Customers are turning to bank cards at accelerated charges this vacation season as monetary pressures reshape buying conduct throughout the USA. In line with TransUnion’s Q4 2025 Shopper Pulse Examine launched on November 20, 2025, 42% of People anticipate to depend on bank cards as their most well-liked fee methodology through the holidays, representing a four-percentage-point enhance from 38% in 2024.

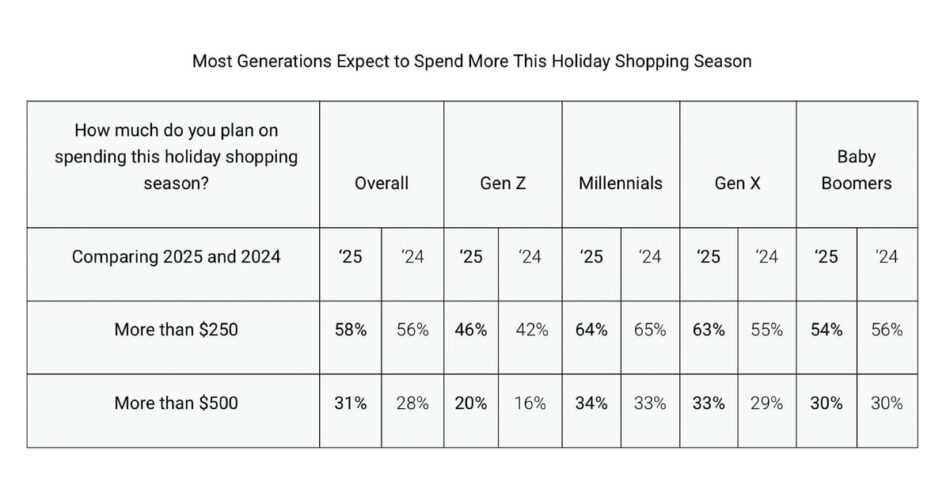

The research, carried out between October 1 and October 14, 2025, surveyed 3,000 adults and revealed persistent financial nervousness regardless of sturdy spending intentions. Almost six in 10 shoppers (58%) anticipate to spend greater than $250 this vacation season, up two share factors from 56% final yr. The findings arrive as retailers put together for his or her most important income interval amid ongoing considerations about inflation and worldwide commerce tariffs.

Subscribe PPC Land e-newsletter ✉️ for comparable tales like this one

Charlie Clever, senior vice chairman and head of world analysis and consulting at TransUnion, acknowledged: “As the vacation purchasing season kicks off in earnest subsequent weekend, our newest Shopper Pulse research suggests we might even see elevated spending this yr. It is clear that bank cards would be the most well-liked fee methodology for a lot of shoppers.”

The bank card desire marks a big behavioral shift. Almost 175 million People now maintain a number of energetic bank cards, based on TransUnion, representing regular development in each cardholders and open accounts. The rise in deliberate bank card utilization coincides with expectations for total spending ranges to stay close to file highs, with 31% of shoppers planning to spend over $500 in comparison with 28% in 2024.

Procuring conduct follows conventional patterns regardless of earlier promotional pushes by retailers. The best share of shoppers (41%) plan to buy on-line between Thanksgiving and Cyber Monday, whereas 33% intend to buy in particular person through the Thanksgiving weekend. These figures recommend promotional occasions through the conventional vacation kickoff interval retain their affect on buy timing.

Monetary optimism declines as revenue development moderates

General client optimism about family funds declined three share factors year-over-year. The research discovered 55% of People stay optimistic about their monetary scenario over the subsequent 12 months, down from 58% in Q4 2024. This represents a continuation of range-bound sentiment that has fluctuated between 54% and 58% since Q1 2023, with a single peak of 60% in Q3 2024.

The decline correlates with moderating revenue expectations. Simply 48% of shoppers anticipate their revenue to extend within the subsequent yr, down from 53% a yr in the past, whereas 43% anticipate revenue to remain the identical, up from 40% in 2024. Regardless of massive company layoffs and the federal authorities shutdown that started October 1, 2025, through the survey interval, solely 35% cited jobs amongst their prime three monetary considerations.

