Land e-newsletter ✉️ for related tales like this one

Abstract

Who: E-newsletter creators, e mail service suppliers together with Substack, beehiiv, Mailerlite, LinkedIn, Ghost, Equipment, and Mailchimp, analyzed by InboxReads by way of its annual trade report.

What: The e-newsletter trade shifted towards sponsorship monetization in 2025, with 77% of publications searching for promoting partnerships whereas paid subscription adoption stagnated at 2%. Platform consolidation continued with Substack sustaining 41% market share and beehiiv holding 29%, whereas cross-promotion curiosity declined to 61% of submissions.

When: Information covers newsletters submitted to InboxReads throughout 2025, with the sixth annual State of Newsletters report printed December 17, 2025.

The place: The evaluation encompasses newsletters submitted to InboxReads globally, with platform distribution and monetization tendencies reflecting the broader e mail e-newsletter trade.

Why: The shift towards sponsorship monetization displays the problem most creators face constructing subscription audiences massive sufficient to generate sustainable revenue by way of paywalls alone. Platform consolidation demonstrates community results and model recognition benefits that make competing in opposition to established suppliers more and more troublesome. Cross-promotion decline suggests creators are reassessing effectiveness of automated partnership packages that delivered low-quality subscriber progress.

Source link