Have you ever ever observed your revenue margins shrinking, even when your gross sales are regular? It could be extra than simply rising prices — the actual situation could possibly be income leakage.

Income leakage occurs when earned revenue slips by means of gaps in your system. This could possibly be as a result of billing errors, handbook processes, or missed renewals that go unnoticed.

Every mistake could seem small, however over time, it results in important misplaced income and disrupts your money circulate. Most corporations don’t even detect the leaks till they’ve already misplaced 1000’s of {dollars}.

On this put up, you’ll study the whole lot that you must learn about income leakage and tips on how to repair the workflow points that trigger it.

What’s income leakage?

Income leakage is the lack of revenue your corporation has earned however by no means truly receives. It’s not attributable to poor gross sales or market downturns, however by avoidable errors and inefficiencies.

The problem is that these income leakages usually occur quietly throughout routine operations. For instance, points reminiscent of a missed bill, an expired contract, or an unbilled service can rapidly add up.

Even a 1% leak can eat into your revenue margins and disrupt your money circulate over time. That won’t sound like a lot at first, however for a corporation incomes $10 million, that’s as much as $100,000 in misplaced income.

Consider it like a leaking bucket. You retain producing new gross sales, but when these holes aren’t sealed, your income will nonetheless drain away.

Frequent causes of income leakage

Now that what income leakage is, let’s take a look at the causes and examples of income leakage. Each one among these small cracks can lead to income leakage if ignored.

Beneath are the frequent causes of income leakage and the way they present up in real-life situations.

1. Handbook processes

Counting on spreadsheets and handbook entry leaves your operations weak to errors, inefficiencies, and inconsistencies. Handbook processes decelerate workflows, improve the chance of errors, and make it tough to enhance customer experience and guarantee accuracy throughout billing cycles.

Handbook information entry is susceptible to errors that can lead to income leakage. A single lacking zero or incorrect amount can skew your income figures. These minor discrepancies can accumulate to important losses.

Past the monetary impression, handbook processes additionally harm customer experience. Delayed invoices, incorrect billing, or refund errors can frustrate prospects and weaken their belief in your model.

Additionally Learn:

2. Billing errors

Duplicate invoices, missed fees, or inaccurate billing can quietly drain your income. One small typographical error can value lots of and even 1000’s of {dollars} over time.

Think about a SaaS firm with lots of of subscriptions. Whereas some accounts renew mechanically, a missed billing schedule replace could cause income leakages. These ignored renewals usually go unbilled for months, quietly costing the corporate 1000’s in misplaced income earlier than anybody even notices.

Moreover, unbilled renewals or failed funds can result in involuntary churn, the place prospects lose entry with out that means to cancel.

3. Low cost misuse and pricing errors

Unauthorized reductions, outdated pricing fashions, or mismatched charges can injury your revenue margins. Even minor pricing errors can snowball into severe monetary gaps.

Let’s say your gross sales crew runs a limited-time promo for 15% off. However the code by no means expires, and prospects maintain utilizing it for months. That small mistake can cut back margins and have an effect on your revenue forecasts.

Though misused reductions would possibly increase short-term gross sales, they will additionally create confusion that impacts customer engagement.

4. Contract mismanagement

Service-based companies usually lose observe of billable hours when contracts or timesheets aren’t up to date correctly, which may result in income leakage.

For instance, a producing firm indicators multi-year provide contracts however lacks a centralized monitoring system. When some contracts expire unnoticed, the corporate retains supplying merchandise with out updating billing data.

Over time, this oversight causes important income leakage. Poorly tracked or outdated buyer contracts could cause missed renewals and unbilled providers.

Poorly managed contracts don’t simply impression income, in addition they undermine your customer satisfaction goals. At present’s prospects count on accuracy, transparency, and consistency in each billing and customer service delivery.

