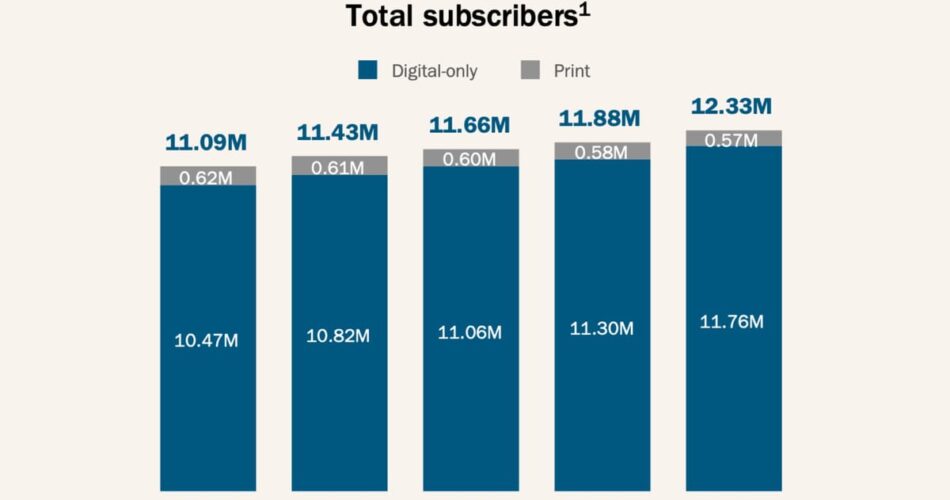

The New York Occasions Firm added roughly 460,000 internet digital-only subscribers throughout the third quarter of 2025, bringing its complete subscriber base to 12.33 million, in line with monetary outcomes introduced on November 5, 2025. Digital promoting revenues surged 20.3 p.c in comparison with the identical interval in 2024, demonstrating the writer’s continued capacity to monetize each readership and advertiser demand.

Whole digital-only common income per person elevated 3.6 p.c year-over-year to $9.79, pushed primarily by subscribers transitioning from promotional pricing to greater charges and worth will increase applied for sure tenured subscribers, in line with the earnings launch. The mix of subscriber progress and ARPU enlargement pushed digital-only subscription revenues up 14.0 p.c to $367.4 million for the quarter.

Digital promoting revenues reached $98.1 million within the third quarter, marking a 20.3 p.c improve from $81.6 million in the identical interval of 2024. The corporate attributed this efficiency to robust marketer demand and new promoting provide, in line with chief monetary officer Will Bardeen throughout the November 5 earnings name. Whole promoting revenues climbed 11.8 p.c to $132.3 million, partially offset by a 7.1 p.c decline in print promoting to $34.2 million.

The subscriber additions got here throughout a number of merchandise within the firm’s portfolio. Bundle and multiproduct subscribers now comprise 51 p.c of the overall digital-only subscriber base, reaching roughly 6.27 million. Information-only subscribers totaled roughly 1.56 million, whereas different single-product subscribers reached roughly 3.92 million as of September 30, 2025.

“Q3 was one other nice quarter throughout the board at The Occasions and our outcomes reveal that our technique is working as designed,” said Meredith Kopit Levien, president and chief govt officer, within the earnings launch. “We noticed robust income progress and we’re producing vital free money circulation.”

Working revenue elevated 36.6 p.c year-over-year to $104.8 million, whereas adjusted working revenue climbed 26.1 p.c to $131.4 million. Working revenue margin for the quarter reached 15.0 p.c, representing a year-over-year improve of roughly 300 foundation factors. Adjusted working revenue margin expanded to 18.7 p.c, up roughly 240 foundation factors from the prior yr interval.

Whole revenues grew 9.5 p.c to $700.8 million within the third quarter. Subscription revenues elevated 9.1 p.c to $494.6 million, with digital-only merchandise driving progress whereas print subscription revenues decreased 3.0 p.c to $127.2 million. The decline in print subscriptions mirrored decrease home home-delivery and single-copy revenues, in line with the corporate’s monetary statements.

Affiliate, licensing and different revenues elevated 7.9 p.c to $73.9 million, primarily pushed by greater licensing revenues. Digital affiliate, licensing and different revenues totaled $49.2 million for the quarter, in line with footnotes within the firm’s monetary statements.

Working prices rose 5.8 p.c to $596.0 million, with adjusted working prices growing 6.2 p.c to $569.4 million. Value of income climbed 5.2 p.c to $349.1 million, pushed primarily by greater journalism prices, subscriber servicing bills, and promoting servicing prices. Gross sales and advertising and marketing prices jumped 15.1 p.c to $79.6 million, whereas product growth prices elevated 9.8 p.c to $67.0 million.

The corporate invested closely in video journalism throughout the quarter, remodeling award-winning podcasts into video exhibits and introducing a brand new Watch tab in its flagship Occasions app. Video games product growth continued with the launch of Pips, a brand new logic puzzle. The writer additionally expanded its use of synthetic intelligence for automated voice options, personalization, concentrating on, and monetization throughout buyer journeys and promoting merchandise, in line with ready remarks from the earnings name.

Diluted earnings per share reached $0.50 for the quarter, an $0.11 improve year-over-year. Adjusted diluted earnings per share totaled $0.59, up $0.14 from the third quarter of 2024. The corporate generated $420.3 million in internet money from working actions throughout the first 9 months of 2025, in comparison with $258.8 million in the identical interval of 2024. Free money circulation reached $392.9 million for the nine-month interval, up from $237.7 million within the prior yr.

