Sponsored product commercial protection throughout main United States retail media networks elevated 7% year-over-year within the second half of 2025, with retailers demonstrating a elementary shift from static advert placements towards dynamic, algorithm-driven product positioning, based on data released by Pentaleap in its H2 2025 Sponsored Products Benchmarks Report.

The report, printed December 2025, analyzed desktop search outcomes from 12 main retail media networks together with Amazon, Walmart, The Residence Depot, Goal, Staples, Macy’s, Kroger, CVS, Lowe’s, Albertsons, Greatest Purchase, and Workplace Depot throughout the April by September 2025 interval. Pentaleap collected publicly obtainable information protecting 2,500 consultant key phrases throughout grocery, pharmacy, magnificence, style, electronics, workplace, and furnishings classes, monitoring greater than 3,500 identifiable manufacturers.

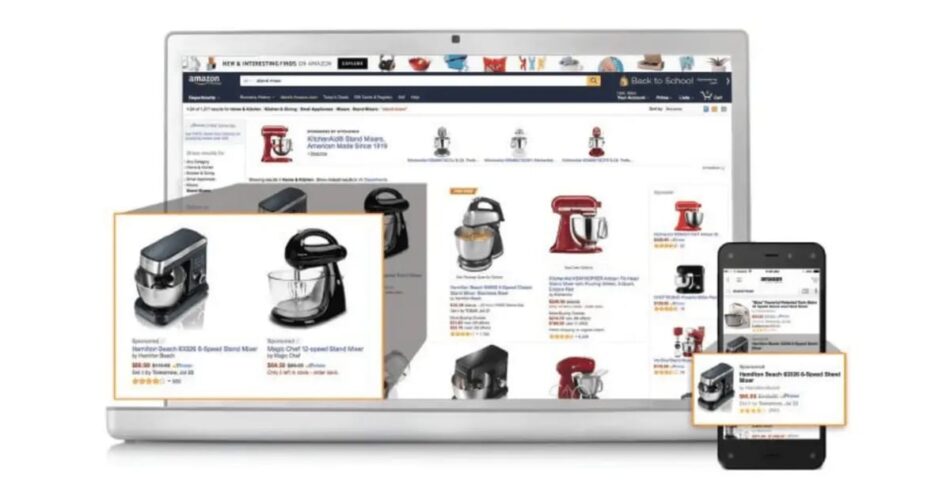

The protection growth displays rising advertiser demand for retail media placements, however the report identifies a extra important improvement: retailers are basically altering how they monetize search stock. A rising variety of networks now place ads dynamically all through product grids relatively than reserving particular mounted positions, enabling extra versatile stock administration and improved relevance matching.

Subscribe PPC Land publication ✉️ for comparable tales like this one

Main networks embrace fluid advert placement methods

Walmart achieved 100% sponsored product protection throughout tracked search queries in Q2-Q3 2025, sustaining a comparatively unchanged place from the earlier 12 months. Amazon remained at 99% protection throughout the identical interval. Nevertheless, a number of mid-tier retail media networks demonstrated substantial protection enhancements, with Albertsons recording an 81% improve to achieve 73% protection, The Residence Depot rising 20% to realize 94% protection, and Lowe’s increasing 35% to achieve 49% protection.

The Residence Depot’s growth proved notably notable from a strategic standpoint. The retailer elevated protection from an already substantial base whereas concurrently shifting towards extra distributed advert placement throughout product grid positions. This represents a departure from concentrated sponsorships in predetermined slots towards fluid positioning that harmonizes paid placements with natural search outcomes.

CVS and Macy’s emerged as standout examples of shops absolutely embracing dynamic advert supply. Each networks now distribute sponsored merchandise throughout all ten grid positions primarily based on efficiency indicators relatively than sustaining mounted premium slots. Macy’s particularly transitioned from a fixed-slot strategy noticed in 2024 towards full grid flexibility by September 2025, based on the benchmarking information.

Andreas Reiffen, CEO and co-founder at Pentaleap, said within the report: “The largest shift we’re seeing is not about who has essentially the most protection—it is about how retailers are utilizing it. Many main U.S. retailers tracked on this report are including stock. However past merely including extra slots, a rising quantity are inserting advertisements dynamically or utilizing a Fluid technique, harmonizing advertisements and natural to maximise each relevance and efficiency.”