5. Poor communication between groups

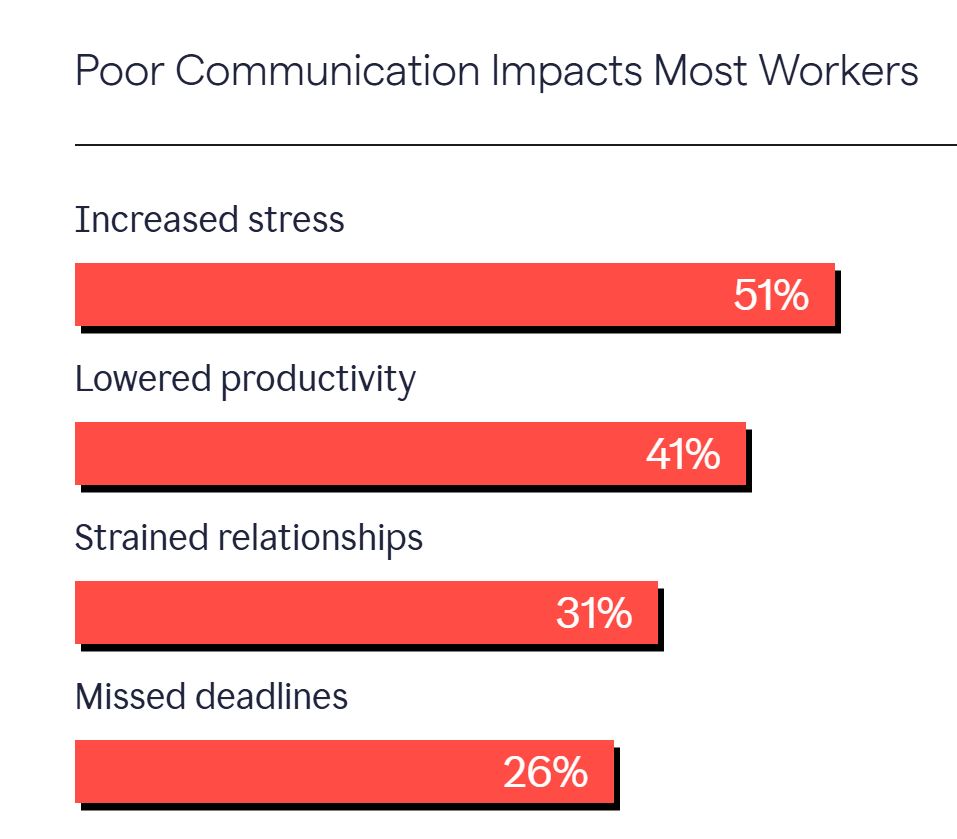

Poor communication throughout groups is a significant explanation for income leakage. A 2024 report confirmed that poor communication elevated stress amongst employees, resulting in decrease productiveness and missed deadlines. These gaps silently erode income over time.

Picture through Grammarly

Missteps reminiscent of unrecorded reductions, mismatched invoices, and delayed collections regularly stem from cross-departmental misalignment.

With out effective communication and interdepartmental collaboration, even probably the most superior automation or reporting instruments can not solely stop these income leakages.

You should make your business more productive as these inefficiencies cut back visibility and make it tougher to search out income leakage.

6. Weak follow-up and overdue funds

One of many greatest challenges SaaS companies face is weak follow-up on funds, which frequently results in overdue invoices piling up.

When invoices aren’t persistently tracked and reminders aren’t despatched promptly, prospects could merely neglect to pay or delay funds. These could cause unseen income leakage that quietly impacts your money circulate.

One other situation that always goes unnoticed is utilization monitoring errors. If a buyer exceeds their subscription limits however isn’t billed for the additional utilization, your corporation finally ends up absorbing these prices. Over time, these contribute to important income leakage.

Additionally Learn:

How you can calculate income leakage

So, how will you inform precisely how a lot cash is slipping away from your corporation?