Money and marketable securities totaled $1.1 billion as of September 30, 2025, a rise of $184.9 million from year-end 2024. The corporate maintained a $400 million unsecured revolving line of credit score with no excellent borrowings as of quarter-end. In the course of the third quarter, the writer repurchased 482,833 shares of Class A Frequent Inventory for about $27.3 million, with roughly $393.0 million remaining licensed for repurchases as of October 31, 2025.

Third-quarter outcomes included $2.4 million in litigation-related prices related to the corporate’s lawsuit towards Microsoft Company and OpenAI Inc. alleging unauthorized use of journalism and content material for generative synthetic intelligence product growth. The quarter additionally included a $3.5 million cost associated to impairment of a non-marketable fairness funding.

For the fourth quarter of 2025, the corporate initiatives digital-only subscription revenues will improve 13 to 16 p.c year-over-year, with complete subscription revenues anticipated to develop 8 to 10 p.c. Digital promoting revenues are forecast to extend mid-to-high-teens, whereas complete promoting revenues ought to climb high-single-to-low-double-digits. Affiliate, licensing and different revenues are anticipated to extend mid-single-digits, with adjusted working prices projected to rise 6 to 7 p.c.

The efficiency displays broader trends in digital media monetization, the place subscription fashions mixed with diversified promoting income streams present publishers with a number of pathways to monetary sustainability. The corporate’s digital promoting progress outpaced many rivals throughout a interval when programmatic advertising platforms reported varied performance throughout completely different market segments.

Bundle and multiproduct ARPU reached $12.84 within the third quarter, up from $12.35 in the identical interval of 2024. Information-only ARPU climbed to $12.67 from $11.48 year-over-year, whereas different single-product ARPU remained comparatively steady at $3.51. The variations in ARPU throughout product classes mirror completely different pricing methods and worth propositions, much like patterns noticed throughout social media platforms with diverse monetization approaches.

Purchase adverts on PPC Land. PPC Land has commonplace and native advert codecs by way of main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you may attain trade professionals.

Capital expenditures totaled roughly $8 million within the third quarter, in comparison with roughly $6 million within the prior yr interval. For full-year 2025, the corporate expects capital expenditures of roughly $35 million, depreciation and amortization of roughly $85 million together with roughly $28 million of acquired intangible belongings amortization, and curiosity revenue and different internet of roughly $40 million on a pre-tax foundation.

The corporate’s promoting efficiency got here regardless of ongoing industry challenges around measurement and attribution, with digital promoting infrastructure going through scrutiny over concentrating on accuracy and transparency. The New York Occasions attributed its promoting energy to a portfolio of compelling merchandise in areas with broad marketer enchantment together with sports activities, video games, and buying, mixed with a big engaged viewers that entrepreneurs can goal successfully.

Media bills, representing prices to advertise the subscription enterprise, elevated 18.0 p.c to $41.3 million from $35.0 million within the third quarter of 2024, primarily pushed by greater model advertising and marketing bills. This funding in subscriber acquisition occurred as the corporate maintained confidence in its capacity to widen the quantity of people that use and interact deeply with its content material throughout a number of platforms.

Subscribe PPC Land e-newsletter ✉️ for related tales like this one

Timeline

- November 5, 2025: The New York Times announces Q3 2025 earnings, reporting 460,000 internet digital subscriber additions and 20.3% digital promoting income progress

- September 30, 2025: Quarter ends with 12.33 million complete subscribers, together with 11.76 million digital-only subscribers

- Third quarter 2025: Firm launches Pips logic puzzle, expands video journalism throughout platform, introduces Watch tab in flagship app

- Third quarter 2025: Bundle and multiproduct subscribers surpass 50% of digital-only base for first time, reaching 6.27 million

- Could 2024: Company reports Q1 2024 results displaying continued digital subscription momentum

- First quarter 2024: Firm begins reporting litigation prices associated to generative AI lawsuit against Microsoft and OpenAI

Subscribe PPC Land e-newsletter ✉️ for related tales like this one

Abstract

Who: The New York Occasions Firm (NYSE: NYT), a publicly traded media group led by president and CEO Meredith Kopit Levien and CFO Will Bardeen, serving greater than 12 million subscribers throughout print and digital merchandise together with information, video games, sports activities, cooking, and buying content material.

What: Third-quarter 2025 monetary outcomes displaying 460,000 internet digital-only subscriber additions, 14.0% digital subscription income progress to $367.4 million, 20.3% digital promoting income improve to $98.1 million, 9.5% complete income progress to $700.8 million, 36.6% working revenue improve to $104.8 million, and expanded working margins reaching 15.0%.

When: Outcomes introduced November 5, 2025, protecting the quarter ended September 30, 2025, with earnings convention name held at 8:00 a.m. Japanese Time that morning and monetary steerage supplied for fourth quarter 2025 and full-year expectations.

The place: World operations headquartered in New York with digital merchandise reaching subscribers worldwide, investor communications distributed via firm web site traders.nytco.com, and companies delivered throughout net platforms, cell functions, related tv, and conventional print distribution channels.

Why: Outcomes reveal profitable execution of subscription-first technique combining world-class journalism with way of life merchandise in giant addressable markets, a number of income stream diversification via promoting and licensing progress, strategic investments in video and AI know-how to reinforce person engagement, and operational self-discipline enabling margin enlargement whereas sustaining product growth spending throughout information and rising codecs.

Source link