In the event you had been hoping for some aid from stratospheric reminiscence pricing, do not maintain your breath. DRAM costs aren’t anticipated to peak till at the least 2026, TechInsights analyst James Sanders tells El Reg.

DRAM is an extremely broad class and consists of the whole lot from the DDR5 present in desktops and servers to the GDDR7 and HBM utilized by graphics playing cards and AI accelerators.

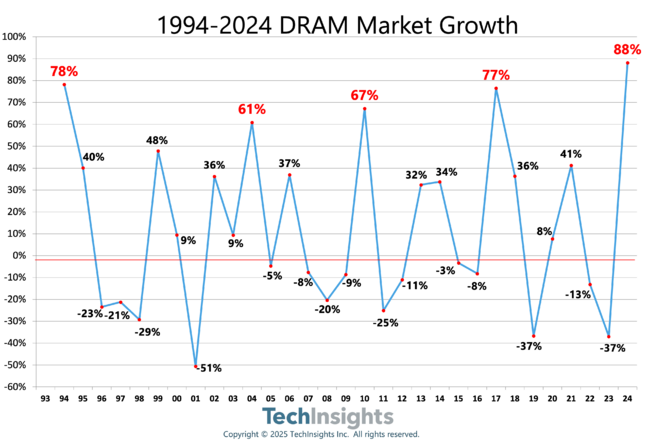

The market can also be notoriously unstable and liable to wild swings in pricing, spiking as inventories are drawn down and cratering as new capability is introduced on-line, Sanders explains.

In accordance with TechInsights, reminiscence pricing was already on the rise in 2024, rising 88 % from a quite steep valley the 12 months prior. Based mostly on earlier DRAM booms, one would possibly count on it to develop at a slower tempo in 2025, earlier than contracting in 2026 or 2027.

Nevertheless, Sanders tells us that is unlikely to occur this time round. “I believe we’re wanting on the peak in 2026,” he stated, including that even then he solely expects DRAM costs to settle in 2027 earlier than rising once more in 2028.

So what’s in charge for the sky-high reminiscence costs? Effectively, as you might need already guessed, it is AI. However it’s not the complete story. Timing can also be an element.

In accordance with Sanders, the AI growth kicked off at what was very presumably the worst time for reminiscence distributors. “This demand began within the Valley for the DRAM {industry}. That makes financially attempting to construct extra capability actually difficult,” he stated. “In the event you’re dashing, the time to convey extra capability on-line is about three years. It is a quirk of unhealthy timing that is led to the circumstances that we’re in now.”

Extra realistically, DRAM distributors, like Samsung, SK Hynix, and Micron, are 4 or 5 years to ramp manufacturing at a brand new fab, at which period the market circumstances may have modified significantly.

Timing can also be why the DRAM scarcity is hitting some more durable than others. “The buyer market is within the stratosphere, whereas OEMs are a few 12 months out, they usually’re not getting heartburn fairly but,” he defined.

In different phrases, big {hardware} distributors like Dell and HP aren’t struggling practically as a lot as a result of they have a tendency to lock of their orders early, whereas smaller distributors are on the mercy of spot pricing. The truth is, forward of the Christmas vacation, G.Ability, a provider of reminiscence for avid gamers, issued a statement pinning the blame for jacking the worth of its merchandise on AI.

“DRAM costs are experiencing vital industry-wide volatility, attributable to extreme world provide constraints and shortages, pushed by unprecedented excessive demand from the AI {industry},” the corporate wrote. “Because of this, G.Ability procurement and sourcing prices have considerably elevated. G.Ability pricing displays industry-wide element value will increase from IC suppliers and is topic to vary with out discover primarily based on market circumstances.”

What’s extra, AI is driving demand for a unique class of reminiscence that, in contrast to conventional DRAM, is not a lot use in most client purposes.

“It is a little bit completely different from earlier boom-bust cycles, in that wafers are being redirected towards HBM and away from consumer-grade reminiscence,” Sanders stated.

Excessive-bandwidth reminiscence consists of a number of layers of DRAM, which because the identify implies, permits it to realize a lot greater bandwidth than a typical DRAM module you would possibly discover in a pocket book or RDIMM. With HBM3e, it is not unusual to see a single 36 GB chip ship 1 TB/s of bandwidth. By comparability, a single 8 GB LPDDR5x module would possibly be capable of obtain 140 GB/s.

HBM is used nearly completely in high-end datacenter GPUs and AI accelerators, like Nvidia’s B300, AMD’s MI355X, or Amazon’s Trainium3. Due to this, Sanders says, the reminiscence market is quickly diverging.

“As a result of there is not any client demand for HBM — the buyer market cannot bear that worth in any respect — it’s actually turning into two markets which can be indifferent from one another,” he stated.

Reminiscence distributors are at the moment within the midst of a reminiscence transition as they put together to ramp manufacturing of HBM4 modules, which can energy chips like Nvidia’s Vera Rubin and AMD’s MI400s beginning subsequent 12 months. Initially, Sanders says these chips will command a worth premium.

And whereas TechInsights does count on the reminiscence market to settle in 2027, it will not final. As you could recall, Nvidia plans to cram 576 Rubin-Extremely GPUs every geared up with a terabyte of HBM4e reminiscence right into a single rack beginning in, that is proper, 2027.

This would possibly clarify why Micron CEO Sanjay Mehrotra not too long ago instructed traders that attributable to robust AI datacenter demand, “combination {industry} provide will stay substantially short of the demand for the foreseeable future.”

Not that he is actually complaining. Whereas finish prospects are grappling with reminiscence costs which have gone up 3x in only a few months, the reminiscence fabs are raking within the money. In Micron’s Q1 2026 earnings name this month, the corporate noticed revenues rise 56 % whereas web revenue greater than doubled from $1.87 billion this time final 12 months to $5.24 billion.

And whereas reminiscence distributors might now have the capital essential to finance extra fabs, it’s going to be at the least three extra years earlier than they enter manufacturing. And even after they do, the majority of capability is prone to be allotted towards HBM and different enterprise merchandise.

One wildcard in all of that is China’s CXMT, Sanders explains.

“CXMT would not essentially play by the identical algorithm that everybody else does,” he defined.

For one, they haven’t any significant HBM output right now. Second, many had anticipated the corporate to focus closely on DDR4, however as an alternative, Sanders says the corporate now seems to be transitioning to DDR5.

At present, CXMT is not a really giant participant within the DRAM enterprise. It definitely would not assist that the corporate is topic to United States export controls. Regardless of this, TechInsights expects the corporate to develop significantly by the top of the last decade from 5 to 10 % of the market, which ought to in concept assist develop the provision of DDR5 total. ®

Source link