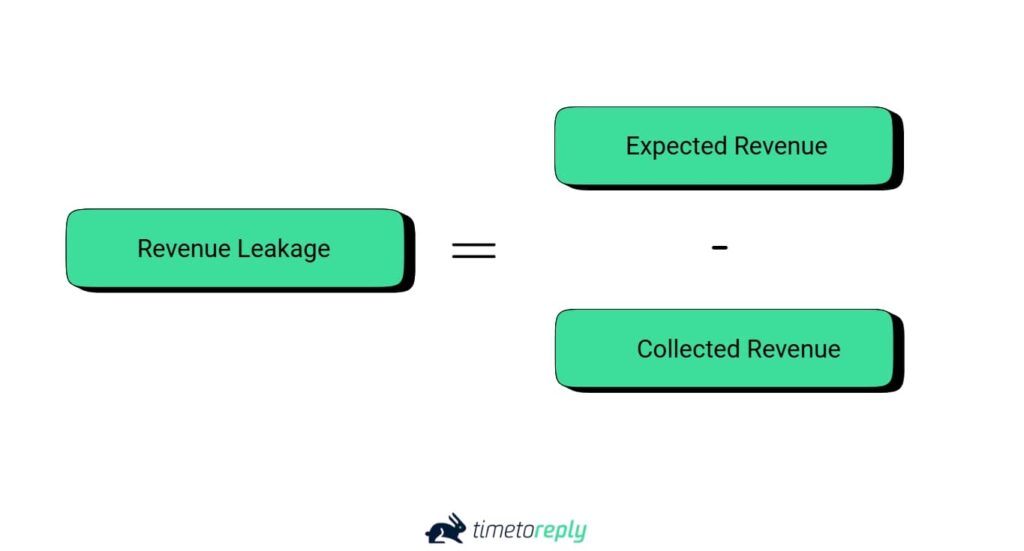

Begin with a easy formulation:

Income Leakage = Anticipated Income – Collected Income

For instance, think about your SaaS firm projected $100,000 in month-to-month subscriptions however collected solely $95,000. That $5,000 hole represents your income leakage, which is the revenue that was earned however by no means realized.

As soon as you possibly can quantify it, you possibly can pinpoint these income leakages and repair them earlier than they drain your earnings. That’s why calculating income leakage often is simply as necessary as monitoring your bills.

How you can detect and measure income leakage

How do you truly determine and observe income leakage earlier than it drains your earnings?

Listed below are easy methods to begin:

- Audit your total billing system:

- Overview each bill, quote, and fee report

- Flag duplicate fees, lacking funds, and pricing errors

- Right points instantly to forestall long-term income loss

- Observe gross sales and buyer information often

- Centralize gross sales and buyer information in a single platform

- Eradicate outdated or scattered data

- Use automated tracking tools to catch hidden leaks early

- Overview income recognition guidelines

- Affirm that revenue is recorded on the right time

- Modify accounting practices that delay or misstate income

- Standardize recognition insurance policies throughout departments.

- Evaluate projected vs. earned income

- Create month-to-month studies evaluating anticipated vs. precise income

- Examine any recurring gaps between projections and collections

- Use findings to enhance billing accuracy and forecasting

- Look ahead to information inconsistencies

- Audit your databases for duplicates, lacking entries, or outdated information

- Align all information sources below a single model

- Set information validation guidelines to forestall future errors

- Use automation to test accuracy

- Automate reconciliation and fee verification processes

- Arrange alerts for unpaid invoices and mismatched data

- Exchange handbook spreadsheet monitoring with built-in instruments

You’ll be able to’t repair what you don’t measure. Begin monitoring early, and also you’ll spot leaks earlier than they flip into misplaced earnings.

Additionally Learn:

How you can stop income leakage

Now that you just perceive how income leakage happens, the subsequent step is to forestall it. Listed below are the simplest methods to forestall income loss:

1. Automate your billing and invoicing

Handbook billing is likely one of the greatest causes of missed funds and underbilling. If you automate billing, you remove repetitive errors and enhance on-time collections.

Current analysis on SMEs reveals automation boosts productiveness by up to 30% and reduces handbook errors by 25%, bettering effectivity. Combine your billing system with challenge administration and stock ranges to make sure each useful resource is accounted for.

2. Enhance key contract visibility metrics

Lack of visibility into contracts usually ends in missed renewals, unbilled adjustments, and unnoticed income leakage. Implement a centralized contract repository with automated alerts for key dates, phrases, and pricing updates to remain on prime of each obligation.

