Commerce media networks throughout seven main industries stay in early maturity phases regardless of widespread adoption ambitions, in response to a benchmark study launched November 19, 2025, that assessed 788 decision-makers answerable for commerce media technique and execution.

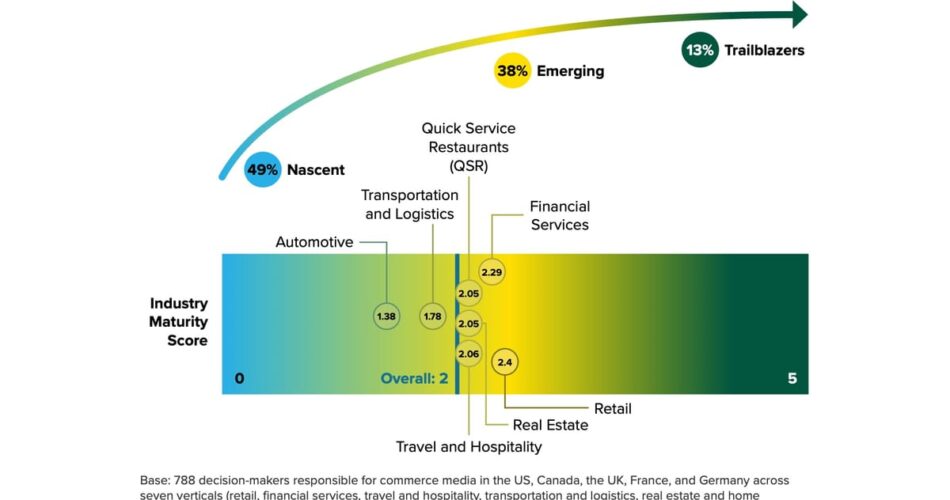

Koddi launched its commissioned commerce media benchmark examine carried out by Forrester Consulting, evaluating maturity throughout retail, journey and hospitality, monetary companies, transportation and logistics, actual property and residential companies, fast service eating places, and automotive sectors. The findings present that whereas 42% of respondents describe their commerce media operations as operationalized or absolutely superior, solely 13% meet the factors for “trailblazers” throughout technique, know-how, measurement and operations.

The analysis identifies a considerable hole between perceived and precise operational sophistication. Organizations with formalized applications usually lack the mixing, automation, and measurement capabilities required to function at scale. Practically half of respondents (49%) fall into the “nascent” class, operating pilots or casual sponsorships with out constant frameworks.

Subscribe PPC Land publication ✉️ for related tales like this one

Market potential drives strategic precedence

Commerce media is projected to exceed $1.3 trillion by 2030, in response to Koddi. The market sits on the intersection of media, knowledge, and commerce, remodeling transactional environments like retailer websites, reserving platforms, and supply apps into high-performing digital channels.

Networks are at completely different factors on their paths to scale, starting from early pilots to enterprise-grade applications. The examine gives a playbook serving to every trade apply finest practices from each other, establish gaps to maturity and speed up towards scalable commerce media networks.

Forrester carried out the web survey in July 2025, analyzing respondents from firms with annual revenues starting from $500 million to greater than $5 billion throughout North America and Europe. Respondents spanned advertising and marketing, monetization, operations, and knowledge management roles.

The analysis establishes three maturity segments primarily based on a framework anchored on 4 pillars: technique and management, platforms and know-how, measurement and attribution, and integration and operations. The general maturity rating stands at 2 out of a most of 5.

Retail leads however faces integration challenges

Retail emerged as essentially the most mature sector with 22% categorised as trailblazers, although most retailers lag in unifying their media ecosystems. Retail media is projected to capture 20% of global advertising revenue by 2030, representing roughly $300 billion in response to analysis monitoring the sector’s enlargement.

Regardless of sturdy foundations in knowledge and partnerships, retail networks face automation and scaling challenges. Solely 16% have achieved centralized or automated artistic administration, in response to the examine. Handbook opinions and disjointed instruments restrict agility and delay time to market.

Just below half (48%) report disconnected onsite, offsite, and in-store stock. Sixty-three p.c establish measurement as their largest barrier, with few in a position to monitor incrementality or closed-loop attribution throughout on-line and offline gross sales.

Monetary companies excel in knowledge, battle with activation

Monetary companies networks achieved 26% stating they provide full-funnel commerce media, however this largely displays rigorous knowledge governance moderately than full media readiness. The sector excels at managing delicate buyer knowledge responsibly but struggles with agile, scalable media execution.

Eighty-seven p.c of economic companies respondents establish bettering concentrating on and personalization utilizing first-party knowledge as a excessive or essential precedence. Robust compliance and consent frameworks give them a sturdy benefit in privacy-focused landscapes.

Nevertheless, regulatory approval and concentrating on stays a high barrier at 67%. Handbook assessment reliance and lengthy approval cycles stifle artistic testing and iteration. Solely 19% leverage AI-driven optimization, revealing restricted media activation capabilities regardless of sturdy knowledge maturity.

Practically half (45%) are exploring cobranded placements in e-commerce checkout flows and embedded finance alternatives. These partnerships lengthen attain whereas preserving strict compliance requirements.

Journey holds intent knowledge however faces fragmentation

Journey and hospitality firms seize precious client knowledge from search to reserving to loyalty redemption, but solely 8% qualify as trailblazers. Their problem facilities on changing wealthy intent alerts into scalable monetization.

Sixty p.c of journey networks activate in the course of the discovery section, 68% within the reserving funnel, and 50% post-booking. This breadth of activation gives end-to-end visibility, creating foundations for omnichannel promoting.

Complicated conversion paths stay problematic. Half cite lengthy reserving cycles and post-exposure attribution points, making advertiser ROI troublesome to reveal. Forty-five p.c report disconnected stock throughout onsite, in-app, and in-transit environments.

