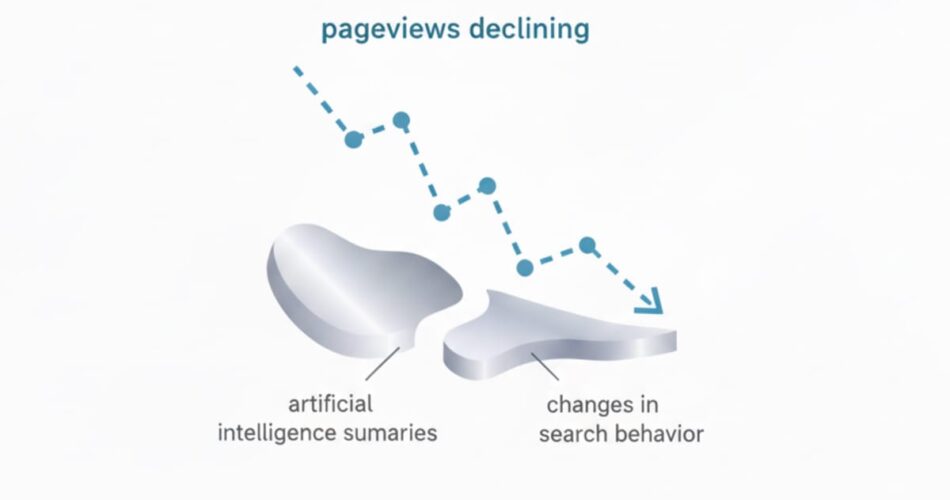

On November 6, 2025, Teads Holding Co. introduced third-quarter monetary outcomes that uncovered a structural problem dealing with digital publishers: pageviews are declining sooner than anticipated, pushed by synthetic intelligence summaries and modifications in search habits. The corporate reported that publishers throughout its community skilled roughly 10-15% pageview declines through the third quarter, in line with CEO David Kostman through the earnings name.

The admission marks one of many first occasions a serious promoting know-how platform has quantified the site visitors influence publishers face from AI-powered search options. Teads works with hundreds of premium publishers globally, giving the corporate direct visibility into web site site visitors patterns throughout various content material classes and geographic markets.

“The decline of web page views is accelerating due to AI summaries and modifications in discovery,” Kostman said through the November 6 earnings name. The corporate disclosed that income reached $318.8 million within the third quarter, representing 42% progress year-over-year on an as-reported foundation however a 15% decline on a professional forma foundation after accounting for the Outbrain merger accomplished earlier in 2025.

The pageview decline immediately impacts Teads’ enterprise mannequin, which relies on serving ads throughout writer web sites. Chief Monetary Officer Jason Kiviat defined that site visitors reductions represented one element of a $10 million income headwind through the quarter. “Publishers, we noticed a decline of roughly 10-15% in web page views throughout Q3 2025,” Kiviat confirmed, with single-digit declines in in-app site visitors following related traits from prior quarters.

Publishers have responded to falling pageviews by making an attempt to extend income per thousand impressions, however these pricing changes have confirmed inadequate to offset quantity losses. The corporate famous that whereas publishers search greater RPMs to compensate for site visitors declines, the general influence on promoting revenues stays unfavorable throughout the platform.

The site visitors challenges align with broader industry patterns documented throughout 2025. Analysis from Ahrefs revealed in April 2025 discovered that when AI Overviews seem in search outcomes, the primary natural hyperlink loses a median of 34.5% of clicks. Further research have documented declines reaching 54.6% for sure question varieties when AI-generated summaries present direct solutions inside search interfaces.

Google Community promoting revenues declined 1% year-over-year to $7.4 billion through the second quarter of 2025, according to Alphabet’s July earnings announcement, reflecting diminished monetization alternatives for publishers collaborating in AdSense, AdMob, and Google Advert Supervisor applications. The decline means that diminished site visitors from Google Search is starting to influence writer monetization capabilities throughout the promoting ecosystem.

BuzzFeed reported on the same day as Teads that direct site visitors to BuzzFeed.com now surpasses each Fb and Google referrals, with direct visits, inside referrals, and app utilization accounting for 63% of site visitors. The shift away from exterior platform dependency comes as Fb referral site visitors has plummeted 50% for publishers over the previous 12 months, whereas Google dominates 63.41% of all U.S. web site referrals however more and more retains customers inside its personal ecosystem by way of AI options.