Youthful generations keep considerably increased optimism ranges. Gen Z (63%) and Millennials (65%) expressed constructive outlooks about their funds, in comparison with Gen X (50%) and Child Boomers (45%). Excessive-income households incomes $100,000 or extra yearly reported 63% optimism, although this represents a five-percentage-point decline from the earlier yr—the biggest lower amongst all revenue teams.

“We proceed to see a resilient client, at the same time as optimism has declined from its peak lately,” Clever added. “Uncertainty round tariffs and the timing of our analysis—carried out on the onset of the federal authorities shutdown—could also be contributing elements.”

The research revealed stark polarization throughout revenue ranges relating to monetary well being. Amongst households incomes $100,000 or extra yearly, 79% reported their funds had been higher than or as deliberate, in comparison with simply 51% of lower-income households incomes lower than $50,000 yearly. Inflation emerged as the important thing issue driving this divide: 77% of these whose funds had been worse than deliberate reported their incomes weren’t maintaining with inflation, in comparison with simply 13% of these whose funds had been higher than anticipated.

Inflation and tariffs dominate client considerations

Inflation stays the overwhelming monetary concern for American shoppers, with 81% citing it amongst their prime three worries affecting family funds over the subsequent six months. This determine holds regular with 80% in Q4 2024. Recession ranks because the second most typical concern at 52%, adopted by housing costs at 43%.

Groceries (79%) maintained their place as the worth enhance most regarding to shoppers, basically unchanged from 80% a yr in the past. Insurance coverage considerations elevated from 43% in Q4 2024 to 47% in Q4 2025, whereas medical care considerations rose from 41% to 45% over the identical interval.

Tariff nervousness weighs closely on client sentiment. The research discovered 86% of respondents reported at the very least some degree of concern over the impression of worldwide commerce tariffs on their family funds, with 34% saying they’re very involved. This represents a slight enhance from 85% in Q3 2025.

Excessive-income households demonstrated better resilience to inflation pressures. Amongst households incomes $100,000 or extra yearly, 45% mentioned their incomes saved up with inflation, in comparison with simply 26% of households incomes lower than $50,000 and 36% of middle-income households incomes between $50,000 and $99,999.

Purchase adverts on PPC Land. PPC Land has commonplace and native advert codecs through main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you possibly can attain business professionals.

Private consumption expenditure rose 0.6% in August 2025, based on the Bureau of Financial Evaluation cited within the research. This development occurred regardless of persistent financial uncertainty, demonstrating continued client resilience. Excessive-income households deliberate to take care of or enhance spending throughout a number of classes within the subsequent three months: medical companies (89%), digital companies (83%), retail gadgets like clothes and electronics (69%), discretionary gadgets together with eating out and journey (63%), and enormous purchases like home equipment and automobiles (56%).

Credit score demand indicators blended financial outlook

Plans to hunt new credit score or refinance present credit score declined to 30% in Q4 2025, down from 33% in Q3 2025 and 31% a yr in the past. Demand remained notably sturdy amongst youthful generations, with Gen Z (44%) and Millennials (46%) expressing considerably increased intentions to use for credit score in comparison with Gen X (27%) and Child Boomers (12%).

Amongst these planning to use for credit score within the coming yr, new bank cards remained the highest precedence at 55%, unchanged from earlier quarters. The fourth most typical credit score motion was growing obtainable credit score on present bank cards (20%), aligning with the broader development of shoppers utilizing bank cards to handle vacation budgets.

The quickest rising credit score motion was making use of for a brand new auto mortgage or lease, with 23% of credit score seekers planning this transfer, up from 19% in Q3 2025. New private loans (21%), mortgage refinancing (14%), and new residence fairness traces of credit score (12%) rounded out the highest credit score merchandise shoppers deliberate to pursue.