The fluid strategy allows retailers to judge every search question individually, figuring out optimum advert placement primarily based on contextual relevance, product availability, pricing, and person intent indicators relatively than merely filling predetermined positions with highest bidders. This technique theoretically improves each shopper expertise and promoting efficiency by making certain promoted merchandise preserve relevance to go looking context.

Protection development concentrated in particular classes

Class-level evaluation revealed uneven growth throughout product verticals. Electronics maintained sturdy sponsored product presence all through the monitoring interval, with main manufacturers Samsung, TCL, and GE demonstrating year-over-year impression quantity will increase of 11%, 136%, and 82% respectively among the many high advertisers in that class.

Style class impressions grew extra modestly, with the highest ten manufacturers in that vertical recording collective 18% year-over-year development. Nevertheless, particular person model efficiency diverse considerably, with Jockey growing 176%, Levi’s increasing 36%, and Tops rising 79%, whereas different style advertisers confirmed declining sponsored presence.

Magnificence manufacturers demonstrated constant development all through the April-September interval, with Neutrogena rising because the class chief after growing sponsored presence 182% year-over-year. L’Oréal and Revlon maintained sturdy positions with 98% and 120% development respectively. The sweetness class’s sustained growth displays growing retailer funding in higher-margin product classes the place sponsored placements can drive important incremental income.

Grocery confirmed essentially the most volatility amongst main classes tracked. Ben’s Unique, Starbucks, and Jimmy Dean’s fluctuated considerably month-to-month, with Ben’s Unique absent from sponsored auctions in early spring earlier than returning to class management by September, although nonetheless under prior-year volumes. This sample suggests both funds reallocation or strategic testing amongst client packaged items advertisers in retail media channels.

Furnishings recorded the strongest year-over-year development amongst all classes analyzed, with the highest ten advertisers collectively increasing impression volumes 182%. New entrants together with Costco, Bestier, and EnHomeC drove this growth, whereas established furnishings retailers maintained comparatively steady presence. The class’s speedy development aligns with broader e-commerce growth in dwelling items following pandemic-accelerated digital adoption.

Key phrase technique turns into extra refined

Retailers demonstrated improved functionality to monetize each short-tail and long-tail search queries throughout the monitoring interval. Amazon, Walmart, Staples, Kroger, and Goal maintained constant sponsored product protection throughout one-word, two-word, three-word, and four-word queries, indicating mature algorithmic programs able to matching advertiser stock to various search contexts.

The Residence Depot recorded notably sturdy enchancment in two-word question protection, increasing from roughly 40% in Q2-Q3 2024 to roughly 70% in Q2-Q3 2025. This improvement suggests the retailer enhanced its key phrase matching algorithms or expanded advertiser participation throughout extra particular product searches.

CVS and Albertsons each achieved greater than 30 proportion level will increase in one-word question protection year-over-year, reaching the mid-80% vary. Nevertheless, each networks confirmed declining protection as question complexity elevated, suggesting their advert serving programs carry out higher with broad class searches than particular product requests. This sample signifies potential optimization alternatives as these networks mature their sponsored product applied sciences.

Workplace Depot maintained comparatively flat protection throughout all question lengths, hovering within the low-to-mid 20% vary no matter key phrase specificity. This constant efficiency throughout question sorts, whereas considerably under class leaders, suggests a deliberate technique targeted on particular product classes or advertiser segments relatively than complete key phrase monetization.

Purchase advertisements on PPC Land. PPC Land has commonplace and native advert codecs through main DSPs and advert platforms like Google Adverts. By way of an public sale CPM, you may attain business professionals.

Advert density varies by community technique

Common in-grid sponsored merchandise per web page load remained comparatively steady year-over-year for many retailers, with strategic changes occurring on the margins. Amazon continued to guide with roughly 17 in-grid placements supplemented by 23 carousel positions and 6 extra format placements per common web page load. Walmart adopted with 10 in-grid placements alongside 13 carousel positions and three extra codecs.

The Residence Depot diminished common in-grid placements barely from roughly 7 to six per web page whereas concurrently increasing general protection by 20 proportion factors. This trade-off suggests the retailer prioritized relevance over density, opting to point out fewer sponsored merchandise per search however extending protection to extra search queries general.

Albertsons demonstrated the same sample, reducing from roughly 7 in-grid placements to six.5 whereas attaining 81% protection development. This strategic adjustment probably displays the retailer’s transition towards extra selective advert serving primarily based on relevance indicators relatively than maximizing fill charge throughout all obtainable stock.