Teads’ demand-side platform enterprise skilled explicit stress through the quarter. A small variety of giant shoppers exited the DSP, resulting in a $5 million decline in Ex-TAC income, which represents roughly two-thirds of the DSP phase. “The income influence of those components has been bigger than anticipated, most notably in our DSP enterprise, the place a number of giant shoppers considerably diminished their scale throughout our platform,” Kiviat said.

The corporate’s related tv enterprise offered a contrasting progress narrative. CTV income grew roughly 40% year-over-year through the third quarter on a professional forma foundation, reaching a trajectory to realize $100 million for the total 12 months. Linked TV now represents about 6% of Teads’ complete promoting spend, with margins increasing year-over-year as the corporate scales its CTV choices and additional differentiates its merchandise.

Teads has executed over 2,500 HomeScreen CTV campaigns since launching the product, securing partnerships with TCL and Google TV through the quarter. The corporate positions its CTV HomeScreen product as differentiated throughout the fastest-growing format in connected television advertising, the place business information initiatives budgets to double from 14% in 2023 to twenty-eight% in 2025.

The corporate launched CTV Efficiency globally through the quarter, introducing optimization and measurement capabilities that join premium streaming publicity to deterministic downstream outcomes together with web site visits and conversions. The measurement solution marks a shift from impression-based metrics to outcome-driven promoting on streaming platforms, addressing persistent attribution challenges in CTV campaigns.

October efficiency information offered restricted encouragement for administration. Income and bookings in cross-sell actions grew over 55% month-over-month throughout October, although this progress got here from a small base following the Outbrain merger integration. The corporate emphasised that constructing significant income from cross-sell alternatives requires prolonged timeframes as advertisers check new stock sources and publishers consider new demand companions.

Teads offered fourth-quarter steerage anticipating Ex-TAC gross revenue between $142 million and $152 million, with adjusted EBITDA steerage between $26 million and $36 million. Administration introduced no less than $35 million in annualized adjusted EBITDA enchancment from new operational initiatives, with preliminary influence starting within the fourth quarter of 2025.

Purchase advertisements on PPC Land. PPC Land has commonplace and native advert codecs by way of main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you may attain business professionals.

The corporate acknowledged $14 million in value synergies through the third quarter, approaching a $60 million annual run charge for 2026 that had been beforehand guided. Administration prompt extra value discount alternatives stay out there past the preliminary $60 million goal. Working bills elevated year-over-year, pushed primarily by the acquisition influence, with $4 million of acquisition and integration-related prices and $1 million of restructuring expenses recorded through the quarter.

Ex-TAC gross revenue reached $130.5 million within the third quarter, rising 119% year-over-year on an as-reported foundation. The expansion charge exceeded income progress as a consequence of favorable income combine modifications ensuing from the Outbrain acquisition, supplemented by continued enhancements in income combine and RPM progress within the legacy Outbrain enterprise. Adjusted EBITDA totaled $19.2 million for the quarter.

Money circulation efficiency confirmed important stress. Adjusted free money circulation represented a $24 million use of money through the quarter, pushed by a $32 million semiannual curiosity fee. The corporate ended the quarter with $138 million in money, money equivalents, and marketable securities, alongside €15 million in short-term overdraft and $628 million in long-term debt at a ten% coupon maturing in 2030.

Teads introduced organizational modifications through the earnings name, together with the appointment of Molly Spielman as Chief Business Officer to guide the restructured go-to-market group. The operational modifications carried out through the second and third quarters in the USA and Europe have produced measurable enhancements in gross sales pipeline improvement, however administration acknowledged that the timeline to understand income from these pipeline enhancements has confirmed longer than initially anticipated.

The three key markets of the USA, United Kingdom, and France—which collectively characterize roughly 50% of income—are driving all the headwind on the legacy Teads enterprise, with many different international locations remaining impartial or rising. The DACH area, which represents Teads’ second-largest market, has proven progress throughout this era of broader challenges.