Two-thirds (66%) of shoppers reported having adequate entry to credit score and lending merchandise, whereas 68% mentioned they might be accepted in the event that they wanted new credit score. These figures recommend total confidence in credit score availability regardless of tightening credit score situations in some segments. Most shoppers (88%) take into account entry to credit score necessary for reaching monetary targets, although this varies by technology, with Gen Z (95%) and Millennials (96%) valuing credit score entry greater than Child Boomers (76%).

Credit score historical past (33%) and revenue or employment standing (29%) emerged because the main causes shoppers deserted plans to use for brand spanking new credit score or refinancing. Price considerations (24%) and uncertainty about whether or not modifications would sufficiently enhance fee conditions (24%) additionally factored closely in selections to desert credit score functions.

Margaret Poe, head of client credit score schooling at TransUnion, acknowledged: “Constructing a basis of sound monetary and credit score habits and working towards them persistently are the keys to long-term credit score well being. Customers who commonly monitor their credit score are effectively on their approach to placing themselves in a greater place to organize for in the present day’s credit score market.”

Credit score monitoring positive aspects significance regardless of inconsistent conduct

The research discovered 95% of People imagine monitoring their credit score studies is necessary, with 60% contemplating it extraordinarily or crucial. Regardless of this widespread recognition, precise monitoring conduct reveals important variation. Simply 54% of shoppers reported checking their credit score at the very least month-to-month, whereas 11% claimed they by no means monitor their credit score in any respect.

Youthful generations demonstrated essentially the most energetic credit score monitoring habits. Gen Z (65%) and Millennials (64%) reported checking their credit score at the very least month-to-month, considerably increased than Gen X (54%) and Child Boomers (45%). Every day monitoring remained comparatively uncommon at simply 6% of shoppers, whereas weekly monitoring captured 18% and month-to-month monitoring 30%.

Amongst shoppers who monitor their credit score studies, the highest motivations included defending in opposition to fraud (46%), monitoring for accuracy (44%), and bettering credit score scores (32%). The free nature of credit score monitoring companies influenced 47% of customers, making it the one most cited cause for checking credit score studies.

TransUnion launched Credit score Necessities earlier in 2025, offering free entry to each day credit score studies and scores, personalised credit score affords, and academic supplies. The platform affords alerts about important modifications to credit score studies, together with late funds, new accounts, and arduous inquiries, in addition to notifications about credit score rating shifts.

The service arrives as shoppers show sturdy curiosity in understanding their credit score standing earlier than opening new accounts. Of the 30% planning to use for brand spanking new credit score inside the subsequent yr, 55% intend to hunt new bank cards—making pre-application credit score checking notably related for this group.

Customers acknowledge that various knowledge sources might have an effect on their credit score scores. When requested how their credit score scores would change if companies used info not on commonplace credit score studies—corresponding to rental funds, short-term mortgage historical past, and purchase now, pay later loans—45% believed their scores would enhance, whereas 35% thought scores would stay the identical and 14% anticipated decreases.

Fraud and identification safety reveal safety gaps

In Q4 2025, 42% of shoppers reported being focused with e-mail, on-line, cellphone name, or textual content messaging fraud schemes however didn’t fall sufferer, representing a three-percentage-point enhance from Q4 2024. One other 7% mentioned they had been focused and fell sufferer, down from 9% a yr in the past. Simply 51% of shoppers reported being unaware of any fraud schemes focusing on them.

Phishing emerged as essentially the most steadily reported fraud scheme, with 46% of these focused experiencing fraudulent emails, web sites, social posts, or QR codes designed to steal knowledge. Smishing—fraudulent textual content messages meant to trick recipients into revealing knowledge—affected 45% of fraud targets, whereas vishing, fraudulent cellphone calls looking for delicate info, reached 34%.