Goal and Walmart each elevated common advert load modestly, with Goal rising from roughly 4.5 to 4.8 in-grid placements and Walmart increasing from 8.5 to 10.5 placements. These will increase occurred alongside corresponding protection enhancements, suggesting each retailers recognized extra monetizable stock with out compromising shopper expertise.

Staples, Greatest Purchase, and Workplace Depot concentrated nearly all of sponsored merchandise above the fold, delivering greater than 50% of placements within the high half of search outcomes pages. This strategy contrasts with Amazon and Walmart, which distributed ads extra evenly all through all the web page, balancing premium positioning with complete key phrase protection.

Model participation shifts towards smaller advertisers

The distribution of sponsored product impressions shifted notably towards mid-tier and smaller manufacturers throughout the monitoring interval. Throughout all retailers analyzed, the “tail” phase—outlined as manufacturers showing in advert slots at frequencies under 0.2%—elevated from 33% to 35% of whole impression share year-over-year. In the meantime, “head” manufacturers showing at frequencies exceeding 1% declined from 36% to 34% of impressions.

The Residence Depot and Kroger demonstrated essentially the most dramatic shifts in advertiser combine. The Residence Depot diminished head model impression share from 31% to fifteen% whereas increasing tail model share from 32% to 47%. Kroger equally decreased head focus from 45% to 24% whereas rising tail illustration from 17% to 25%. These modifications point out each retailers efficiently onboarded quite a few smaller advertisers or that public sale dynamics shifted to favor long-tail model participation.

Amazon elevated head model focus barely from 8% to 13% whereas sustaining sturdy tail model illustration at 60% of impressions, down from 67% the prior 12 months. This sample suggests the most important retail media platform skilled renewed funding from main advertisers whereas retaining strong participation from rising and mid-tier manufacturers.

Market-enabled retailers collectively maintained 76% of impressions within the tail phase in comparison with 30% for non-marketplace retailers. This substantial distinction displays the structural benefit marketplaces possess by third-party vendor participation, which naturally expands obtainable advertiser stock past conventional vendor relationships.

Walmart demonstrated essentially the most balanced advertiser distribution amongst main networks, with solely 3% head focus, 23% torso illustration, and 75% tail participation. This distribution signifies extremely aggressive public sale dynamics with restricted model dominance, probably pushed by the retailer’s in depth market operations and aggressive retail media growth.

Electronics, magnificence, and grocery lead impression volumes

Electronics manufacturers commanded the best sponsored product impression volumes throughout all tracked classes, with Samsung producing roughly 32,000 model appearances throughout monitored search queries in Q2-Q3 2025. Workplace provides adopted, led by HP with roughly 48,000 appearances regardless of decrease general class protection, reflecting the focus of promoting funding on this vertical.

Magnificence and style manufacturers demonstrated sturdy year-over-year development in sponsored presence. Neutrogena’s 182% growth positioned it because the fastest-growing main advertiser within the magnificence class, whereas Calvin Klein and Wrangler achieved 79% and 75% development respectively in style. These beneficial properties replicate elevated retail media funding from client packaged items producers and attire manufacturers searching for to guard market share in aggressive classes.

Furnishings advertisers collectively achieved 182% impression quantity development, the strongest efficiency amongst all classes tracked. Costco emerged because the class chief with roughly 31,000 appearances, demonstrating how large-scale retailers can quickly construct sponsored product presence when committing sources to retail media growth. The furnishings class’s development aligns with broader tendencies in dwelling items e-commerce and suggests retailers are efficiently monetizing higher-consideration product classes.

Grocery manufacturers confirmed inconsistent efficiency patterns all through the monitoring interval. Ben’s Unique fluctuated from minimal presence in spring to class management in fall, finally recording 30% year-over-year decline regardless of the September restoration. Starbucks maintained extra constant presence with 166% development, whereas smaller manufacturers like Olipop and Hostess achieved 248% and 150% growth respectively. This volatility signifies grocery advertisers are actively testing seasonal methods and funds allocation fashions in retail media channels.