This ensures all billable gadgets are captured on time and offers your crew the transparency wanted to handle contracts and income extra successfully.

3. Conduct common interval income audits

Schedule quarterly or biannual audits to determine and handle unnoticed income gaps.

Throughout audits, evaluate booked income with precise money acquired to determine discrepancies early.

You can too combine your CRM and accounting methods to make information verification seamless and environment friendly.

4. Monitor lively reductions and promotions

Low cost leakage is commonly ignored, however it will probably have a big impression in your income over time. Carefully monitor all low cost exercise, together with coupon codes, promotional affords, and pricing exceptions, to make sure they’re correctly licensed and aligned together with your pricing technique.

Unchecked reductions impression margins and might create inconsistencies that result in long-term income leakage.

5. Select the best accounting software program

Lastly, the instruments you utilize make a big distinction. Choose accounting software program that helps automation, integrates seamlessly with different enterprise instruments, customer success software, and contains built-in compliance options.

This ensures your total monetary course of, from invoicing to reporting, runs effectively and transparently. The proper platform reduces handbook workload, gives integrations to streamline your workflow, and minimizes the chance of income leakage attributable to information silos or human error.

6. Use dependable buyer help instruments

You need to use customer service software to automate dispute decision, cut back friction, and enhance fee velocity. Pair your accounting platform with customer service tools for improved billing-related communication.

As well as, customer support tools can play an important function in figuring out income leakage early.

7. Practice your gross sales and finance groups

Let’s be trustworthy, know-how alone can’t repair the whole lot. Stopping income leaks takes extra than simply software program. It requires expert groups who know what to search for and a powerful construction that helps environment friendly, correct workflows.

Your crew is your first line of protection in opposition to income leakage. Spend money on coaching packages that assist them perceive communication, billing insurance policies, contract phrases, and construct essential customer service skills. Steady coaching will assist to improve customer service throughout each interplay.

Additionally Learn:

How you can repair income leakage

If income leakage has already began, don’t panic. You’ll be able to nonetheless rectify the state of affairs and get better misplaced revenue with the best actions.

Right here’s tips on how to plug the leaks and get your funds again on observe:

1. Establish the supply of the leak

Begin by tracing the place cash is slipping away. Evaluate your booked income with precise collections, and test for mismatches in:

- Billing data

- Contract phrases

- Fee receipts

- Low cost or refund logs

2. Reconcile your accounts

Reconciliation helps determine and proper unnoticed errors in your accounting system. Match your invoices, funds, and deposits line by line to make sure all recorded income aligns with precise money circulate.

Performing this course of month-to-month helps stop discrepancies from snowballing and protects you from main year-end surprises.

3. Replace your pricing and contracts

Generally, income leakage happens as a result of outdated or unclear pricing fashions. Overview each lively contract to make sure your phrases replicate present charges, billing, and deliverables.

When you handle subscriptions, guarantee your subscription administration software program mechanically updates pricing for renewals to forestall potential income leakage.

4. Implement sensible automation instruments

Use the very best recurring billing software program and accounting instruments that mechanically sync funds, subscriptions, and invoices. These instruments cut back handbook errors and assist stop income leakage by guaranteeing constant, correct revenue circulate monitoring.

Combine your CRM and accounting methods for effective customer engagement and to keep up full transparency throughout your total income cycle.

5. Recuperate uncollected income

Underbilled accounts are a standard income leakage, however they will usually be recovered if caught early. To plug these leaks, arrange a structured follow-up course of that features automated fee reminders, follow-up emails, and escalation steps for overdue accounts.

Moreover, contemplate providing early-payment reductions or versatile fee plans for long-term shoppers to enhance restoration charges and cut back ongoing income leakage.

6. Monitor monetary efficiency repeatedly

When you’ve addressed current leaks, the work isn’t over. Develop a devoted income leakage dashboard that tracks vital metrics reminiscent of bill accuracy, days gross sales excellent (DSO), and churn charge.

Persistently monitoring income leakage lets you rapidly determine and plug new gaps earlier than they impression your backside line.