Generational variations in fraud publicity had been pronounced. Amongst Gen X and Child Boomers, 51% reported experiencing phishing makes an attempt, in comparison with simply 30% of Gen Z and 43% of Millennials. This sample suggests older shoppers face increased focusing on charges for these conventional fraud-enabling scams, or show better consciousness of tried fraud.

Following knowledge breach notifications, client response proved insufficient to stop potential fraud. Among the many 30% of People notified that particulars about their identities or on-line accounts had been stolen within the final three months, lower than half (46%) checked affected accounts for unauthorized exercise and simply 41% modified passwords on affected accounts.

Proactive safety measures remained restricted. Round one-third of information breach victims modified passwords on unaffected accounts (34%) or checked credit score studies for unauthorized trades (36%). Simply 27% signed up for credit score or identification monitoring companies, 25% positioned freezes on credit score, and 18% closed affected accounts.

Broader cybersecurity behaviors confirmed comparable gaps between concern and motion. Simply over 1 / 4 (27%) of shoppers took no motion within the final 60 days because of cybersecurity considerations. Amongst those that did take motion, altering passwords (47%) and checking credit score studies (44%) had been most typical—each up two share factors from 2024. Nevertheless, solely 22% added safer login choices, 13% enrolled in identification monitoring, and 12% initiated credit score freezes or bought identification theft safety.

Amongst those that took no cybersecurity actions, 49% mentioned they had been not sure what steps to take, 17% selected to not make investments cash in safety, 16% felt overwhelmed by the choices, and 15% selected to not make investments time in safety measures.

Price range changes reveal spending priorities

Greater than half (52%) of shoppers in the reduction of on discretionary spending like eating out, journey, and leisure within the final three months, whereas 30% canceled subscriptions or memberships. These cuts affected all generations, with Child Boomers (52%), Gen X (56%), and Millennials (52%) lowering discretionary spending at comparable charges. Gen Z confirmed barely decrease discount charges at 50%.

Digital service modifications mirrored blended conduct. Whereas 20% total canceled or decreased digital companies, 11% added or expanded such companies, suggesting shoppers prioritize completely different digital choices primarily based on worth notion. Gen Z (19%) and Millennials (18%) had been almost definitely so as to add new digital companies regardless of financial pressures.

Debt and financial savings behaviors confirmed cautious optimism. Almost 1 / 4 (24%) saved extra in emergency funds, whereas 22% paid down debt sooner. Nevertheless, 17% elevated utilization of obtainable credit score, and 16% saved extra for retirement. Simply 15% in the reduction of on retirement financial savings, whereas 13% used retirement financial savings to cowl present bills.

Wanting forward three months, shoppers deliberate blended spending modifications throughout classes. For payments and loans, 40% anticipated to take care of present spending ranges, 45% anticipated maintaining spending the identical, and 11% deliberate decreases. Digital companies confirmed 53% anticipating secure spending, 25% planning will increase, and 18% anticipating cuts.

Discretionary spending plans revealed cautious shoppers: 44% anticipated to lower such spending, 32% deliberate to take care of present ranges, and 21% meant to extend spending on eating out, journey, and leisure. Giant purchases like home equipment and automobiles confirmed 35% planning decreases, 31% anticipating secure spending, and 18% intending will increase.

Medical care and companies demonstrated the strongest spending resilience, with 54% planning to take care of present ranges, 28% anticipating will increase, and simply 11% anticipating cuts. This sample displays the non-discretionary nature of healthcare bills regardless of monetary pressures.

Advertising and marketing implications for fourth-quarter campaigns

The TransUnion findings arrived as holiday spending forecasts indicated consumers would spend $890.49 per person, representing the second-highest quantity in 23 years of monitoring by the Nationwide Retail Federation. The correlation between bank card utilization intentions and total spending patterns suggests shoppers keep buying energy by way of strategic use of obtainable credit score.

Generational divides in monetary optimism and spending conduct current distinct alternatives for entrepreneurs. Younger consumers drove higher financial optimism and holiday spending intentions regardless of financial uncertainty, with Millennials and Gen Z demonstrating better willingness to take care of or enhance spending in comparison with older generations who exercised extra warning.