Format adoption stays concentrated in core placements

Most retailers maintained constant sponsored product format choices year-over-year, with in-grid placements remaining the dominant unit sort. All 12 networks tracked make the most of in-grid sponsored merchandise, whereas 10 of 12 supply product carousel codecs. Model carousel and video carousel adoption remained restricted, with solely 7 and 4 networks respectively implementing these enhanced codecs.

Macy’s added model carousel functionality throughout the monitoring interval, becoming a member of Amazon, Walmart, The Residence Depot, CVS, Staples, and Greatest Purchase in providing this format. Albertsons launched video carousel placements, turning into solely the fourth community alongside Amazon, Walmart, and Greatest Purchase to offer this premium format possibility. These additions point out continued format experimentation amongst mid-tier networks searching for differentiation and enhanced advertiser engagement.

Goal launched model carousel choices in late 2024 or early 2025, increasing format variety for advertisers on that platform. The timing aligns with Goal’s broader retail media growth following its Roundel rebranding and suggests the retailer is investing in aggressive function parity with bigger networks.

Regardless of format growth amongst some networks, adoption of enhanced items stays restricted in comparison with commonplace in-grid placements. This sample probably displays each technical implementation complexity and advertiser demand dynamics, with most manufacturers prioritizing primary sponsored product protection earlier than investing in premium format testing.

The focus in core codecs aligns with retail media growth patterns documented by IAB Europe, which reported sponsored merchandise because the central driver of the sector’s 22.1% growth in 2024 in comparison with 6.1% development within the broader promoting market. Standardized codecs allow simpler advertiser adoption and scalability throughout networks, supporting speedy market growth.

Programmatic integration allows unified marketing campaign administration

The retail media infrastructure supporting sponsored merchandise has advanced considerably throughout 2025, with a number of know-how suppliers introducing options that allow programmatic entry to onsite stock. Pentaleap and Teads announced an industry-first RTB integration in July 2025 that permits real-time bidding for sponsored product ads throughout a number of retail networks, addressing pace limitations that beforehand prevented programmatic options from functioning in retail environments.

Criteo became the first onsite retail media partner for Google Search Ads 360 in September 2025, offering advertisers entry to sponsored product stock throughout greater than 200 retail companions by Google’s established promoting interface. The combination goals to deal with operational complexity that has restricted advertiser adoption of retail media platforms past dominant gamers.

The Trade Desk partnered with Koddi in October 2025 to allow programmatic buy of onsite retail media stock together with sponsored product ads by unified marketing campaign administration infrastructure. The collaboration launched initially with Gopuff, with extra retailers anticipated to hitch in subsequent months.

These programmatic integrations replicate broader industry trends toward platform interoperability relatively than fragmented walled-garden approaches. As documented by IAB Europe analysis cited within the Pentaleap report, manufacturers working with 4 to 6 retail media networks doubled from 10% to 24% year-over-year, signaling clear diversification methods amongst advertisers that require extra environment friendly cross-network administration capabilities.

Macy’s integration of Amazon Retail Ad Service in November 2025 represents a special strategy to infrastructure consolidation, with the division retailer adopting Amazon’s promoting know-how to allow sponsored product campaigns by Amazon’s current marketing campaign administration instruments. This partnership supplies advertisers who already use Amazon Adverts a streamlined technique to interact Macy’s digital viewers with out constructing separate marketing campaign infrastructure.

The know-how developments throughout 2025 deal with elementary challenges which have characterised retail media growth. Traditionally, every retail media community required separate marketing campaign setup, inventive adaptation, reporting infrastructure, and optimization workflows. This fragmentation created operational limitations for advertisers searching for to activate campaigns throughout a number of retail environments, notably for mid-tier and smaller manufacturers missing devoted retail media sources.

The shift towards fluid advert placement methods carries important implications for advertisers managing sponsored product campaigns. Dynamic positioning primarily based on relevance indicators relatively than mounted premium slots reduces the predictability of placement location however theoretically improves general marketing campaign efficiency by higher matching of merchandise to shopper intent.

Advertisers accustomed to bidding aggressively for high grid positions may have to regulate methods as extra retailers undertake fluid approaches. Fairly than focusing totally on attaining place one or two, marketing campaign optimization ought to emphasize relevance indicators together with product content material high quality, pricing competitiveness, availability, and alignment with search context.

The growth of long-tail model participation suggests retail media platforms have gotten extra accessible to smaller advertisers. Networks that beforehand concentrated impression share amongst dominant manufacturers are actually distributing stock extra broadly, creating alternatives for rising manufacturers and area of interest merchandise to realize visibility in sponsored placements.