Retail media and connected television are converging as commerce media expands past conventional retail environments. Journey firms more and more associate with cost suppliers and loyalty applications to enhance measurement and concentrating on capabilities.

Purchase advertisements on PPC Land. PPC Land has normal and native advert codecs through main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you possibly can attain trade professionals.

Transportation, actual property, QSR, and automotive lag behind

Transportation and logistics networks have real-time knowledge however require unified governance, automation and integration to scale. Solely 4% self-reported providing full-funnel commerce media. Fifty-nine p.c prioritize first-party knowledge personalization, recognizing the facility of location, timing, and behavioral insights.

Actual property and residential companies have deep viewers belief however want unified techniques and automatic workflows to monetize at scale. Solely 15% are categorised as trailblazers. Forty-seven p.c report issue connecting purchaser, vendor, and repair supplier knowledge.

Fast service eating places have world-class transaction and loyalty knowledge however stay in early test-and-learn phases. Solely 14% stated they provide full-funnel commerce media. Sixty p.c of campaigns obtain their highest ROI by specializing in limited-time gives, making QSR media too tactical.

Automotive networks are wealthy in knowledge however restricted by fragmented execution. Solely 3% qualify as trailblazers. Greater than half (51%) cite inconsistent or unavailable vendor knowledge as a key impediment, whereas 55% report no closed-loop measurement from publicity to sale.

Automation and integration separate leaders

Networks that centralize and automate marketing campaign administration speed up time to market and unlock effectivity. Nevertheless, most nonetheless depend on handbook artistic approvals and have disconnected tech stacks and uncoordinated workflows.

Solely 12% can seamlessly activate and measure campaigns throughout onsite, offsite, and in-store environments, exposing the operational and knowledge silos that restrict omnichannel maturity. This represents a essential hole as programmatic infrastructure advances across retail media networks.

Eighty-seven p.c of respondents establish bettering concentrating on and personalization utilizing first-party knowledge as a essential or excessive precedence. Eighty-six p.c cite strengthening measurement and attribution to show ROI to advertisers, signaling a transparent shift towards accountability.

Superior organizations scale shortly by forging strategic partnerships to unlock incremental endemic and non-endemic demand. Monetary manufacturers associate with checkout suppliers whereas journey manufacturers collaborate with loyalty ecosystems.

Information and activation maturity not often align

Industries are mismatched of their sophistication of knowledge versus media. Monetary companies organizations excel in knowledge compliance but battle with agile, scalable media execution. Journey firms activate broadly throughout discovery, reserving, and loyalty phases but battle to unify knowledge and show ROI.

Nicholas Ward, president and co-founder of Koddi, said within the announcement: “One of the necessary insights on this examine is how otherwise every vertical is maturing. Retail leads in media sophistication, whereas monetary companies lead in knowledge. Each can supply insights that the remainder of the trade can be taught from.”

The examine examined how IAB Europe’s standardization efforts handle fragmentation challenges limiting sector development. Not like established digital promoting classes with mature measurement frameworks, commerce media has operated with out basic trade requirements.

Infrastructure holds again progress

Forty-two p.c of respondents describe their applications as operationalized or superior, revealing a large “confidence-to-capability” hole. Legacy infrastructure, lack of automation, and messy measurement stay constraints.

Funding priorities deal with measurable outcomes and data-driven execution. Eighty-five p.c cite driving incremental product gross sales as a essential or excessive precedence, whereas 84% prioritize producing incremental media income, exhibiting that development will depend on promoting efficacy.

Major platforms are adapting to meet commerce media demand. The Commerce Desk enabled programmatic retail media shopping for by way of integration with Koddi’s platform in October 2025, eliminating the necessity for separate marketing campaign administration throughout a number of networks.

Measurement as forex represents a basic shift. Strengthening measurement and attribution drives 86% of precedence rankings, demonstrating networks’ recognition that proving enterprise affect determines their aggressive positioning.

The analysis signifies each vertical faces the identical maturity mandate: combine, automate, and guarantee accountability. Regardless of completely different beginning factors, all networks should unify knowledge, automate execution, and show affect by way of closed-loop measurement to advance.

Subscribe PPC Land publication ✉️ for related tales like this one

Timeline

Subscribe PPC Land publication ✉️ for related tales like this one

Abstract

Who: Koddi commissioned Forrester Consulting to judge commerce media maturity throughout industries. The examine surveyed 788 senior decision-makers from organizations with annual revenues starting from $500 million to greater than $5 billion, representing retail, monetary companies, journey and hospitality, transportation and logistics, actual property and residential companies, fast service eating places, and automotive sectors.

What: A commerce media benchmark examine revealing that solely 13% of networks meet trailblazer standards throughout technique, know-how, measurement and operations, regardless of 42% describing their operations as operationalized or superior. The analysis identifies three maturity segments: nascent (49%), rising (38%), and trailblazers (13%).

When: Forrester carried out the web survey in July 2025, with Koddi releasing the findings on November 19, 2025. The examine examines commerce media’s present state because the market approaches projected $1.3 trillion worth by 2030.

The place: The analysis spans North America (United States and Canada) and Europe (United Kingdom, France, and Germany), analyzing commerce media maturity throughout seven main trade verticals with various ranges of operational sophistication and market readiness.

Why: The benchmark issues as a result of commerce media networks sit at completely different factors on their paths to scale, starting from early pilots to enterprise-grade applications. The examine gives a playbook serving to every trade apply finest practices, establish gaps to maturity and speed up towards scalable commerce media networks. The findings reveal that almost all organizations acknowledge commerce media’s potential to hyperlink advert spend on to measurable outcomes, however few have constructed the infrastructure, automation, and measurement disciplines required to scale successfully.

Source link