The focus of purchasing exercise throughout particular durations requires coordinated planning throughout promoting channels. November retail sales rose 4.53% year-over-year, establishing baseline expectations for December efficiency. The 41% of shoppers planning to buy on-line throughout Thanksgiving by way of Cyber Monday, mixed with 33% purchasing in particular person throughout Thanksgiving weekend, demonstrates the continued significance of conventional promotional durations.

Financial considerations have an effect on advertising and marketing technique past easy price range allocation. Tariff concerns pushed 34% of shoppers to start holiday buying early, reshaping promotional timing and messaging approaches. The 86% of shoppers involved about tariff impacts requires cautious communication about worth propositions with out explicitly referencing financial pressures.

Polarization throughout revenue ranges the place high-income households at 79% reported higher monetary positions in comparison with simply 51% of lower-income households requires precision focusing on. Retail media networks continue expanding their capabilities to allow refined viewers segmentation primarily based on buy historical past and monetary behaviors, making it attainable to deploy focused approaches assembly shoppers at completely different financial positions.

The fraud and safety findings recommend alternatives for monetary companies entrepreneurs to deal with rising client considerations about identification safety. With 49% of fraud targets experiencing phishing makes an attempt and solely 54% monitoring credit score month-to-month, instructional campaigns about safety greatest practices might construct model belief whereas addressing real client wants.

Subscribe PPC Land e-newsletter ✉️ for comparable tales like this one

Timeline

Subscribe PPC Land e-newsletter ✉️ for comparable tales like this one

Abstract

Who: TransUnion, a worldwide info and insights firm with over 13,000 associates working in additional than 30 international locations, carried out the analysis in partnership with third-party analysis supplier Dynata. The research surveyed 3,000 U.S. adults aged 18 and older throughout all 50 states, with quotas balancing responses to census statistics on age, gender, family revenue, race, and area.

What: The Q4 2025 Shopper Pulse Examine revealed 42% of People plan to depend on bank cards for vacation purchases (up from 38% final yr), 58% anticipate to spend over $250 throughout holidays (up from 56% final yr), 55% stay optimistic about family funds within the subsequent 12 months (down from 58% final yr), 48% anticipate revenue to extend within the subsequent yr (down from 53% final yr), and 86% categorical concern about tariff impacts on family funds.

When: The web survey was carried out October 1-14, 2025, spanning the primary two weeks of the U.S. authorities shutdown. TransUnion launched outcomes on November 20, 2025, forward of the Thanksgiving weekend (November 28-30) and Cyber Monday (December 1) that historically mark the beginning of peak vacation purchasing. The findings cowl client attitudes about present monetary situations and expectations for the subsequent 3-12 months.

The place: The analysis lined United States resident demographics with illustration from all 50 states, inspecting client attitudes and behaviors about family budgets, spending, debt, credit score entry, fraud safety, and identification monitoring throughout revenue ranges ($50,000 or much less, $50,000-$99,999, $100,000 or extra), generational cohorts (Gen Z 18-28, Millennials 29-44, Gen X 45-60, Child Boomers 61+), and geographic areas.

Why: The research issues for advertising and marketing professionals as a result of it demonstrates basic shifts in client fee preferences pushed by monetary pressures, with bank card utilization accelerating as the popular vacation fee methodology. The info reveals polarization throughout revenue ranges affecting buying energy and spending intentions, generational variations in monetary optimism requiring focused messaging approaches, persistent inflation and tariff considerations weighing on 81% and 86% of shoppers respectively, and gaps between fraud consciousness and protecting motion creating alternatives for monetary companies advertising and marketing. The focus of 41% of purchasing throughout Thanksgiving by way of Cyber Monday, mixed with 58% planning to spend over $250, makes fourth-quarter promoting effectiveness crucial for annual income targets throughout retail and monetary companies sectors.

Source link