Administration expressed confidence within the strategic thesis behind the Outbrain merger and the potential of the mixed cross-screen, outcome-driven branding and efficiency promoting platform. The corporate emphasised give attention to money circulation technology and profitability enchancment whereas working to speed up the return to progress by way of the operational modifications carried out throughout latest quarters.

Teads indicated plans to check new proof-of-concept initiatives to monetize AI giant language mannequin inputs, representing one potential avenue to take part within the site visitors patterns reshaping writer economics. The corporate has not disclosed particular timeline particulars or income expectations for these AI monetization experiments.

The implications for digital promoting lengthen past a single quarter’s monetary outcomes. Publisher traffic declines documented across 2025 counsel elementary modifications in how audiences uncover and devour content material, with synthetic intelligence options offering direct solutions inside search interfaces moderately than directing customers to writer web sites. These site visitors patterns create challenges for promoting know-how platforms whose enterprise fashions rely upon commercial supply throughout third-party writer properties.

Teads’ admission of quantified pageview declines gives concrete information supporting what many publishers have reported anecdotally all through 2025. The ten-15% site visitors discount throughout a single quarter, if sustained or accelerated, would characterize a fabric problem to digital media economics constructed round page-based promoting impressions. Publishers making an attempt to compensate by way of greater RPMs face sensible limits on pricing will increase earlier than advertisers shift spending to different channels.

The distinction between declining internet pageviews and rising related tv income inside Teads’ portfolio illustrates the broader transition occurring throughout digital promoting. Connected television’s share of media budgets is projected to double from 14% in 2023 to 28% in 2025, with 72% of entrepreneurs planning to extend programmatic promoting funding. This progress happens as conventional internet site visitors faces headwinds from AI-powered search options and altering person discovery patterns.

The monetary stress on promoting know-how platforms depending on writer site visitors creates incentives for enterprise mannequin diversification. Teads’ funding in related tv measurement capabilities, outcome-driven promoting options, and potential AI monetization represents efforts to take part in rising income streams whereas managing declines in legacy pageview-based stock.

Timeline

- February 3, 2025 — Teads completes merger with Outbrain, combining operations throughout complementary promoting platforms

- April 17, 2025 — Ahrefs research documents 34.5% organic click reduction when AI Overviews appear

- July 23, 2025 — Google Network advertising revenues decline 1% to $7.4 billion amid AI feature expansion

- August 7, 2025 — Google revenue shift reaches 90% as network advertising faces decline

- September 25, 2025 — Teads research shows CTV HomeScreen ads achieve 48% attention rate

- October 16, 2025 — Raptive drops pageview requirement from 100,000 to 25,000 monthly visits

- October 23, 2025 — Teads launches deterministic CTV measurement for streaming campaigns

- November 6, 2025 — Teads experiences Q3 outcomes with 10-15% writer pageview decline and 40% CTV progress

- November 6, 2025 — BuzzFeed shifts away from Google and Facebook as direct traffic reaches 63%

Abstract

Who: Teads Holding Co., a publicly-traded promoting know-how platform working with hundreds of premium publishers globally, alongside CEO David Kostman and CFO Jason Kiviat who disclosed the site visitors traits through the earnings name.

What: The corporate reported publishers throughout its community skilled 10-15% pageview declines through the third quarter of 2025, pushed by AI summaries and modifications in discovery patterns, whereas related tv income grew 40% year-over-year, demonstrating divergent traits throughout digital promoting codecs.

When: The monetary outcomes cowl the quarter ended September 30, 2025, with the earnings announcement and name occurring on November 6, 2025, offering the primary quantified disclosure from a serious promoting platform about AI-driven writer site visitors impacts.

The place: The site visitors declines affected publishers globally throughout Teads’ community, with explicit stress in the USA, United Kingdom, and France—three markets representing roughly 50% of the corporate’s income—whereas different areas together with DACH confirmed impartial or optimistic traits.

Why: Synthetic intelligence summaries in search outcomes and altering person discovery patterns are retaining audiences inside search interfaces moderately than directing site visitors to writer web sites, creating structural challenges for promoting platforms whose enterprise fashions rely upon serving ads throughout third-party writer properties whereas concurrently driving progress in different codecs like related tv that function with completely different site visitors dynamics.

Source link