Additionally Learn:

The hidden value of income leakage

Income leakage isn’t only a finance situation, it quietly undermines buyer success, erodes belief, damages model status, and hinders long-term enterprise progress.

Right here’s how income leakage impacts your corporation:

- Decreased buyer expertise: Errors, billing disputes, or delays frustrate prospects, decreasing loyalty and repeat gross sales.

- Decrease buyer satisfaction: When shoppers are overcharged, underbilled, or misinformed, their confidence in your corporation drops.

- Operational pressure: Groups spend extra time firefighting points as an alternative of innovating or bettering service supply.

- Missed financial worth: Income leakage reduces your complete worth output, which is the true monetary profit your corporation delivers to stakeholders.

- Workforce burnout: Fixed handbook reconciliation drains focus, creativity, and productiveness over time.

Fixing these points includes making a sustainable system that protects your earned income, improves customer experience, and drives long-term progress.

Additionally Learn:

FAQ

1. What causes income leakage in companies?

Income leakage happens when earned revenue shouldn’t be collected as a result of elements like handbook processes, inaccurate billing, errors, or poor system integration.

2. How can I determine income leakage?

You’ll be able to determine income leakage by doing the next:

- Audit your billing cycle and buyer information often

- Evaluate invoices with contracts and gross sales studies

- Reconcile projected vs. precise income to catch hidden gaps

3. Why is it necessary to repair income leakage early?

Small leaks might sound insignificant at first, however over time, they will multiply and trigger substantial injury to your backside line.

Addressing income leakage early ensures that each greenback your corporation earns is captured, serving to you keep wholesome money circulate and shield revenue margins.

4. What are the very best methods to forestall income leakage?

You’ll be able to stop income leakage by doing the next:

- Automate your billing and invoicing processes to cut back errors

- Arrange correct income recognition to report revenue precisely

- Use dependable buyer and gross sales information to keep away from inconsistencies

- Practice your crew to test for pricing errors, unauthorized reductions, and handbook billing points that would trigger leaks

5. Which industries expertise probably the most income leakage?

Income leaks have an effect on industries that depend on complicated billing or recurring funds, reminiscent of:

- SaaS companies

- Telecom corporations

- Healthcare suppliers

- Skilled providers

Anyplace pricing or buyer contracts are complicated, the chance of income leakage is excessive.

6. How usually ought to I audit my billing and income methods?

You must audit your billing methods and income assortment methods not less than as soon as each quarter.

Common evaluations assist uncover administrative errors, unauthorized reductions, or outdated buyer data that would trigger leaks. The sooner you see these points, the simpler it’s to repair workflows and keep constant revenue margins.

7. What’s the distinction between income leakage and income loss?

Income leakage happens when your corporation has earned revenue that doesn’t make it into your accounts as a result of inner errors, inefficiencies, or oversights.

In distinction, income loss occurs when potential revenue is rarely realized. For instance, once you lose prospects or miss out on gross sales alternatives.

Merely put, income leakage is commonly preventable. You’ll be able to enhance your inner processes and controls. Income loss, alternatively, often requires extra substantial gross sales efforts and buyer retention methods.

8. Can automation instruments remove income leakage?

Whereas automation instruments might help cut back income leakage, they don’t remove it. Automated billing and income recognition methods assist reduce human error, missed invoices, and information mismatches.

Nonetheless, companies nonetheless want common monitoring, system audits, and information validation to catch exceptions or integration points that trigger income leakages.

Additionally Learn:

Cease income leakage earlier than it drains your progress

When income leaks go undetected, they quietly have an effect on your revenue margin and cut back long-term progress. The excellent news is that with the best precautions, you possibly can handle income leakage earlier than it turns into an issue.

Don’t wait till the numbers don’t add up. Strengthen your income assurance practices, prepare your groups, and put money into instruments like timetoreply to enhance billing accuracy and information integrity.

timetoreply provides your crew real-time visibility into buyer communication, response times, and follow-ups. You’ve labored onerous to earn that income; now be sure to maintain it.

Get began with timetoreply to identify gradual replies, stop income leakage, and enhance buyer responsiveness.

Source link