Nevertheless, the elevated competitors for sponsored stock additionally creates challenges. As extra manufacturers take part in auctions and retailers develop monetizable key phrases, cost-per-click charges could improve whilst impression volumes develop. Advertisers ought to monitor effectivity metrics fastidiously and modify bidding methods primarily based on precise conversion efficiency relatively than merely maximizing impression share.

The category-level efficiency variations documented within the report point out retailers are monetizing some product verticals extra successfully than others. Electronics and workplace provides command excessive impression volumes, suggesting mature public sale dynamics and powerful advertiser demand. Furnishings’s speedy development signifies rising alternative as retailers develop capabilities in higher-consideration classes.

For retail media networks, the benchmarking information reveals substantial headroom for protection growth amongst mid-tier platforms. Networks working under 80% key phrase protection have clear alternatives to extend monetization by improved algorithms, expanded advertiser recruitment, or enhanced marketing campaign administration instruments that scale back limitations to participation.

The fluid placement methods adopted by main networks exhibit a recognition that relevance drives efficiency in retail media environments. Consumers conducting product searches count on to see objects matching their intent, whether or not natural or sponsored. Networks that harmonize paid and natural outcomes by clever positioning could obtain higher shopper expertise metrics alongside improved promoting efficiency.

Subscribe PPC Land publication ✉️ for comparable tales like this one

Timeline

- January 9, 2025: Microsoft Promoting introduces Curate for Commerce and Sponsored Promotions by Manufacturers to assist retailers monetize first-party data

- April 17, 2025: IAB Europe publishes Guide to Sponsored Products revealing 22.1% retail media development versus 6.1% whole promoting market development

- July 15, 2025: IAB Europe releases updated retail media definitions protecting on-site, off-site and in-store promoting codecs

- July 24, 2025: Pentaleap and Teads announce RTB integration for sponsored products enabling real-time bidding throughout a number of retail networks

- September 10, 2025: Criteo becomes first onsite retail media partner for Google Search Ads 360 offering unified marketing campaign administration

- September 23, 2025: Topsort partners with Skai to develop international retail media attain throughout 40 international locations

- October 9, 2025: Trade Desk announces Koddi integration for onsite retail media stock with Gopuff as first companion

- November 8, 2025: Macy’s integrates Amazon Retail Ad Service for sponsored product campaigns

- November 11, 2025: Amazon launches Sponsored Products video format with interactive function thumbnails

- December 2025: Pentaleap releases H2 2025 Sponsored Merchandise Benchmarks Report documenting 7% protection development and fluid placement adoption

Subscribe PPC Land publication ✉️ for comparable tales like this one

Abstract

Who: Pentaleap analyzed sponsored product efficiency throughout 12 main United States retail media networks together with Amazon, Walmart, The Residence Depot, Goal, Staples, Macy’s, Kroger, CVS, Lowe’s, Albertsons, Greatest Purchase, and Workplace Depot, monitoring greater than 3,500 identifiable manufacturers.

What: Sponsored product commercial protection elevated 7% year-over-year throughout tracked retailers throughout Q2-Q3 2025, with important shifts towards dynamic “fluid” advert placement methods that distribute sponsored merchandise all through product grids primarily based on relevance indicators relatively than mounted premium positions. The Residence Depot, Albertsons, and Lowe’s recorded the strongest protection development at 20%, 81%, and 35% respectively.

When: The evaluation lined the April by September 2025 interval (Q2-Q3 2025), evaluating efficiency towards the identical interval in 2024. Pentaleap launched the benchmarking report in December 2025.

The place: The examine targeted solely on desktop search outcomes inside the USA market throughout 2,500 consultant key phrases spanning grocery, pharmacy, magnificence, style, electronics, workplace, and furnishings classes.

Why: The report issues for advertising professionals as a result of it paperwork elementary modifications in how retail media networks monetize search stock, shifting from mounted advert slots towards algorithm-driven placement that prioritizes relevance. This transition impacts marketing campaign technique, bidding approaches, and aggressive dynamics as smaller manufacturers acquire elevated entry to sponsored stock whereas main advertisers adapt to extra distributed placement patterns. The findings additionally exhibit substantial headroom for protection growth amongst mid-tier networks and reveal category-specific development alternatives for advertisers.

Source link